T7 Release 9.1

T7 Release 9.1 is a backwards compatible release (no backwards compatibility: market and date reference interfaces).

New features, changes and improvements:

- Product extension for Equity Bespoke Baskets

- Eurex EnLight Enhancements

- Further changes and enhancements (i.e. stepwise introduction of FIX LF Interface, report and TES changes)

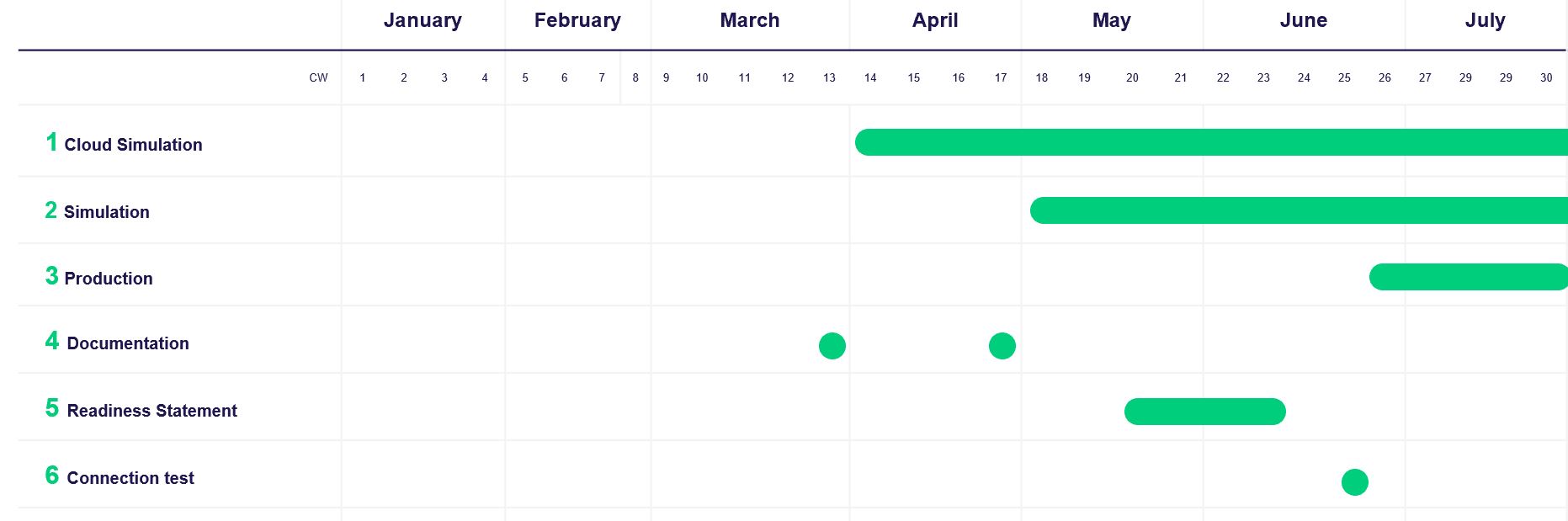

Simulation start: 3 May 2021

Production start: 28 June 2021

System Documentation

- T7 Release 9.1 - Final Functional Technical Release Notes Eurex v.1.2

The release notes for T7 give an overview of the functional and technical enhancements and changes to be introduced. - T7 Release 9.1- Functional Reference v.9.1.2

This document provides a detailed insight into the functional concepts of the T7 trading architecture. - T7 Release 9.1 - Function and Interface Overview v.9.1.2

The document provides an overview of T7. It describes the major functional and system features, and provides a high level description of the interface landscape. - T7 Cross System Traceability v.9.1-1.0

This document contains detailed information on order, quote and trade traceability across trading and clearing systems focusing on the markets XEUR (Eurex Frankfurt) and XETR (Xetra Frankfurt).

Enhanced Trading Interface

- T7 Release 9.1 - Enhanced Trading Interface (ETI) - Manual v.1.1

The document provides information relating to the T7 Enhanced Trading Interface (ETI) and contains a detailed description of the concepts and the messages used by the interface for both the Cash and Derivatives Markets. (Please Note: This document is valid without changes for T7 Release 9.1 Simulation & Production.) - T7: Enhanced Trading Interface - Derivatives Message Reference v.9.1-D0002

This document provides a reference to all message formats for the Enhanced Trading Interface derivatives markets. (Please Note: This document is valid without changes for T7 Release 9.1 Simulation & Production.) - T7: Enhanced Trading Interface - Cash Message Reference v.9.1-C0002

This document provides a reference to all message formats for the Enhanced Trading Interface cash markets. (Please Note: This document is valid without changes for T7 Release 9.1 Simulation & Production.) - T7 Release 9.1 Enhanced Trading Interface - XSD XML representation and layouts v.1.1

The package contains the XML representation and the schema files for the Enhanced Trading Interface (ETI) for both the Cash and Derivatives Markets. (Please Note: This document is valid without changes for T7 Release 9.1 Simulation & Production.)

