Jan 12, 2026

Eurex

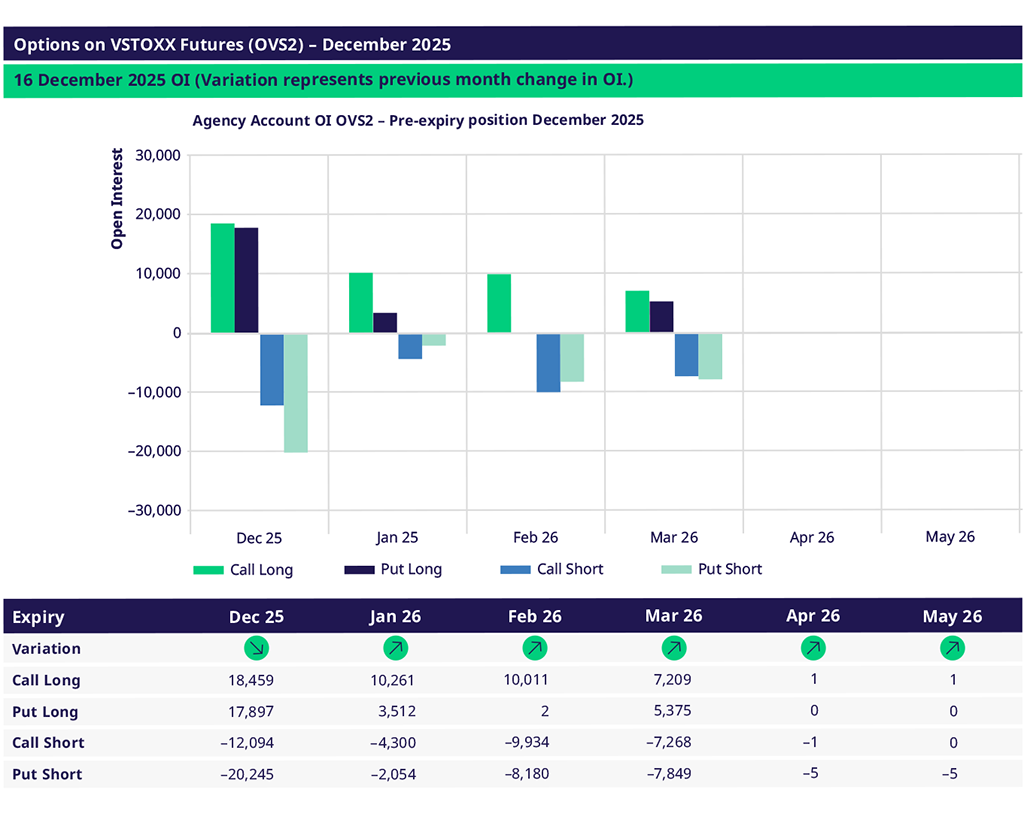

Focus on VSTOXX® Derivatives | December 2025 recap

- European markets finished the year with a strong Santa Rally, as all indices were up over 2% despite the U.S. markets struggling.

Because of the strong equity indices in early December, implied volatility dropped to a low of 14.8, before recovering to 16 by month’s end.

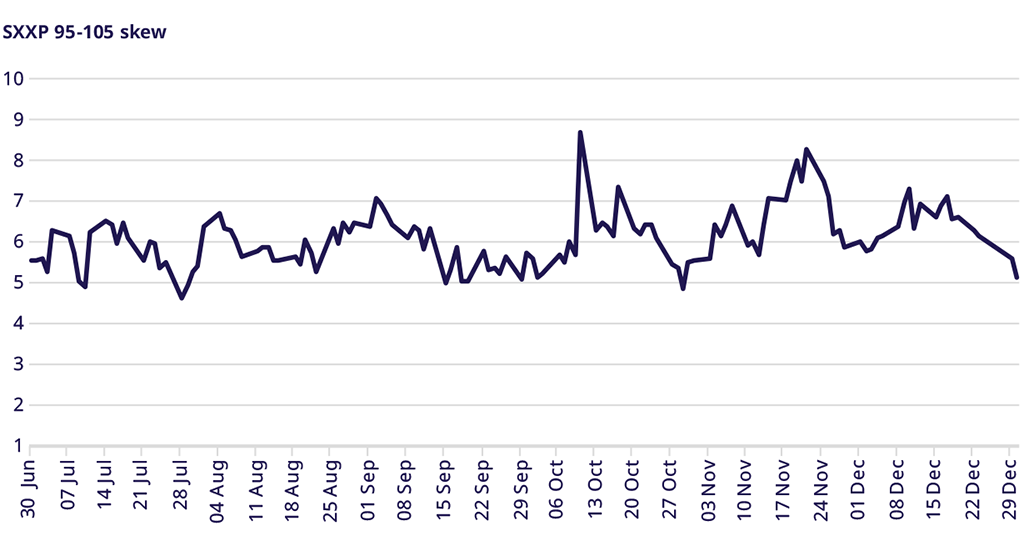

Skew rose to a high of 7.3 volatility points as we neared expiration but sold off to close near the lowest levels in the past six months at 5.1 as indices rallied into year-end.

