T7 Release 10.0

With T7 Release 10.0 Eurex introduced the following new features, changes and enhancements:

- Next Generation Exchange Traded Derivatives (ETDs) Contracts

- Self-Match Prevention (SMP) and Matching Cascades

- Eurex EnLight: Staging of Request-For-Quote and Auto Pulling of Quotes

- Enhancing Pre-Trade Risk Limits for Future Spreads

- Aggregation of off-book Trade Sides

- SFTP up/download functionality for non-MiFIR transaction reporting - Art. 26 (5) MiFIR

- SFTP upload functionality for short codes and algoIDs

- Trading Sessions for the T7 FIX LF interface

Please note that T7 Release 10.0 will not provide backwards compatibility for ETI or FIX.

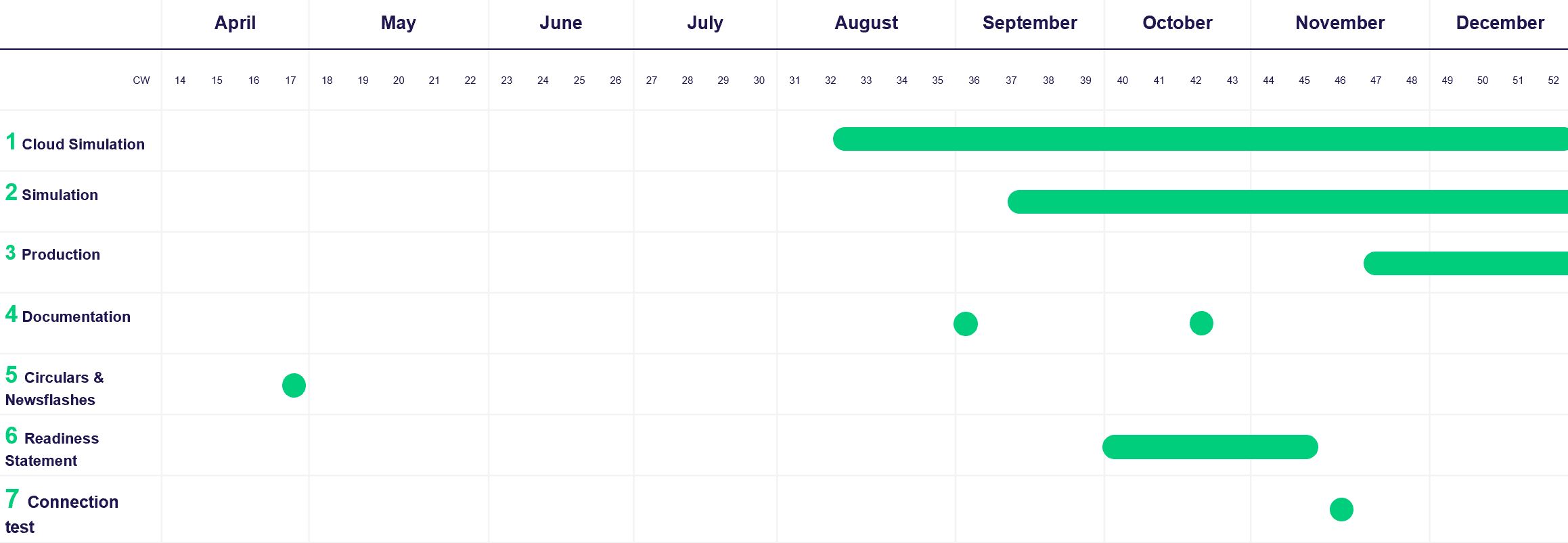

Simulation start: 13 September 2021

Production start: 22 November 2021

System Documentation

- T7 Release 10.0 - Final Functional Technical Release Notes Eurex v.1.1

Published 4 Nov 2021 - The release notes for T7 give an overview of the functional and technical enhancements and changes to be introduced. - T7 Release 10.0- Functional Reference v.10.0.4

Published 4 Nov 2021 - This document provides a detailed insight into the functional concepts of the T7 trading architecture. - T7 Release 10.0 - Function and Interface Overview v.10.0.3

Published 30 Aug 2021 - The document provides an overview of T7. It describes the major functional and system features, and provides a high level description of the interface landscape. - T7 Cross System Traceability v.10.0-1.0

Published 30 Aug 2021 - This document contains detailed information on order, quote and trade traceability across trading and clearing systems focusing on the markets XEUR (Eurex Frankfurt) and XETR (Xetra Frankfurt).

Enhanced Trading Interface

- T7 Release 10.0 - Enhanced Trading Interface (ETI) - Manual v.1.3

Published 26 Nov 2021 - The document provides information relating to the T7 Enhanced Trading Interface (ETI) and contains a detailed description of the concepts and the messages used by the interface for both the Cash and Derivatives Markets.

Please note: In the Quote Execution Notification with T7 Release 10.0, the value of QuoteEventType (28539) has changed from 3 (Removed Quote Side) to 6 (Quote Quantity Removed) for Quote Deletion due to Passive Liquidity Protection and Pending Cancellation Executed.

- T7: Enhanced Trading Interface - Derivatives Message Reference v.10.0-D0003

Published 4 Nov 2021 - This document provides a reference to all message formats for the Enhanced Trading Interface derivatives markets. (Please Note: This document is valid without changes for T7 Release 9.1 Simulation & Production.) - T7: Enhanced Trading Interface - Cash Message Reference v.10.0-C0003

Published 4 Nov 2021 - This document provides a reference to all message formats for the Enhanced Trading Interface cash markets. (Please Note: This document is valid without changes for T7 Release 9.1 Simulation & Production.) - T7 Release 10.0 Enhanced Trading Interface - XSD XML representation and layouts v.1.2

Published 4 Nov 2021 - The package contains the XML representation and the schema files for the Enhanced Trading Interface (ETI) for both the Cash and Derivatives Markets. (Please Note: This document is valid without changes for T7 Release 9.1 Simulation & Production.)

FIX Gateway

- T7 FIX Gateway Manual (FIX 4.4) v.10.0-1

Published 4 Nov 2021 - The document provides information on the T7 FIX Gateway for both the Cash and Derivatives Markets and contains a detailed description of the concepts and messages used by the interface. This document is only applicable for FIX version 4.4. - T7 FIX Gateway - FPL Repository v.10.0-1

Published 4 Nov 2021 - The FPL (FIX Protocol Language) repository contains the XML representation of the T7 FIX Gateway version 4.4 for both the Cash and Derivatives markets. - T7 FIX Gateway - Fiximate v.10.0-1

Published 4 Nov 2021 - The package provides a browser-based representation of the repository for the T7 FIX Gateway version 4.4 for both the Cash and Derivatives markets with navigation capabilities.

FIX LF

T7 Release 10.0 - FIX LF Manual v.1.2

Published 4 Nov 2021 - The document provides information on the T7 FIX LF interface for both the Cash and Derivatives Markets and contains a description of the conncectivity, concepts and messages used by FIX LF.T7: FIX LF Interface - Derivatives Message Reference v.10.0-D0002

Published 4 Nov 2021 - The purpose of this document is to provide all message formats for the derivatives markets part of the FIX LF interface.T7: FIX LF Interface - Cash Message Reference v.10.0-C0002

Published 4 Nov 2021 - The purpose of this document is to provide all message formats for the cash markets part of the FIX LF interface.T7 FIX LF QuickFix Engine Dictionary and Message Reference v.1.2

Published 4 Nov 2021 - The package contains the QuickFix Engine dictionaries (FIXLF44_Derivatives.xml, FIXLF44_Cash.xml) and message reference files including message and field descriptions (FIXLF_DerivativesExt.xml, FIXLF_CashExt.xml) for the T7 FIX LF interface per marketplace type.

- T7_EMDI_MDI_RDI_Manual_v.10.0.3

Published 4 Nov 2021 - The document provides information relating to the market and reference data interfaces (EMDI, MDI, RDI and RDF) and contains a detailed description of the concepts and messages used by the interfaces. - T7_EMDI_MDI_RDI_XML_Representation_v.10.0.3

Published 4 Nov 2021 - The package contains the XML FAST template files (FAST 1.1 and 1.2) and FIXML schema files for the T7 market and reference data interfaces (EMDI, MDI and RDI). - T7 Enhanced Order Book Interface Manual v.10.0.1

Published 4 Nov 2021 - The document provides information relating to the T7 Enhanced Order Book Interface (EOBI) and contains a detailed description of the concepts and messages used by the interfaces. - T7 Enhanced Order Book Interface - XML Representation v.10.0.1

Published 4 Nov 2021 - The package contains the XML representation and the schema files for the T7 Enhanced Order Book Interface (EOBI). - Extended Market Data Service Trade Prices, Settlement Prices and Open Interest Data Manual v.10.01

Published 4 Nov 2021 - The document provides information relating to the market and reference data interfaces (EMDI, MDI, RDI and RDF) and contains a detailed description of the concepts and messages used by the interfaces. - Extended Market Data Service - XML FAST Templates - FIXML schema files v.10.01

Published 4 Nov 2021 - The package contains the XML FAST template files (FAST 1.1 and 1.2) and FIXML schema files for the T7 market and reference data interfaces (EMDI, MDI and RDI). - Extended Market Data Service - Underlying Ticker - Manual v.10.01

Published 4 Nov 2021 - This document provides the information about the Underlying Ticker service for T7. - Extended Market Data Service - Underlying Ticker Service - XML FAST Templates v.10.01

Published 4 Nov 2021 - This document provides the XML FAST templates for the Underlying Ticker service for T7. - T7 Eurex Market Signals_v.10.0

Published 30 Aug 2021 - The package contains the XML representation and the schema files for the T7 Enhanced Order Book Interface (EOBI). - T7 Eurex Market Signals - XML FAST Templates v.10.0

Published 30 Aug 2021 - The document contains the manual providing detailed information about the Eurex Market Signals.

- T7 Derivatives Markets - T7 Trader, Admin and Clearer GUI v.10.0.04

Published 4 Nov 2021 - This document provides information on the T7 Derivatives Markets GUI solutions, the Trader-, Admin- and Clearer GUI for T7. All views and functions of the T7 Derivatives Markets GUIs are described. - T7 Cash Markets - T7 Trader, Admin and Clearer GUI v.10.0.03

Published 4 Nov 2021 - This document provides information on the T7 Cash Markets GUI solutions, the Trader-, Admin- and Clearer GUI for T7. All views and functions of the T7 Cash Markets GUIs are described. - T7 Trader GUI, Admin GUI and Clearer GUI - Installation Manual v.10.0.1

Published 15 Dec 2021 - This document provides information on Deutsche Börse's T7 GUI solutions, the T7 Trader GUI, T7 Admin GUI and T7 Clearer GUI from a technical point of view. The document explains how to establish connection to Deutsche Börse's T7 with the GUI solutions. - T7 Derivatives Market Eurex - Participant and User Maintenance Manual v.1.0

Published 30 Aug 2021 - This manual is intended to assist service administrators who are responsible for maintaining participant and user related data in T7. - T7 Cash Markets - Xetra and Börse Frankfurt: Participant and User Maintenance Manual v.1.0

Published 30 Aug 2021 - This manual is intended to assist service administrators who are responsible for maintaining participant and user related data in T7.

- N7-Network-Access-Guide-v.2.1.5

Published 1 Nov 2021 - This document provides details on the network access options for T7 and Eurex Clearing's interfaces. It includes detailed technical background information, such as router equipment information and port numbers for the configuration of firewalls - T7_Disaster_Recovery_Concept_2022_v_1.0

Published 1 Mar 2022 - This document provides an overview of Deutsche Börse’s disaster recovery concept for the T7 trading system. It contains the required technical background information as well as functional features and limitations to enable participants to continue trading in a DR situation.

- Common Report Engine (CRE), User Guide - version February 2022

Published 9 Feb 2022 - The Common Report Engine (CRE) allows the centralized provisioning of reports. The manual contains everything from access information to CRE naming conventions. - T7 XML Report Reference Manual v.100.3.3

Published 4 Nov 2021 - This document describes all reports based on T7 trading data for both the cash and derivatives markets. - T7 XML Report Manual Modification Notes v.100.3.3

Published 5 Nov 2021 - This document provides an overview of the enhancements and changes to the T7 XML Reports as compared to the previous version. - T7 Reports - XML Schema Files v.100.3.3

Published 4 Nov 2021 - This package contains the reports xsd files for T7 cash markets and derivatives markets reports. - Common Upload Engine (CUE), User Guide - version September 2021

Published 27 Sep 2021 - The Common Upload Engine (CUE) allows admitted participants of the DBAG Group the upload of participant data to dedicated services provided by DBAG Group. The purpose of this document is to provide an overview on how to obtain access to the CUE.

- T7 Release 10.0 - Participant Simulation Guide v.1.1

Published 11 Jan 2022 - This document describes the timeline, new and changed features as well as the simulation focus days for this T7 release. Please use this document to plan and prepare your T7 Release simulation participation.

- T7 Release 10.0 - Incident Handling Guide v.5.2

Published 30 Aug 2021 - This document provides a detailed description of the reaction of Deutsche Börse's T7 trading system to technical incidents and provides best practices for handling them. In addition the document provides references to the respective focus days in the T7 simulation environment which are intended to simulate such incidents. - Known Limitations for T7 Release 10.0 Production v.1.0

Published 19 Nov 2021 - At the moment we do not list any Known Limitations for T7 Release 10.0 production.

- Eurex T7 Release 10.0 - Q&As Focus Call

Publication date: 24 Sep 2021 - T7 Release 10.0 Presentation

Publication date: 17 Sep 2021

Circulars

Circulars

- Eurex Circular 104/21 T7 Release 10.0: Announcement of Eurex T7 functionality activations after Release date

- Eurex Circular 102/21 T7 Release 10.0: Important information for production start

- Eurex Circular 040/21 Announcement of T7 Release 10.0

Newsflashes

- Eurex Exchange Readiness Newsflash | Next Generation ETD Contracts: T7 Release 10.0 Simulation Guide now including Next Generation ETD Contracts specifics

- Eurex Exchange Readiness Newsflash | REMINDER: Eurex T7 Release 10.0: Readiness Statement is available

- Eurex Exchange Readiness Newsflash | T7 Release 10.0 Regulatory Reporting Solution (RRS) for non-MiFIR firms: Readiness Statement is available

- Eurex Exchange Readiness Newsflash | Eurex T7 Release 10.0: Readiness Statement is available

- Eurex Exchange Readiness Newsflash | T7 Release 10.0 Simulation – Regulatory Reporting Solution (RRS) for non-MiFIR firms: A) Updates on functional limitations B) Update of RRS documentation

- Eurex Exchange Readiness Newsflash | T7 Release 10.0 Simulation: T7 Release 10.0 Simulation: Update on access limitations to Common Upload Engine for Regulatory Reporting Solution for non-MiFIR firms and short code/algoID uploads

- Eurex Exchange Readiness Newsflash | T7 Release 10.0: Publication of Focus call - screencast

- Eurex Exchange Readiness Newsflash | T7 Release 10.0 Simulation: A) Limitations in Simulation environment for Regulatory Reporting Solution (RRS) for non-MiFIR firms B) Update of documentation for RRS

- Eurex Exchange Readiness Newsflash | T7 Release 10.0 Simulation: Regulatory Reporting solution for non-MiFIR firms and SFTP functionality for short codes and algo ID

- Eurex Exchange Readiness Newsflash | T7 Release 10.0: Simulation start and publication of documentation

- Eurex Exchange Readiness Newsflash | T7 Release 10.0: Changes to transaction reporting according to Article 26 (5) MiFIR for non-MiFIR firms and SFTP functionality for short codes and algo ID publication of documentation

- Eurex Exchange Readiness Newsflash | T7 Release 10.0 - Preliminary Release Notes are now available

Readiness Videos

MiFID II/MiFIR

Everything you need to know about the Regulatory Reporting Solution (RRS) for non-MiFIR firms initiative, is available on the dedicated RSS webpage.