FIX Gateway

- T7 FIX Gateway Manual (FIX 4.2 and FIX 4.4)_v.9.1

The document provides information on the T7 FIX Gateway for both the Cash and Derivatives Markets and contains a detailed description of the concepts and messages used by the interface. This document describes the FIX 4.2 and 4.4 versions of the interface. - T7 FIX Gateway - FPL Repository v.9.1

The FPL (FIX Protocol Language) repository contains the XML representation of the T7 FIX Gateway version 4.2 and 4.4 for both the Cash and Derivatives markets. - T7 FIX Gateway - Fiximate v.9.1

The package provides a browser-based representation of the repository for the T7 FIX Gateway versions FIX 4.2 + FIX 4.4 for both the Cash and Derivatives markets with navigation capabilities.

FIX Interface

T7: FIX LF Interface - Derivatives Message Reference_v.090.007.020

This document contains all message formats for the derivatives markets part of the T7 FIX LF interface. (The versions of the documents provided are applicable to the software version which will be available in the simulation environment from 20 April and in production from 30 April 2021.)T7: FIX LF Interface - Cash Message Reference_v.090.007.020

This document contains all message formats for the cash markets part of the T7 FIX LF interface. (The versions of the documents provided are applicable to the software version which will be available in the simulation environment from 20 April and in production from 30 April 2021.)T7 FIX LF QuickFix Engine Dictionary and Message Reference v.090.007.020

The package contains the QuickFix Engine dictionaries (FIXLF44_Derivatives.xml, FIXLF44_Cash.xml) and message reference files including message and field descriptions (FIXLF_DerivativesExt.xml, FIXLF_CashExt.xml) for the T7 FIX LF interface per marketplace type. (The versions of the documents provided are applicable to the software version which will be available in the simulation environment from 20 April and in production from 30 April 2021.)

- T7 Market and Reference Data Interfaces Manual v.9.1.2

The document provides information relating to the market and reference data interfaces (EMDI, MDI, RDI and RDF) and contains a detailed description of the concepts and messages used by the interfaces. - T7_EMDI_MDI_RDI_XML_Representation_v.9.1.2

The package contains the XML FAST template files (FAST 1.1 and 1.2) and FIXML schema files for the T7 market and reference data interfaces (EMDI, MDI and RDI). - T7 Enhanced Order Book Interface Manual v.9.1.2

The document provides information relating to the T7 Enhanced Order Book Interface (EOBI) and contains a detailed description of the concepts and messages used by the interfaces. - T7 Enhanced Order Book Interface - XML Representation v.9.1.2

The package contains the XML representation and the schema files for the T7 Enhanced Order Book Interface (EOBI). - Extended Market Data Service Trade Prices, Settlement Prices and Open Interest Data Manual v.9.11

The document provides information relating to the market and reference data interfaces (EMDI, MDI, RDI and RDF) and contains a detailed description of the concepts and messages used by the interfaces. - Extended Market Data Service - XML FAST Templates - FIXML schema files v.9.11

The package contains the XML FAST template files (FAST 1.1 and 1.2) and FIXML schema files for the T7 market and reference data interfaces (EMDI, MDI and RDI). - Extended Market Data Service - Underlying Ticker - Manual v.9.11

This document provides the information about the Underlying Ticker service for T7. - Extended Market Data Service - Underlying Ticker Service - XML FAST Templates v.9.11

This document provides the XML FAST templates for the Underlying Ticker service for T7. - T7 Release 9.0 - Eurex Market Signals_v.9.10

The package contains the XML representation and the schema files for the T7 Enhanced Order Book Interface (EOBI). - T7 Eurex Market Signals - XML FAST Templates v.9.10

The document contains the manual providing detailed information about the Eurex Market Signals.

