Aug 29, 2022

Eurex

MiFID II/MiFIR order flagging requirements: Changes to the Short Code processing logic

1. Introduction

With T7 Release 11.0 which is planned to be launched on 21 November 2022, Eurex will introduce a number of changes to the short code processing logic. These changes will streamline and simplify compliance with the legal requirements on short code-long code registration and use for Exchange Participants.

| |

| |

| |

|

Simulation start: 12 September 2022

Production start: 21 November 2022

2. Required action

Please retrieve your functional and technical documentation from the Eurex website www.eurex.com.

Functional documentation is in the updated reporting handbook “Information handbook for audit trail, transaction and other regulatory reporting under the MiFID II/MiFIR regime” available under:

Rules and Regs > MiFID II/MiFIR > Reporting

Technical documentation is available under:

Support > Initiatives & Releases > T7 Release 11.0

3. Details

A. Changes to the short code processing logic dependent on the Status Indicator

Processing of Status Indicators N and M

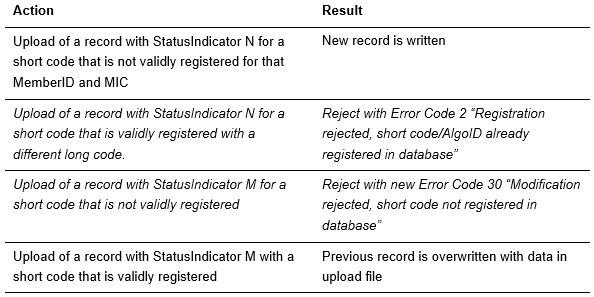

The logic for processing uploads of short code-long code mappings with StatusIndicator N will be amended as follows: If the short code already registered for that MemberID and MIC, the upload will be rejected in report TR160 with Error Code 2 “Registration rejected, short code/AlgoID already registered in database”. This will happen regardless of the long code registered for that short code.

At the same time, uploads of short code-long code mappings with StatusIndicator M will be rejected where the short code is not already registered for that MemberID and MIC. The rejection will be indicated in report TR160 with Error Code 30 “Modification rejected, short code not registered in database”.

In summary, the new processing logic as of T7 Release 11.0 will be as outlined in the table below. Changes as compared to the current processing are italicised:

Processing of StatusIndicators M and D with ValidFromDate T-1 or T

It will no longer be possible technically to modify or delete short code-long code mappings retroactively or intraday. This means that all uploads of short code-long code mappings with Status Indicators M (“Modification”) or D (“Deletion”) where the ValidFromDate is set to T-1 or T, with T being the trading date of the upload, will be rejected in report TR160 with Error Code 27 “Retroactive or intraday changes are not permitted”.

Processing of StatusIndicators N, M and D with ValidFromDate in the future

In order to simplify processes for all involved parties and to prevent the reoccurrence of certain previously observed technical issues, from T7 Release 11.0 new registrations, modifications and deletions (StatusIndicators N, M or D) of short code-long code mappings will only be accepted with a ValidFromDate of the next trading day following the upload date (T+1). New registrations, modifications or deletions with any other ValidFromDate in the future will be rejected in report TR160 with Error Code 28 “Uploads with ValidFromDate in the future can only be processed for the next trading day (T+1)”.

In this context, Exchange Participants are encouraged to consult the Trading Calendar to ensure that modifications and/or deletions of registered short code-long code mappings are uploaded to the exchange with the correct ValidFromDate.

Processing of StatusIndicator M where ClassificationRule is altered

Uploads of modifications (Status Indicator M) that result in a change in the Classification Rule will be rejected with Error Code 29 “Changing classification rule is not permitted” in the report TR160. This will be the case for all Classification Rules L (for “legal entity”), N (for “natural person”), or blank (for the ESMA default values AGGR, PNAL and NORE).

B. Amendments to report TR166

Report TR166 “Identifier Mapping Final Error Report” will be adapted. In addition to the prevailing report structure providing the totals of the concerned short codes, every single short code used will be shown in the report. Hence, Exchange Participants will be provided with a list of all short codes a) used in trading on trading day T, b) missing on trading day T, c) corrected on trading day T+1 and d) not decrypted into long codes before the legally defined deadline (23:30 CE(S)T on T+1), i.e. the “final missings”.

This change is intended to provide additional information to Exchange Participants that may assist them in diagnosing any errors or issues resulting in final missing short codes and should therefore help simplify compliance with the obligation to decrypt all short codes used in trading to the exchange at the latest by the end of the trading day following their use in an order/quote. Report TR166 will continue to be used as a basis for sanctioning proceedings.

The new XML structure for the TR166 “Identifier Mapping Final Error Report” is provided in the document “T7 XML Report Reference Manual” available on the Eurex website under the following path:

Support > Initiatives & Releases > T7 Release 11.0

Further information

Recipients: | All Trading Participants of Eurex Deutschland and Vendors | |

Target groups: | Front Office/Trading, Middle + Backoffice, IT/System Administration, Auditing/Security Coordination, Compliance Departments, Nominated Persons | |

Related circular: | Eurex Circular 095/21 | |

Contact: | Your Key Account Manager or client.services@eurex.com; for regulatory questions eurex.reg.reporting@eurex.com; for technical questions your Technical Key Account Manager or cts@deutsche-boerse.com | |

Web: | www.eurex.com | |

Authorized by: | Michael Peters |