Trading phases

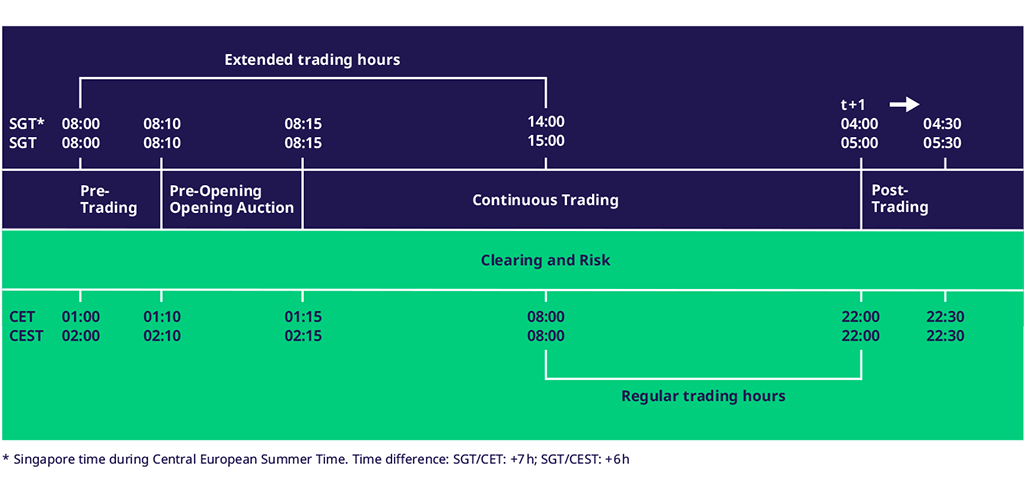

During the trading day, each product has a specific trading phase (state) that gives a structure to the business day.

The instrument state changes in general with the product state.

The following sub-chapters describe each product state in detail; in order to get more details about order restrictions, please see the sub-chapter Order restrictions by trading period.

Overview of content

- Start of Day

- Pre-Trading

- Opening

- Trading

- Closing

- Post-Trading

- End of Day

- Post End of Day

- Halt

- Holiday

- Order restrictions by trading period

Order restrictions by trading period

With the beginning of the pre-trading period, Eurex participants can enter orders. There are restrictions, however, on the types of orders that may be entered outside the main trading period. The chart below illustrates which types of orders can and cannot be entered during the various periods of the trading day:

| Order Type | Pre-Trading | Pre-Opening | Trading | Post-Trading |

Market order | Yes | Yes | Yes | Yes |

Stop order (futures contracts) | Yes | Yes | Yes | Yes |

Restricted limit order (IOC) | No | No | Yes | No |

| Unrestricted limit order (GFD, GTC, GTD) | Yes | Yes | Yes | Yes |

Futures combination | Yes | Yes | Yes | Yes |

Strategies | No | No | Yes | No |

IOC: Immediate or cancel

GFD: Good-for-day

GTC: Good-till-cancelled

GTD: Good-till-date

Additional restrictions apply for the different phases of the post-trading period:

Post-Trading Full | Post-Late 1 | Post-Late 2* | Post-Trading Restricted | |

Eurex Trade Entry Services | Yes | No | No | No |

Give-up/Take-up* | Yes | Yes | No | No |

Trade adjustment/exercise | Yes | Yes | Yes | No |

* for interest rate options on the last trading day only