Feb 25, 2022

Eurex

MiFID II/MiFIR reporting: Clarification on reporting requirements when execution decision is taken by the client

1. Introduction

This circular clarifies the reporting requirements for Exchange Participants in regards to Eurex T7 fields “Execution Qualifier” and “Execution Identifier”, as previously defined in Eurex Circular 040/17.

The following information is only relevant for the case where the Execution Decision was not taken within the Participant firm, but by the client.

2. Required action

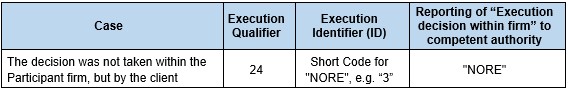

In case the Execution Decision was primarily taken outside the Participant firm, i.e., by the client, the aforementioned fields shall be populated as follows:

It is in the responsibility of the Exchange Participants to determine the decision maker primarily responsible for the execution in accordance with their governance model.

3. Details

In case the Execution Decision was taken by the client, Exchange Participants have to enter the following values in T7 fields “Execution Qualifier” and “Execution Identifier”:

- “24“ in field “Execution Qualifier”, representing the decision maker is a natural person. The entry is required, as Eurex relies on the qualifier to identify whether a short code or algorithm ID was populated in the “Execution Identifier” field.

- The short code for “NORE” in field “Execution Identifier”, e.g. “3”. This entry is stipulated in Section 5.12 ESMA Guidelines on Transaction Reporting, order record keeping and clock synchronisation under MiFID II.

Please note that those entries are default values for the cases when the decision was taken by the client, among those for the orders submitted via Direct Market Access (DMA), irrespective of whether the client is a natural person or an algorithm.

Please also note that any changes to reporting requirements caused by MiFID II/MIFIR amendments or amendments to the Eurex Exchange rulebook and, as a result, system changes, will be reflected in the “Information handbook for audit trail, transaction and other regulatory reporting under the MiFID II/MiFIR regime” (Eurex Reporting Manual).

For further details, please refer to the Eurex website www.eurex.com under the following path:

Rules & Regs > MiFID II/MiFIR > Reporting > Reporting Manual – MiFID II/MiFIR

More detailed information on Execution Qualifier and Execution Identifier can be found in the document ”Enhanced Trading Interface – Derivatives Message reference” available on the Eurex website under:

Support > Initiatives & Releases > T7 Release 10.0 > Trading Interfaces

Further information

Recipients: | All Trading Participants of Eurex Deutschland and Vendors | |

Target groups: | Front Office/Trading, Middle + Backoffice, IT/System Administration, Auditing/Security Coordination, Compliance | |

Contact: | client.services@eurex.com | |

Web: | www.eurex.com | |

Authorized by: | Michael Peters |