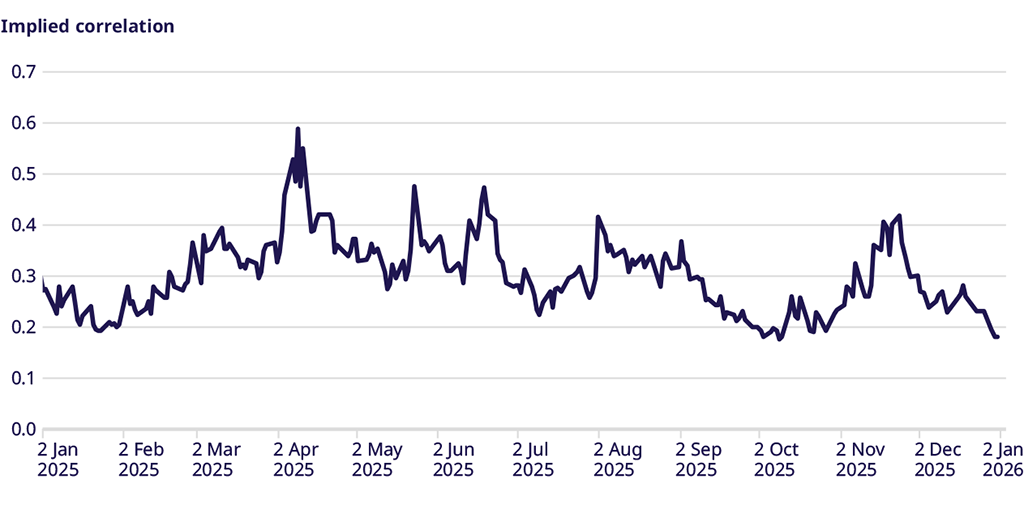

Implied correlation moved lower throughout the month and closed December at the lowest levels of the year.

