Mar 07, 2022

Eurex

T7 Release 10.1 – Next Generation ETD Contracts: Contract notation concept

1. Introduction

With the introduction of Next Generation ETD Contracts, sub-monthly expiring contracts will be supported on product level supplementing already existing contracts expiring on a monthly, quarterly or yearly basis. The enhanced contract scope is affecting the trading, clearing and risk management layer of Eurex.

The present circular is focusing on the contract notation applied on the T7 Trader GUI. Since the contract display notation is based on a month-year notation, the contract display concept of the T7 Trader GUI needs to be enhanced.

The T7 instrument ID required for an instrument identification on a technical level and used as numerical ID in all electronical interfaces of the T7 trading platform is still valid and consistently applies to the sub-monthly expiring contracts in the same way as it already applies for monthly expiring contracts.

The new contract notation concept was already introduced with T7 Release 10.0 and covers sub-monthly expiring contracts. The activation of the sub-monthly expiring contracts is scheduled to take place in the Eurex Production Environment after the launch of T7 Release 10.1 (launch date: 27 June 2022).

Sub-monthly expiring contracts are already supported in the Eurex Simulation Environment and are made available in the new contract notation. Smaller deviations in the contract notation currently visible on the T7 Trader GUI and in the reference data fields of the Eurex RDI/RDF interface compared to what is described by the present circular will be removed presumably with T7 Release 11.0.

More information about the Next Generation ETD Contracts initiative is provided in the T7 10.0 Release Notes and T7 10.1 Release Notes on the Eurex website www.eurex.com under the following links:

Support > Initiatives & Releases > T7 Release 10.0 and T7 Release 10.1

Support > Initiatives & Releases > Project Readiness > Next Generation ETD Contracts

There, you will also find system documentation, circulars, timeline and much more information.

2. Required action

Focusing on the Trader GUI of the T7 trading platform, adaptations are already made to uniquely display sub-monthly expiring contracts.

- Traders are requested to get familiar with the new GUI notation of sub-monthly expiring contracts already provided in the Eurex Simulation Environment (see for example product NOA3 for weekly expiring options contracts or product FMWN for daily expiring futures contracts in the Eurex Simulation Environment).

The concept of the T7 instrument ID required for the identification of contracts (i.e. simple instruments), complex or flexible instruments via all electronical interfaces is still valid and will not be touched by the Next Generation ETD Contracts initiative.

- Trading participants are requested to verify their own internal trading infrastructure whether it can handle sub-monthly expiring contracts and whether it can support products having more than one expiration per month.

New contract reference data attributes are supported via the T7 reference data interface RDI/RDF to facilitate the handling of sub-monthly expiring contracts. With the help of the new contract reference data attributes, front-office ISVs are supported to adapt their service offerings in case the new sub-monthly expiring contracts cannot be uniquely displayed by their front-office applications.

3. Details of the new contract notation

In general, the contract notation of the T7 trading platform will be based on the contract date. This general rule applies to all simple and flexible instruments. Since for most derivative products, the contract date is identical to the expiration date, this conceptual change is only visible for those products where the contract date is different from the expiration date.

Currently, products with contract date different from expiration date are STIRs futures (e.g. Saron futures with product symbol FSR3 and €STR futures with product symbol FST3) and all MSCI futures and options products (e.g. FMEU, OMEU).

The contract display notation on the T7 Trader GUI is enhanced in the following way:

i. T7 GUI contract display notation of primary contracts

Monthly, quarterly, semi-annually or annually expiring contracts are usually expiring on the third Friday of the corresponding month (“primary contracts”)1. The currently valid contract display notation of these contracts is based on month and year of the corresponding contract date. Consequently, the contract display notation of primary contracts will not change, i.e. primary contracts will be displayed in the usual month-year contract display notation.

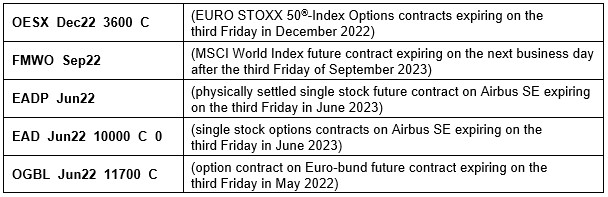

Examples of T7 Trader GUI notation of primary contracts:

1 For fixed income derivatives (e.g. FGBL), the expiration date might deviate from a third Friday of the corresponding contract month.

Sub-monthly expiring contracts are denoted as non-primary contracts and described in the following.

ii. T7 GUI contract display notation of weekly and end-of-month expiring options contracts

As part of the Next Generation ETD Contracts project, the monthly expiring contracts of weekly options products (i.e. OES1, OES2, OES4) will be integrated into the corresponding main options product (here: OESX), and the same applies to monthly expiring contracts of end-of-month options product (here: OMSX). For uniquely displaying weekly and end-of-month expiring options contracts on the T7 Trader GUI after their integration, the contract display notation of primary contracts will be extended to provide additional information for displaying weekly and end-of-month expiring options contracts.

