Feb 09, 2024

Eurex

Focus on VSTOXX® Derivatives | January 2024 recap

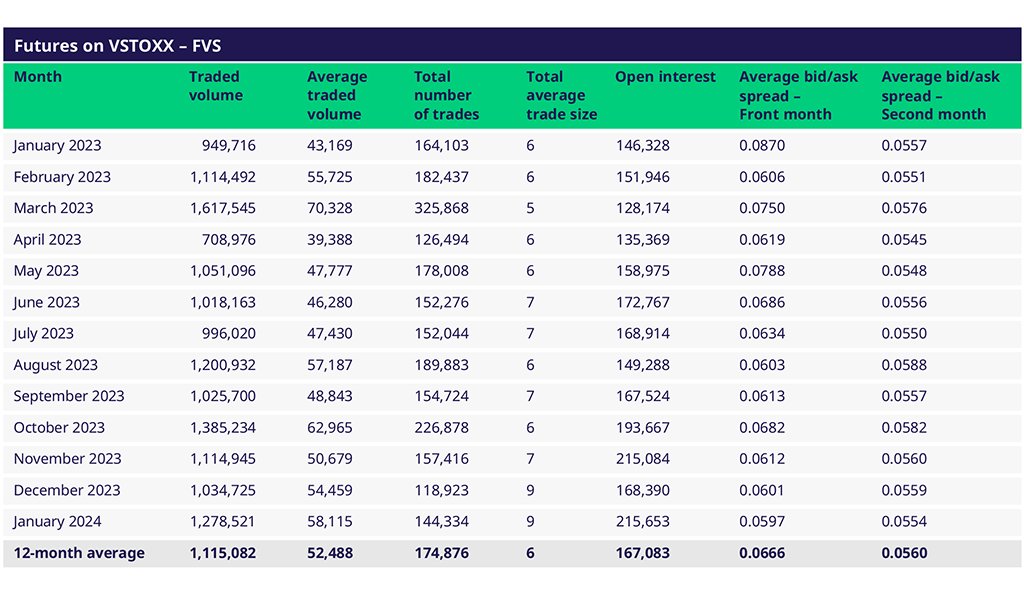

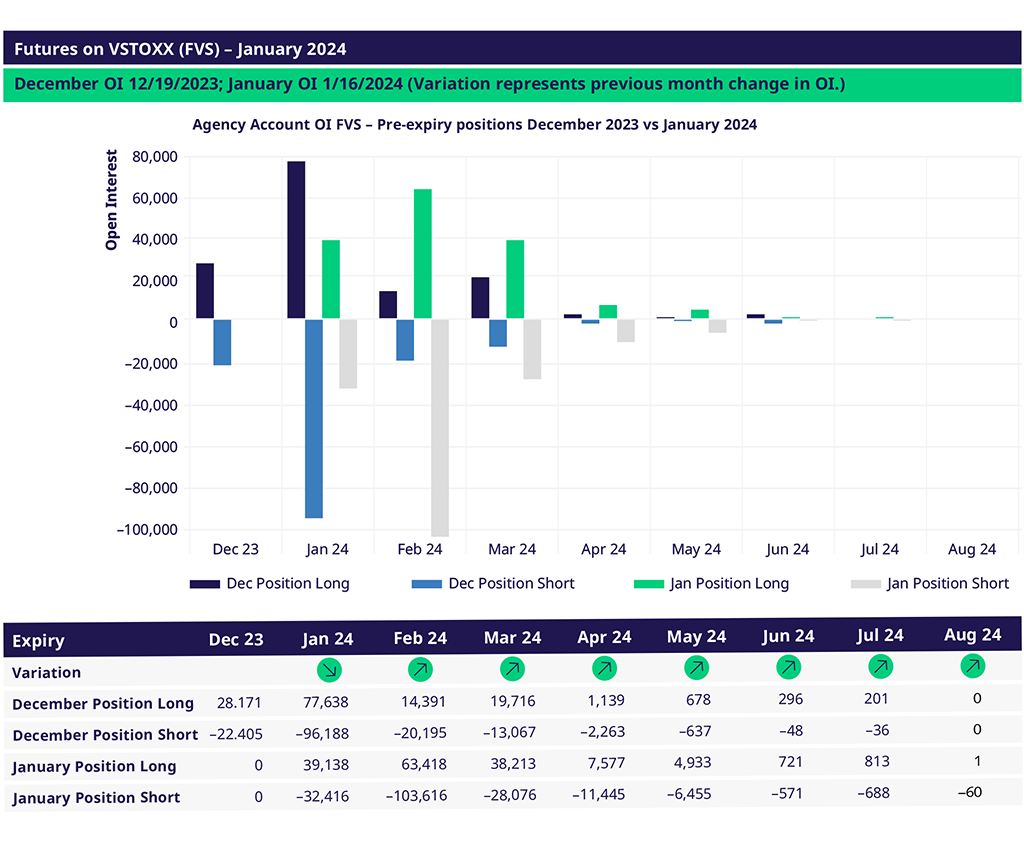

January was a notably active month for VSTOXX® Futures, with Open Interest hitting a 12-month high at over 215k contracts. ADV hit the highest since October, with over 1.278 million contracts traded, driving average daily volume to 58,115 contracts. Screen liquidity remained elevated, with the average bid/ask front month spread the tightest in over a year and the second month spread meaningfully tighter than average. 16 January saw the heaviest trading day for VSTOXX® Futures, with over 102k contracts trading. As of the JAN expiry, the FEB contract Open Interest attributed to A-accounts increasing its short bias, yet A-accounts stayed slightly net long in the MAR contract. Activity further out the curve continues to tick higher as we approach election season globally.