- T7 Derivatives Markets - T7 Trader, Admin and Clearer GUI v.9.1.02

This document provides information on the T7 Derivatives Markets GUI solutions, the Trader-, Admin- and Clearer GUI for T7. All views and functions of the T7 Derivatives Markets GUIs are described. - T7 Cash Markets - T7 Trader, Admin and Clearer GUI v.9.1.02

This document provides information on the T7 Cash Markets GUI solutions, the Trader-, Admin- and Clearer GUI for T7. All views and functions of the T7 Cash Markets GUIs are described. - T7 Trader GUI, Admin GUI and Clearer GUI - Installation Manual v.9.1.0

This document provides information on Deutsche Börse's T7 GUI solutions, the T7 Trader GUI, T7 Admin GUI and T7 Clearer GUI from a technical point of view. The document explains how to establish connection to Deutsche Börse's T7 with the GUI solutions. - T7 Derivatives Market Eurex - Participant and User Maintenance Manual v.1.0

This manual is intended to assist service administrators who are responsible for maintaining participant and user related data in T7. - T7 Cash Markets - Xetra and Börse Frankfurt: Participant and User Maintenance Manual v.1.0

This manual is intended to assist service administrators who are responsible for maintaining participant and user related data in T7.

- N7 Network Access Guide_v2.0.59

This document provides details on the network access options for T7 and Eurex Clearing's interfaces. It includes detailed technical background information, such as router equipment information and port numbers for the configuration of firewalls - T7_Disaster_Recovery_Concept_2021_v_2.1

This document provides an overview of Deutsche Börse’s disaster recovery concept for the T7 trading system. It contains the required technical background information as well as functional features and limitations to enable participants to continue trading in a DR situation.

- T7 XML Report Reference Manual v.91.3.3

This document describes all reports based on T7 trading data for both the cash and derivatives markets. - T7 XML Report Manual Modification Notes v.91.3.3

This document provides an overview of the enhancements and changes to the T7 XML Reports as compared to the previous version. - T7 Reports - XML Schema Files v.91.3.3

This package contains the reports xsd files for T7 cash markets and derivatives markets reports. - Common Report Engine (CRE), User Guide - version April 2021

The Common Report Engine allows the centralized provisioning of reports. The manual contains everything from access information to CRE naming conventions.

- T7 Release 9.1 - Participant Simulation Guide v.1.0

This document describes the timeline, new and changed features as well as the simulation focus days for this T7 release. Please use this document to plan and prepare your T7 Release simulation participation. - Known Limitations for T7 Release 9.1 Simulation v.1.1

This document lists the current known limitations for the T7 Release simulation.

- T7 Release 9.0 - Incident Handling Guide v.5.0

This document provides a detailed description of the reaction of Deutsche Börse's T7 trading system to technical incidents and provides best practices for handling them. In addition the document provides references to the respective focus days in the T7 simulation environment which are intended to simulate such incidents. - Known Limitations for T7 Release 9.1 Production v.1.0

This document lists the current known limitations for the T7 Release prodution.

Circulars

Circulars

- Eurex Circular 051/21 T7 Release 9.1: Important information for production start

- Eurex Circular 098/20 Announcement of T7 Release 9.1

Newsflashes

- Eurex Exchange Readiness Newsflash | Eurex T7 Release 9.1: Reminder regarding Readiness Statement submission

- Eurex Exchange Readiness Newsflash | Eurex T7 Release 9.1: Readiness Statement is available

- Eurex Exchange Readiness Newsflash | T7 Release 9.1: Simulation start and publication of documentation

- Eurex Exchange Readiness Newsflash | T7 Release 9.1 - Preliminary Release Notes are now available

Release Items/ Participants Requirements

Feature/Enhancement | Details | Action Item |

| Eurex EnLight Enhancements | A series of enhancement has been introduced for Eurex EnLight, including improvements to the T7 Trader GUI. | Keep in mind that this processing is not backwards compatible for ETI/FIX version 9.0. |

| Extension of the Equity Basket Trading Product Scope | Eurex did expand the scope of products available for equity basket (EBB) trading, including Options products as well as additional Futures products. | Currently, there is no action required for trading members. |

Contacts

Eurex Frankfurt AG

Customer Technical Support / Technical Helpdesk

Service times from Monday 01:00 – Friday 23:00 CET

(no service on Saturday and Sunday)

T +49-69-211-VIP / +49-69-211-1 08 88 (all)

Eurex Frankfurt AG

Key Account Management

Service times from 09:00 - 18:00 CET

Are you looking for information on a previous initiative? We have stored information about our previous initiatives in our Archive for you!