Examples of T7 Trading GUI display notation of weekly and end-of-month expiring options contracts2:

OESX Dec22-W2Fri 3600 C | (replacing OES2 Dec23 3600 C 0) | |

EAD Jun22-W4Fri 10000 C 0 | (replacing EAD4 Jun23 10000 C 0) | |

OGBL Jun22-W1Fri 11700 C | (replacing OGB1 Jun23 11700 C 0) | |

OESX Sep22-EoM 3600 C | (replacing OMSX Sep22 3600 C) |

Although the Next Generation ETD Contracts initiative is exclusively covering existing weekly expiring Friday options contracts, the day of the week is included to the display notation to be prepared for potential enhancements regarding weekly expiring options different from Friday expirations (e.g. weekly expiring Monday or Wednesday options contracts on top).

As shown in the example above, end-of-month expiring options contracts have their own contract display notation indicated by the extension “EoM”. Please note that an end-of-month notation has priority over the fifth Friday notation in those options products where end-of-month contracts are supported3. For example, options contracts of OESX expiring on the fifth Friday in September 2022 are expressed by OESX Sep22-EoM 3600 C but not by OESX Sep22-W5Fri 3600 C.

2 There are smaller deviations of display notation of weekly expiring contracts currently applied to the T7 Trader GUI and the example display notation mentioned above (e.g. “Fr” instead of “Fri”). The deviations are expected to vanish until the end of 2022.

3 End-of-month options products are OMSX and OSSM and the corresponding options contracts will be integrated into the main options products OESX and OSSX, respectively.

iii. T7 GUI relative day notation of daily expiring futures contracts and complex instruments using daily expiring futures contracts

For uniquely displaying daily expiring futures contracts on the T7 Trader GUI, the GUI notation uses a relative contract date display notation (“relative day notation”). Instead of applying a specific date or a specific day-month-year notation, the contract display notation is referring to the difference between current business day and contract date of the corresponding daily expiring contract.

To indicate that the current business day abbreviated by “T” (for today) is identical to the contract date, the abbreviation “T+0” is used. To display that the contract date is one or two days after to the current business day, the abbreviation “T+1” or “T+2”, respectively, is used.

Examples of T7 display GUI notations involving daily expiring futures contracts4:

- Outright Future: FMEU T+2:

Daily expiring future contract on MSCI Europe index where the contract date is reached in two business days; please note that for MSCI index futures (and options), the expiration date is one business day after the contract date implying that in this example the expiration date is reached in three business days

- Basis Spread: FMEU BSPD T+1 Jun22:

Futures calendar spread in FMEU with a daily expiring futures contract one business day ahead of its contract day as near-term leg and a quarterly expiring contract as long-term leg; such calendar spreads are denoted as basis spreads (“BSPD”) and are relevant in the context of basis trading (here: on MSCI Europe index)

- Outright Future: EADP T+0:

Daily expiring single stock futures contract on Airbus SE where the current business day is identical to the contract date.

- Options volatility Strategy: EAD C 100 Jun22 11800 vs 31 EADP T+0 @ 115.35:

Option volatility strategy containing a call option on Airbus SE and a daily expiring single stock futures contract on Airbus SE expiring on the same business day as underlying leg.

4 There are smaller deviations of display notation of daily expiring contracts currently applied to the T7 Trader GUI and the example display notation mentioned above (e.g. “T1” instead of “T+1”). The deviations are expected to vanish until the end of 2022.

Daily expiring MSCI futures contracts introduced with the Next Generation ETD Contracts initiative are restricted to a maximum lifetime of three business days for MSCI futures contracts, and daily expiring physically settled single stock futures occur with a lifetime of one business day. However, an extension of the maximum lifetime can be easily covered by the contract display notation in a canonical manner allowing figures larger than 2.

A daily expiring contract with a maximum lifetime of one business day means that the derivative contract is created and expiring on the same business day. On the next business day, a new derivative contract is introduced with a different T7 instrument ID, different contract ID, and different ISIN compared to its predecessor of the business day before. However, the display of the daily expiring contract does not change on the T7 Trader GUI (e.g. EADP T+0) although it is a different contract compared to its predecessor.

Daily expiring contracts with a maximum lifetime of more than one business day are conceptually embedded to daily expiring contracts with a maximum lifetime of one business day. As an example, a daily expiring contract denoted by "T+2" at the current business day is denoted by "T+1" on the following business day and keeps its T7 instrument ID, contract ID, and ISIN, i.e. the T7 Trader GUI is changing the contract display name from one to the next business day although the contract itself did not change. Again, the contract denoted one business day later by "T+2" is a different contract with different T7 instrument ID, different contract ID and ISIN compared to the contract one business day before also denoted by "T+2".

