Nov 05, 2013

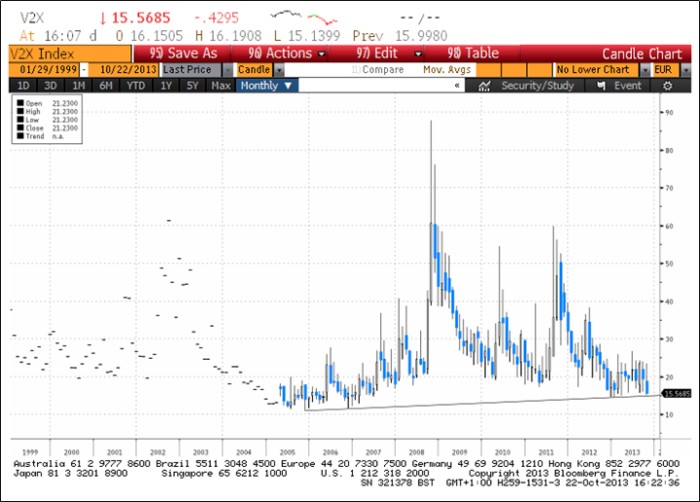

VSTOXX®: Bears eye crucial support lines

VSTOXX® is holding longterm support line from November 2005, which comes in at 14.8902 and also above the yearly low at 14.5213. Risks remain skewed to the downside given long-term studies continue to point lower and as yet well above historic levels of reversal. Focus remains on the monthly Bollinger band base, which is currently valued at 13.5038 and below here not much significant support until November 2006 low at 11.9845. Needs to break above 20.00 congestion level to ease downside pressure.

RES 3: 26.8033 High June 2013

RES 2: 20.000 Congestion level

RES 1: 17.2637 Low March 2012

SUP 1: 14.8902 Support line from Nov 2005

SUP 2: 14.5213 Jan 2013 low

SUP 3: 13.5038 Monthly Bollinger band base

SUP 4: 11.9845 November 2006 reversal low

PREVIOUS CLOSE: 15.6427