Next Generation ETD Contracts

Eurex introduced a more flexible set-up of Exchange Traded Derivatives (ETD) products by implementing an enhanced contract identification concept on 27 March 2023 allowing more than one expiration per month on product level (sub-monthly contracts).

New features, changes and improvements:

- Integration of Weekly Expiring Instruments on Product Level

- Volatility Strategies in Single Stock Options

- Market-on-Close Futures T+X (Basis Trading in Equity Index Futures)

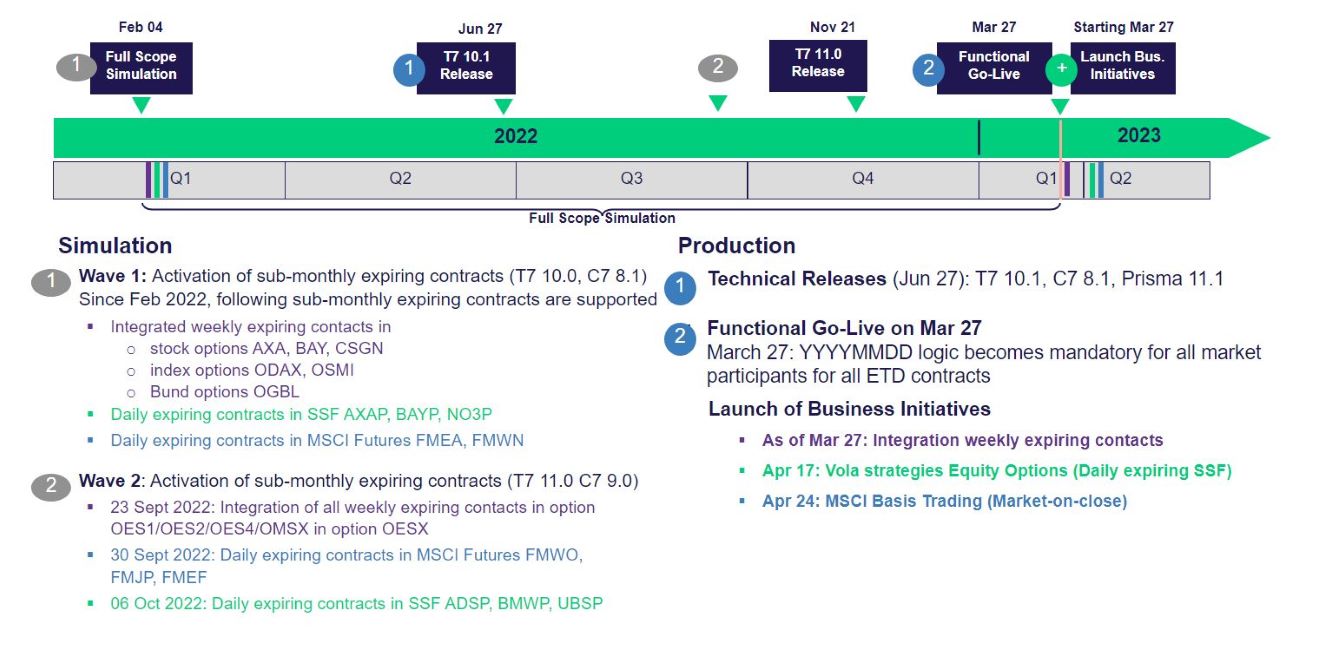

Simulation start: 6 Dec 2021 (limited testing), Feb 2022 (full scope testing)

Production start: 27 March 2023

Timeline & Roll-Out Approach

Supporting Documents

- Next Generation ETD Contracts - Product List

Publication date: 23 Mar 2023 - Eurex NextGen Updated Timeline

Publication date: 07 Feb 2023 - Next generation ETD Contracts - Roll-out Approach Eurex Production

Publication date: 24 Jan 2023 - Next Generation ETD Contracts - 4th Focus Call Presentation

Publication date: 24 Jan 2023 - Next Generation ETD Contracts - Focus Calls Q&A

Publication date: 02 Nov 2022 - Next Generation ETD Contracts - Checklist

Publication date: 14 Sep 2022 - Next Generation ETD Contracts - June Release Impacts for Participants

Publication date: 25 Mar 2022 - Next Generation ETD Contracts - 3rd Focus Call Presentation

Publication date: 31 Jan 2022 - Next Generation ETD Contracts - Known limitations T7 Release 10.0

Please find details regarding T7 Release 10.0 "Known limitations" T7 Release 10.0 > System Documentation > Production - Next Generation ETD Contracts - 2nd Focus Call Presentation

