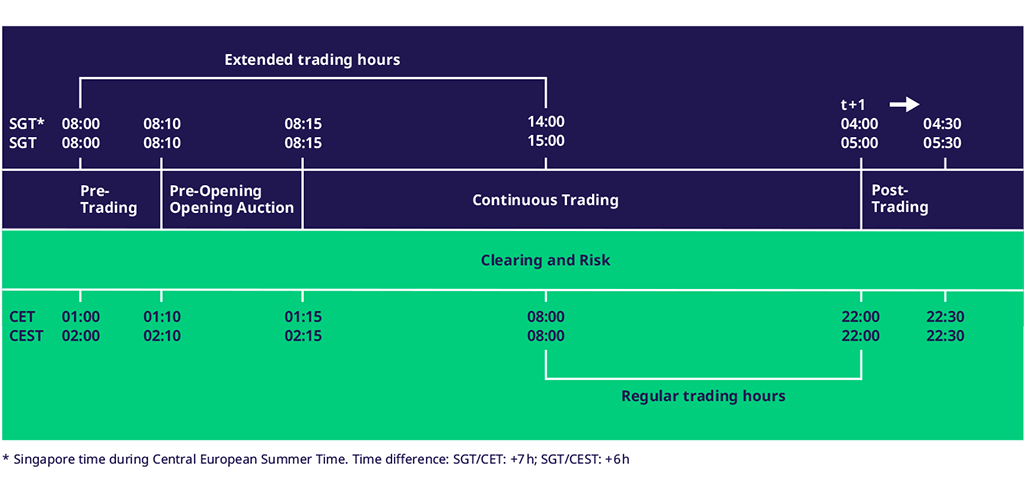

Trading phases

During the trading day, each product has a specific trading phase (state) that gives a structure to the business day.

The instrument state changes in general with the product state.

The following sub-chapters describe each product state in detail; in order to get more details about order restrictions, please see the sub-chapter Order restrictions by trading period.

Overview of content

Post-Trading

The product state Post-Trading terminates the trading session of a business day. It is typically a time where traders can maintain their orders in preparation of the next trading day. No matching occurs in this phase.

Normally, instruments are in the instrument state 'Book'.