Thus, daily expiring contracts with a maximum lifetime of N>1 business days are associated with a rolling daily creation and expiration cycle with a cycle frequency of N business days. As an example, a daily expiring MSCI futures contract with contract date 24.02.2022 and a lifetime of N=3 business days has the following contract notations:

- On business day 22.02.2022: FMWN T+2

- On business day 23.02.2022: FMWN T+1

- On business day 24.02.2022: FMWN T+0

- On business day 25.02.2022: Expiration and final settlement

Thus, the daily changing display notation of the same contract indicated by T+(N-1), T+(N-2), (…), T+1, T+0 on consecutive business days is a consequence of the relative day notation5. Please note that for MSCI futures, the expiration date is following the contract date by one business day. As an example, a MSCI futures contract indicated by T+0 is expiring and finally settled on the next business day and a MSCI futures contract indicated by T+1 is reaching its contract date on the next business day and is expiring and finally settled on the next of next business day.

As an additional particularity, a daily expiring MSCI futures contract on its expiration and final settlement day is indicated with “T-1” in the RDI reference data, e.g. FMWN T-1. Please also note that for all MSCI futures and options contracts, the contract date is identical to the last trading day. Therefore, a daily expiring MSCI futures contract is not displayed anymore on the T7 Trader GUI after it passed the contract date, i.e. a MSCI futures contract with “T-1” is not displayed on the T7 Trader GUI.

5 The relative day notation can also assume negative values indicating that the current business day has already passed the contract date (i.e. the contract date is in the past).

iv. Contract display notation and Reference Data Interface

To simplify the handling of monthly and sub-monthly expiring contracts and to provide information about the contract display notation, additional reference data attributes were introduced to the Eurex reference data interface (RDI/RDF).

From a conceptual point of view, these additional RDI/RDF reference data attributes provide a complete set of information how a contract is displayed on the T7 Trader GUI. The field “contract display instruction” (tag 25186) is revealing the information which contract display notation applies to the corresponding contract. In the context of the financial derivative markets of Eurex, the following valid values of the field “contract display instruction” are relevant.

"month" | Indicates that the common month-year contract notation applies. | |

„week-of-month” | Indicates that the contract notation valid for weekly expiring options contracts applies; in case this contract display instruction is set, the field “displayWeek” is indicating the week of the month provided in the field “displayMonth” and the field “displayWeekDay” is indicating the day of the week. | |

„End-of-Month” | Indicates the contract notation valid for options contracts expiring on the last business day of a month which is provided in the field “displayMonth”. | |

„RelativeDay“ | Indicates that the “relative contract date” display notation applies; in case this contract display instruction is set, the difference of number of business days between current business day and contract date is given by the contract reference data field “display relative days”. |

Additional contract display instructions might be used at a later point in time or may apply for other exchanges (e.g. EEX/ECC).

More detailed information about the field “contract display instruction” and other contract display reference data fields can be found in the Eurex RDI Reference Manual. The table in the attachment summarizes the contract display attributes provided via the RDI/RDF reference data interface. Based on these contract display attributes, a trading participant or a front-office ISV can specify their own contract display naming convention in case they would like to use a different contract notation as displayed on the T7 Trader GUI or as provided by the contract attribute “displayName” (tag 28791).

The RDI/RDF contract attribute “display name” is providing a string containing the full contract name as display on the T7 Trader GUI. The field “display name” is consistent with the RDI/RDF field “contract display instruction” and composed of the RDI/RDF contract display fields satisfying the contract display instructions as closely as possible.

Eurex recommends to front-office ISVs to take notice of the contract display notation concept outlined in the present circular.

Please see the table of contract reference data attributes in the attachment.

v. Contract notation of flexible contracts and their display on the T7 Trader GUI

Consistent to the new contract notation concept, flexible contracts of MSCI futures and options products displayed with YYYYMMDD has a last trading day identical to YYYYMMDD and expires one business day later on YYYMMDD + 1 (see also Release Notes of T7 Release 10.0, § 2.2.3).

The switch of the flexible contract notation from expiration date to contract date is scheduled to take place in the production environment on 4 April 2022. Except for flexible contracts in MSCI futures and options products, the switch does not affect flexible contracts in other derivative products since, in this case, the contract date is identical to the expiration date6.

6 STIRs futures products have contract dates different from expiration dates but do not support flexible contracts.

Attachment:

- Table of contract reference data attributes

Further information

Recipients: | All Trading Participants of Eurex Deutschland and Vendors | |

Target groups: | Front Office/Trading, Middle + Backoffice, IT/System Administration | |

Contact: | client.services@eurex.com | |

Web: | Support > Initiatives & Releases > T7 Release 10.0 and T7 Release 10.1, Support > Initiatives & Releases > Project Readiness > Next Generation ETD Contracts | |

Authorized by: | Jonas Ullmann |