Equity Index Volatility

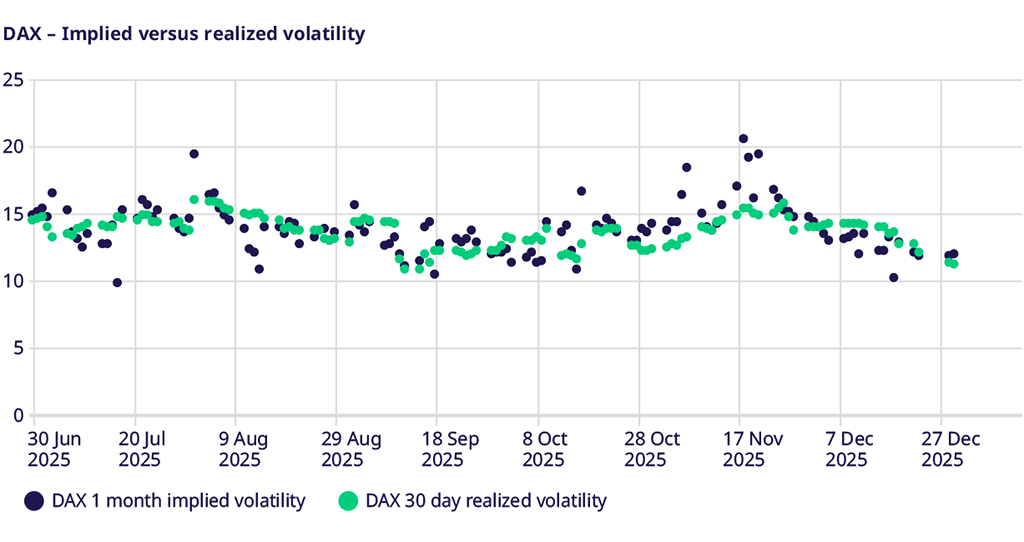

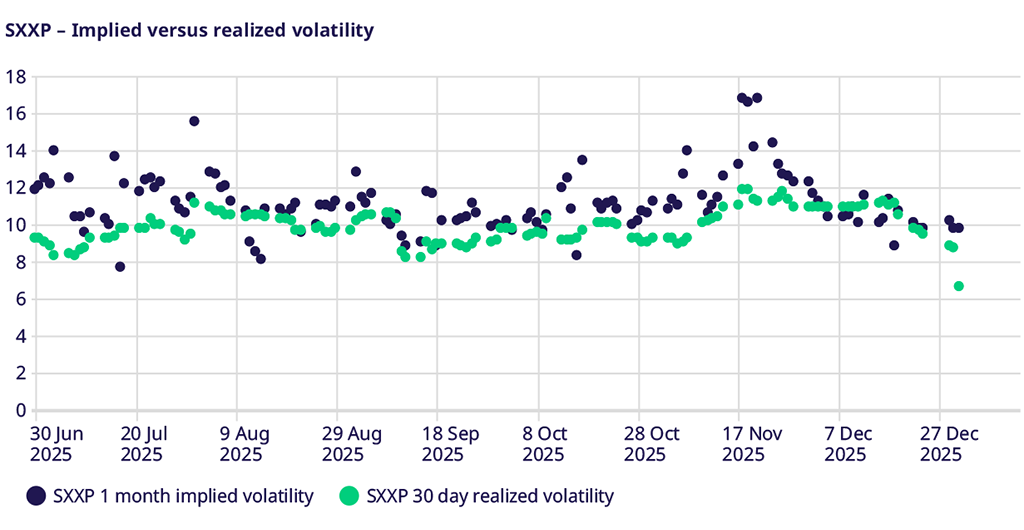

While major markets in the US and Japan struggled in December, European markets ended the year strongly: EURO STOXX 50® up 2.25%, DAX® Index up 2.74%, and STOXX® Europe 600 up 2.9%. This caps the year 2025, in which European markets sharply outperformed most other regions, especially when measured in EUR terms. For most of the year, European markets were led by the cyclical sectors, namely Basic Resources, Banks and Financial Services.

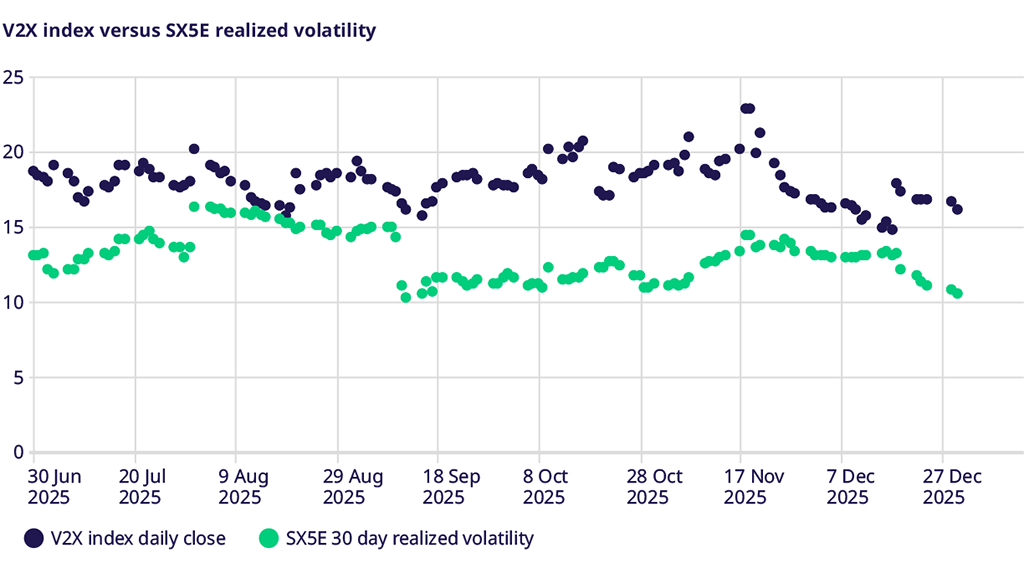

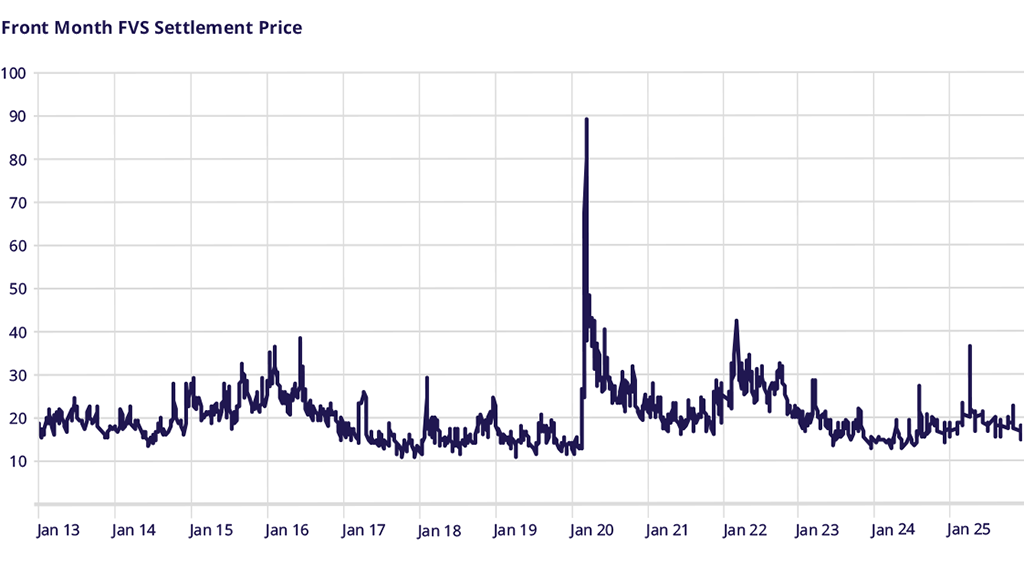

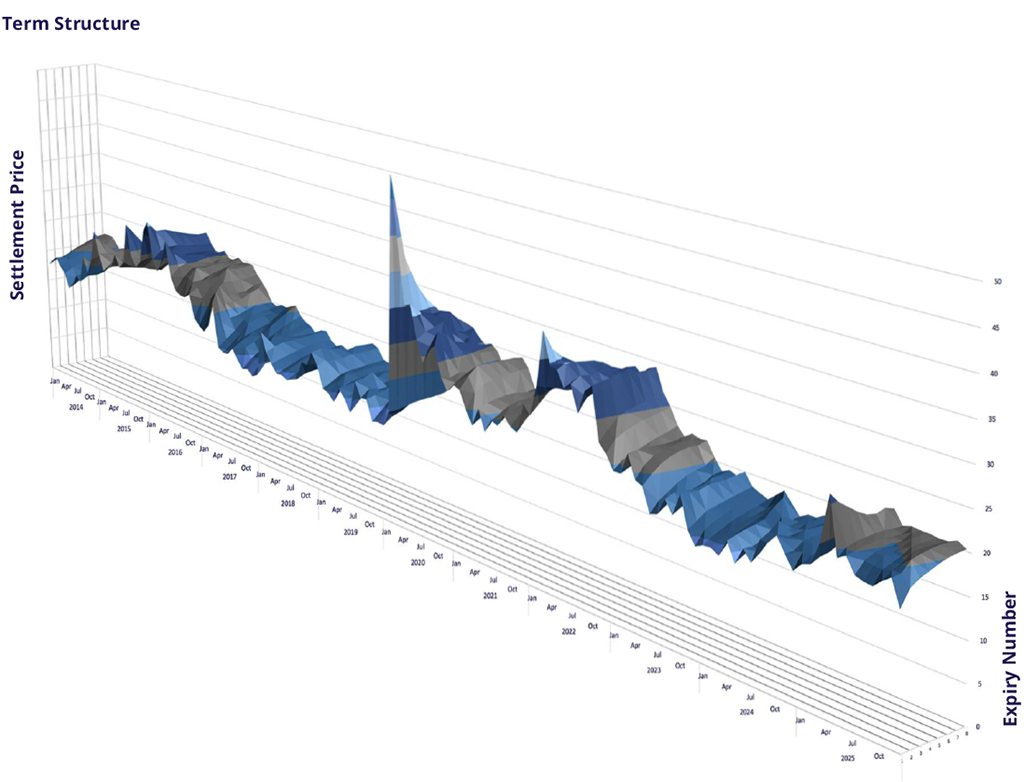

VSTOXX Index Performance

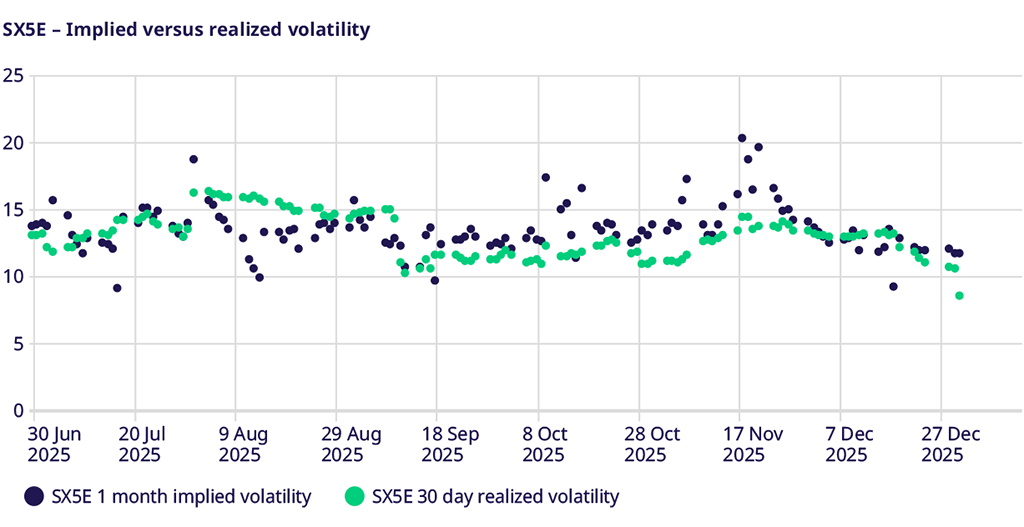

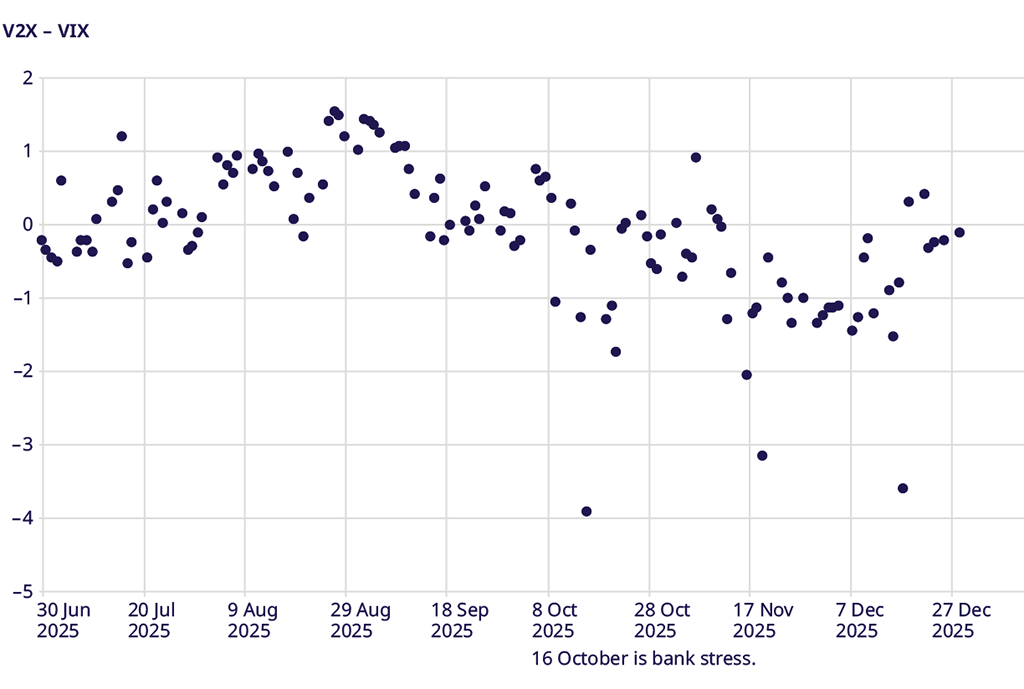

Implied volatility decreased from the start of the month up to the December option expiration. It dropped both in absolute terms from 16.7 to 14.8 in the V2X Index and relative to realized volatility. The gap between the V2X Index and SE realized volatility narrowed significantly, falling from 3.39 to a low of 1.55 vol points. From expiration until year-end, the spread widened, ending the year at 5.5 vol points, driven by the rise in implied volatility and the continued decline in realized volatility around the holiday trading.

STOXX® Europe 600 Index Skew

The 95-105% skew in the STOXX® 600 was in the 6-7 volatility point range but fell in the last few days of the year, closing near the lows of the last 6 months at 5.12 volatility points. As equity indices closed at the year's highs, with potential for continuation, investors showed more interest in upside call options on a relative basis.

Correlation

Implied correlation fell throughout December from 0.30 to 0.18, with the latter again the lowest in the last six months. The falling implied correlation indicates that investors showed more interest in single stocks or single themes versus overall equity exposure into year-end, and the potential for this move to continue into 2026.

Trade the European volatility benchmark

Explore this year's macro events and find an overview of dates.

VSTOXX 101: Understanding Europe’s Volatility Benchmark

Discover the latest STOXX whitepaper today to learn more about the VSTOXX® core methodology, historical performance analysis, and more.

For more information, please visit the website or contact: