Aug 20, 2021

Eurex

Derivatives on Exchange Traded Products: Introduction of Futures on BTCetc - ETC Group Physical Bitcoin

1. Introduction

The Management Board of Eurex Deutschland and the Executive Board of Eurex Frankfurt AG took the following decisions with effect from 13 September 2021:

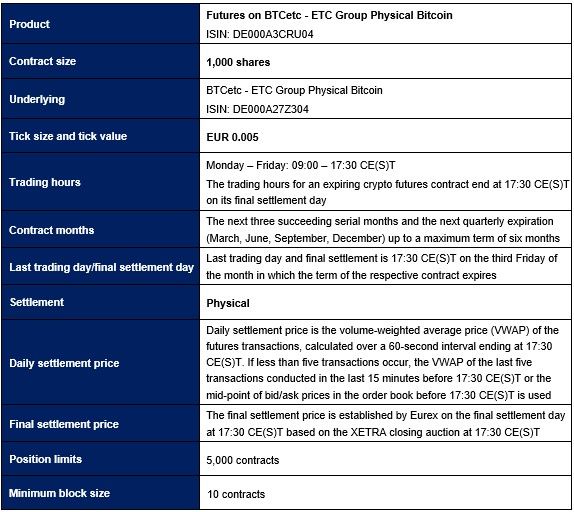

- Introduction of Futures on BTCetc - ETC Group Physical Bitcoin pursuant to Attachment 1

- To determine a position limit in Futures on BTCetc - ETC Group Physical Bitcoin of 5,000 contracts

- To offer a Liquidity Provider Scheme for Futures on BTCetc - ETC Group Physical Bitcoin according to the Product Specific Supplement in Attachment 2

This circular contains all information on the introduction of the new product and the updated sections of the relevant Rules and Regulations of Eurex Deutschland.

Production start: 13 September 2021

2. Required action

There is no action required for participation.

3. Details of the initiative

A. Product overview

Please refer to Attachment 1 for the new product.

B. Contract specifications

For the detailed Contract Specifications, please see Attachment 1.

The full version of the updated Contract Specifications for Futures Contracts and Options Contracts at Eurex Deutschland will be published on the Eurex website as of start of trading under:

Rules & Regs > Eurex Rules & Regulations > Contract Specifications

C. Admission to the Eurex T7 Entry Services (TES)

The new product will be admitted to the Eurex T7 Entry Services (TES). You can find the minimum block trade sizes on product level in the attached Contract Specifications.

An overview of the Eurex T7 Entry Services available for the products as well as detailed information on single product basis with regard to availability, possibility of utilisation and minimum entry size for the various Eurex T7 Entry Services is available on the Eurex website under the link:

Data > Trading files > T7 Entry Service parameters

D. Risk parameters

As of start of trading, risk parameters of the new product will be published on the Eurex website under the link:

Data > Clearing files > Risk parameters and initial margins

and on the Eurex Clearing website www.eurex.com/ec-en under the following link:

You will also find an updated list with details regarding Prisma-eligible Eurex products under this path.

E. Excessive System Usage Fee and Order to Trade Ratio

The Excessive System Usage Fee and the Order to Trade Ratio for the new product are determined in line with the existing products (FSTK). For further information, please refer to the Eurex website under the following links:

Rules & Regs > Excessive System Usage Fee

or

Rules & Regs > Order to Trade Ratio

F. Mistrade parameters and position limits

Mistrade ranges and position limits for the new product will be published as of start of trading on the Eurex website under the links:

Markets > product

or

Data > Trading files > Position Limits

G. Transaction fees

Please refer to the Price List of Eurex Clearing AG under the link:

H. Vendor codes

At start of trading, vendor codes for the new products will be published on the Eurex website under the link:

Markets > Product Overview > Vendor Codes

I. Liquidity Provisioning

Please refer to the attached PSS document (Attachment 2).

Attachments:

- 1 – Updated sections of the Contract Specifications for Futures Contracts and Options Contracts at Eurex Deutschland

- 2 – Product Specific Supplement „Equity 07 – Future on BTCetc - ETC Group Physical Bitcoin”

Further information

Recipients: | All Trading Participants of Eurex Deutschland and Vendors | |

Target groups: | Front Office/Trading, Middle + Backoffice, IT/System Administration, Auditing/Security Coordination | |

Contact: | client.services@eurex.com | |

Web: | www.eurex.com | |

Authorized by: | Randolf Roth |