Apr 10, 2024

Eurex

Focus on VSTOXX® Derivatives | March 2024 recap

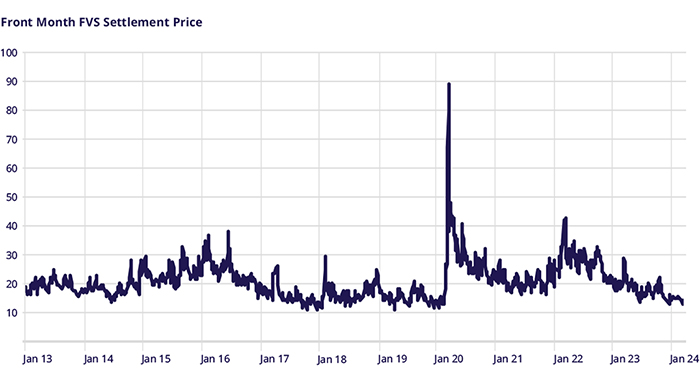

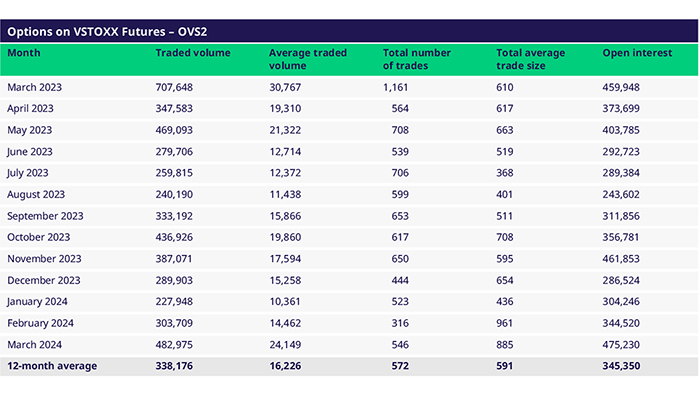

While March brought another relatively subdued month for index volatility (with VSTOXX® generally staying in a three-index point range), Options on VSTOXX® Futures had their most active month in a year. Options volumes were 42% higher than the twelve-month average and 59% above Feb 2024 levels. 6 March was the most active day of the month, with over 63,000 options trading. As a reminder, the revised market-making requirements that went into effect in February resulted in screen prices that are now generally 50% tighter than just a few months ago.

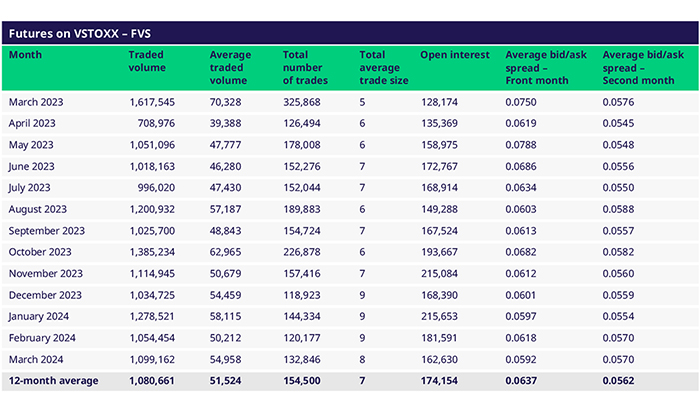

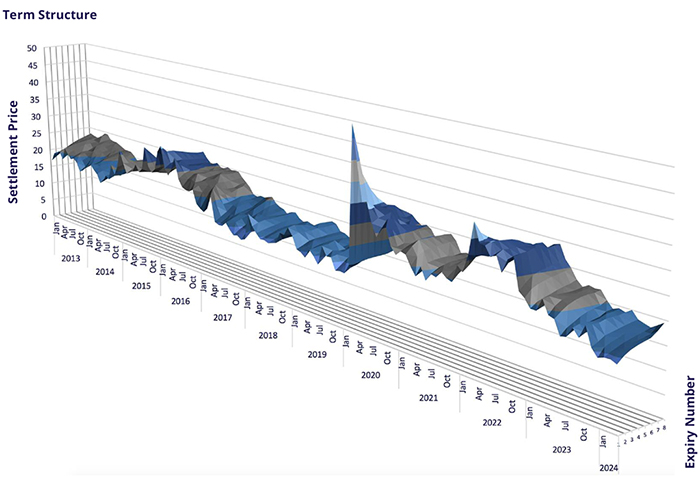

VSTOXX® Futures in March were generally in line with the twelve-month average. On average, the front and second-month futures were quoted just one tick wide. Eurex listed the Nov 24 contract in March, allowing traders to trade meaningfully through the 5 November US Presidential elections.

VSTOXX Futures (FVS)

Trade the European volatility benchmark

Explore this year's macro events and find an overview of dates.

VSTOXX 101: Understanding Europe’s Volatility Benchmark

Discover the latest STOXX whitepaper today to learn more about the VSTOXX® core methodology, historical performance analysis, and more.

For more information, please visit the website or contact: