EURO STOXX 50 Total Return Futures – Transition to €STR flat

Eurex made amendments of the Contract Specifications of the EURO STOXX 50® Index Total Return Futures (TESX) transitioning the reference Funding Rate euro short-term rate (€STR) plus the ECB provided EONIA transition spread (0.085 percent or 8.5 basis points) to €STR flat.

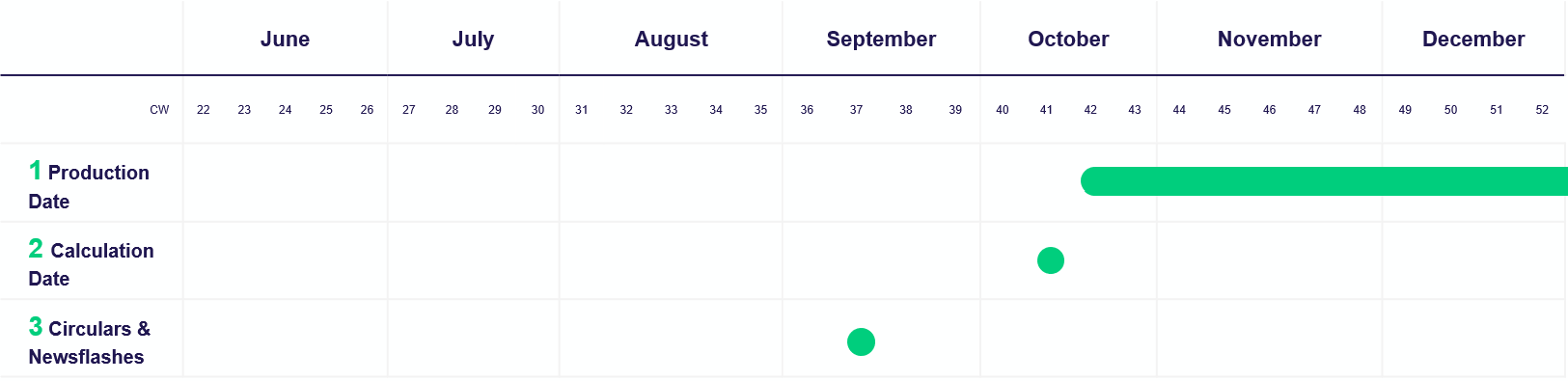

Calculation Date: 15 October 2021

Production Date: 18 October 2021

Circulars

Circulars

- Eurex Circular 086/21 EURO STOXX 50® Index Total Return Futures (TESX): Transition of the reference Funding Rate from €STR plus 0.085 percent to €STR (flat)

- Eurex Circular 066/21 EURO STOXX 50® Index Total Return Futures (TESX): Consultation on the transition of the reference Funding Rate from €STR plus 0.085 percent to €STR (flat)

Newsflashes

Participants Requirements

Feature/Enhancement | Details | Action Item |

| Transition of reference funding rate on TESX | The reference funding rate on EURO STOXX50 Index Total Return Futures (TESX) will be updated from €STR plus 0.085 percent to €STR (flat). A conversion methodology will be applied to all open positions on TESX. For this, Eurex Clearing will “book out” positions at the original previous day’s closing settlement price and “book in” the same positions at the adjusted settlement price applicable for each expiry. | Eurex and Eurex Clearing asks Trading & Clearing Participants to identify impacts related to €STR (flat) change on internal processes, trading, and open positions. Pay specific attention to:

|

Index Total Return Futures

The Index Total Return Future (TRF) is an exchange-listed solution for implicit equity repo trading on the EURO STOXX 50® index

In case of any questions or your require further information, please contact us at client.services@eurex.com or eurextrading@eurex.com.

Are you looking for information on previous releases/projects? We have stored information about our previous releases/projects in our Archive for you!