Publication date: 23 Sep 2021 - 1st Focus Call Presentation

Publication date: 15 Jul 2021

Circulars

Circulars

- Eurex Circular 019/23 Next Generation ETD Contracts: Handling of sub-monthly expiring contracts

- Eurex Circular 014/23 NextGen ETD Contracts: Introduction of new product initiatives

- Eurex Circular 011/23 Next Generation ETD Contracts: Details on integration of Weekly Options and launch dates for daily expiring futures

- Eurex Circular 004/23 Next Generation ETD Contracts: Postponement of introduction date

- Eurex Circular 036/22 NextGen ETD Contracts: Amendments to rollout approach

- Eurex Circular 029/22 T7 Release 10.1 – Next Generation ETD Contracts: Contract notation concept

Newsflashes

- Eurex Exchange Readiness Newsflash | Update T7 Release 12.0 – Eurex Buy-Side Trading Disclosure on hold

- Eurex Exchange Readiness Newsflash | Go-Live of NextGen ETD Contracts: Deletion of non-integrated weekly options – Batch 7

- Eurex Exchange Readiness Newsflash | Go-Live of NextGen ETD Contracts: Deletion of non-integrated weekly options – Batch 6

- Eurex Exchange Readiness Newsflash | Go-Live of NextGen ETD Contracts: Deletion of non-integrated weekly options – Batch 5

- Eurex Exchange Readiness Newsflash | Go-Live of NextGen ETD Contracts: Deletion of non-integrated weekly options – Batch 4

- Eurex Exchange Readiness Newsflash | Go-Live of NextGen ETD Contracts: Deletion of non-integrated weekly options – Batch 3

- Eurex Exchange Readiness Newsflash | Go-Live of NextGen ETD Contracts: Deletion of non-integrated weekly options – Batch 2

- Eurex Exchange Readiness Newsflash | Go-Live of NextGen ETD Contracts: Deletion of inactive, integrated weekly options contracts becoming effective on 3 April 2023

- Eurex Exchange Readiness Newsflash | Go-Live of NextGen ETD Contracts: Deletion of non-integrated weekly options – Batch 1

- Eurex Exchange Readiness Newsflash | Go-Live of NextGen ETD Contracts: “Contract Frequency” flag

- Eurex Exchange Readiness Newsflash | REMINDER: Next Generation ETD Contracts: Readiness Statement is available

- Eurex Exchange Readiness Newsflash | Next Generation ETD Contracts: Additional corporate action event in simulation on 31 January 2023

- Eurex Exchange Readiness Newsflash | Next Generation ETD Contracts: Readiness Statement is available

- Eurex Exchange Readiness Newsflash | Next Generation ETD Contracts updates: Additional supporting events in simulation

- Eurex Clearing Readiness Newsflash | Next Generation ETD Contracts updates: Readiness steps

- Eurex Exchange Readiness Newsflash | Next Generation ETD Contracts: Simulation approach

- Eurex Exchange Readiness Newsflash | Next Generation ETD Contracts updates: Additional products in T7 Simulation, Checklist for Trading Participants and 4th Focus Call

- Eurex Exchange Readiness Newsflash | Additional Next Generation ETD Contracts products and dedicated test case: Simulation updates

- Eurex Exchange Readiness Newsflash | Next Generation ETD Contracts – Product list

Readiness Statement

We kindly ask all Trading Members to submit the Readiness Statement for the Next Generation ETD Contracts initiative by Friday, 17 March 2023 latest.

For your convenience a online submission process has been published. The online Readiness Statement is here available: Readiness Statement. Please enter your dedicated Eurex Clearing PIN in the online questionnaire. The PIN for your company has been sent to the Central Coordinator.

Readiness Videos

Participants Requirements

Changes | Details | Action Item |

T7 10.0 (Nov 2021): API, GUI, Report changes |

|

|

Simulation Start for T7 (early Dec 2021) |

|

|

Full Scope Simulation for T7 (end of Jan 2022) |

|

|

Production Go-Live (27 March 2023) |

|

|

Launch of further Business Initiatives (tbd) |

|

|

Eurex Initiatives Lifecycle

From the announcement till the rollout, all phases of the Eurex initiatives outlined on one page! Get an overview here and find other useful resources.

Contacts

Contact

Eurex Frankfurt AG

Key Account Management

Service times from 09:00 - 18:00 CET

Are you looking for information on a previous initiative? We have stored information about our previous initiatives in our Archive for you!