Release Items/Participants Requirements

Feature/Enhancement | Details | Action Item |

Next Generation Exchange Traded Derivatives (ETDs) Contracts | Eurex is aiming to introduce a more flexible set-up of ETDs by implementing an enhanced contract identification concept allowing more than one expiration per month on product level (sub-monthly contracts). New business initiatives: Integration of weekly expiring instruments on product level Volatility Strategies in Single Stock Options Market-on-Close Futures T+X (Basis Trading in Equity Index Futures) | Trading Members need to: Adjust the Trading GUI due to required changes in displaying adapted contract names. Check their system landscape whether contract handling is referring to limiting expiry month-year information. Due to the integration of weekly options, there might be an impact on the handling of MM protection and the Pre-trade risk limits. We recommend, that Trading Members make the necessary adjustments if required. |

Update to Self-Match Prevention (SMP) and Matching Cascades | Please note that SMP will be offered only via FIX LF interface, but not via the existing FIX gateway. The existing FIX gateways will neither support the original nor the enhanced SMP functionality after Release 10.0. Trading participants relying on this functionality are required to migrate to the new FIX LF interface with T7 Release 10.0. | Trading Members need to adapt changes and upgrade to T7 Release 10.0. |

New Market Order Validation for Options | Depending on the instrument state, the new validation for Market orders in options will be applied to all Market order entries/modifications as well as validated for book Market orders during instrument state changes. | The new Market order validation checkMarketOrder (reflecting the enabling / disabling of the new Market order validation) will be distributed as part of the RDI/RDF product information. |

Pre-trade Risk Limits (PTRL); introduction of Netting Coefficient (NC) for Future Spreads | Eurex will change the way Futures Spreads are counted in Pre-Trade Risk Limits (PTRL) by introducing a Netting Coefficient (NC) that allows Trading Members to determine how much weight Futures Spreads contribute to calculating the relevant quantity consumptions. | Trading Members need to maintain PTRL and NC via the upload functionality of the T7 Trader GUI. The upload functionality will also support amending and deleting existing PTRL and NC. |

SFTP Up/Download Functionality for non-MiFIR Transaction Reporting | Eurex will change the use of RRH in order to fulfill their requirements acc. to Art. 26 (5) Regulation (EU) 600/2014 and replace the current use of Axway SFTP servers with the Common Upload Engine (CUE, for uploading transaction data) and Common Report Engine (CRE, for downloading transaction data). | Non-MiFIR Trading Members have to migrate their upload processes to CUE and CRE. |

SFTP Upload Functionality for Short Codes and algoIDs | Eurex will migrate the upload functionality from Axway SFTP server to the Common Upload Engine with T7 10.0 Release. | Trading Members need to migrate their upload processes to CUE. |

ORS Trader Identification Obligation | An identification obligation will be introduced for Eurex Exchange traders when submitting orders via an Order Routing System (ORS) -ComplianceText (2404). The usage of an ORS by internal employees/trading assistants of the ORS provider who are not admitted as Eurex Exchange traders is not allowed according to §19(1) of the German Exchange Act. | All ORS Providers and ORS Users must comply with the amended rules and the associated identification obligation that will become effective for Trading Members as of 22 November 2021 with T7 Release 10.0. |

Eurex EnLight Enhancements | “Staging of RFQs” allows users to define only a few mandatory fields of an RfQ before submitting it to Eurex EnLight in a suspended state. “Auto Pulling of Quotes” will be introduced in the T7 Trader GUI for the purpose of improving the management of quotes for respondents and requesters. | If you are currently supporting the Eurex EnLight, you can make use of the additional functionality that will be introduced with Release 10.0. |

Trading Sessions for the T7 FIX LF interface | The new FIX LF interface & sessions will use FIX 4.4 protocol and be integrated closer into the T7 architecture in a stepwise approach (initially offered in parallel to existing FIX Gateway, replacement after transition period). | Trading Members need to make sure to order new session in time and perform sufficient testing. |

Contacts

Eurex Frankfurt AG

Customer Technical Support / Technical Helpdesk

Service times from Monday 01:00 – Friday 23:00 CET

(no service on Saturday and Sunday)

T +49-69-211-VIP / +49-69-211-1 08 88 (all)

Eurex Frankfurt AG

Key Account Management

Service times from 09:00 - 18:00 CET

Are you looking for information on a previous initiative? We have stored information about our previous initiatives in our Archive for you!