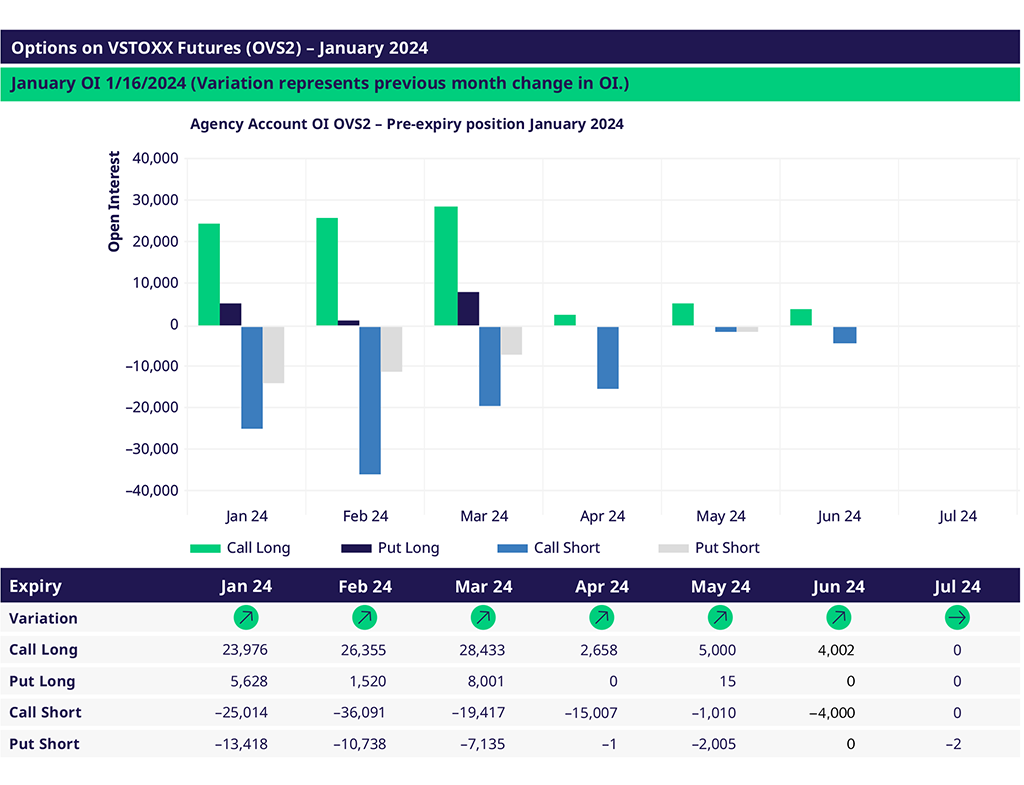

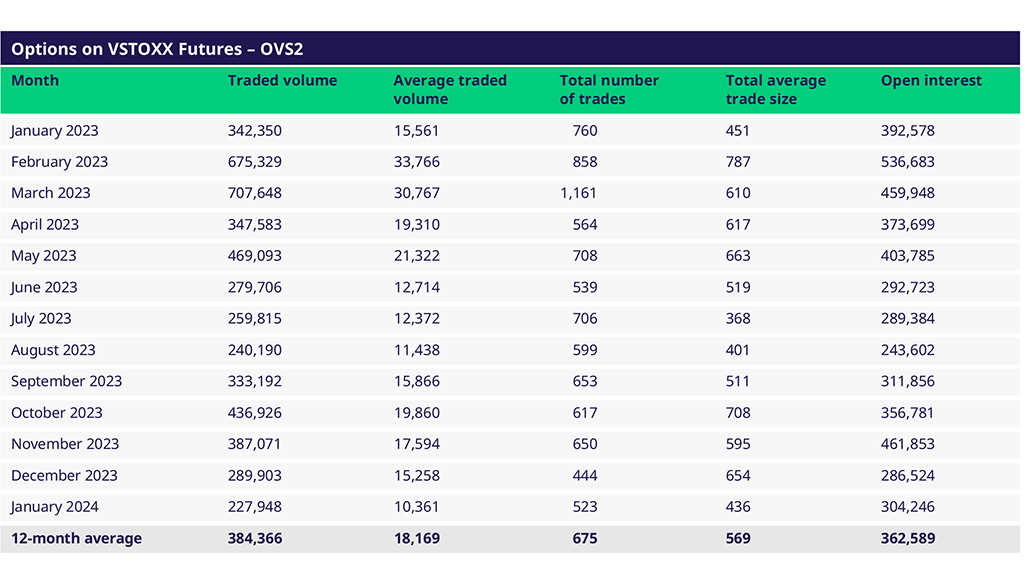

Ahead of 40+ national elections this year and heightened geopolitical uncertainty, screen markets for Options on VSTOXX® Futures (OVS2) are now roughly 50% tighter on the back of revised market-making requirements that came into effect 1 February. In January, OVS2 volumes were lighter than average. However, Open Interest ticked slightly higher from December. As with futures, 16 January was the heaviest trading day, with over 35k options trading.

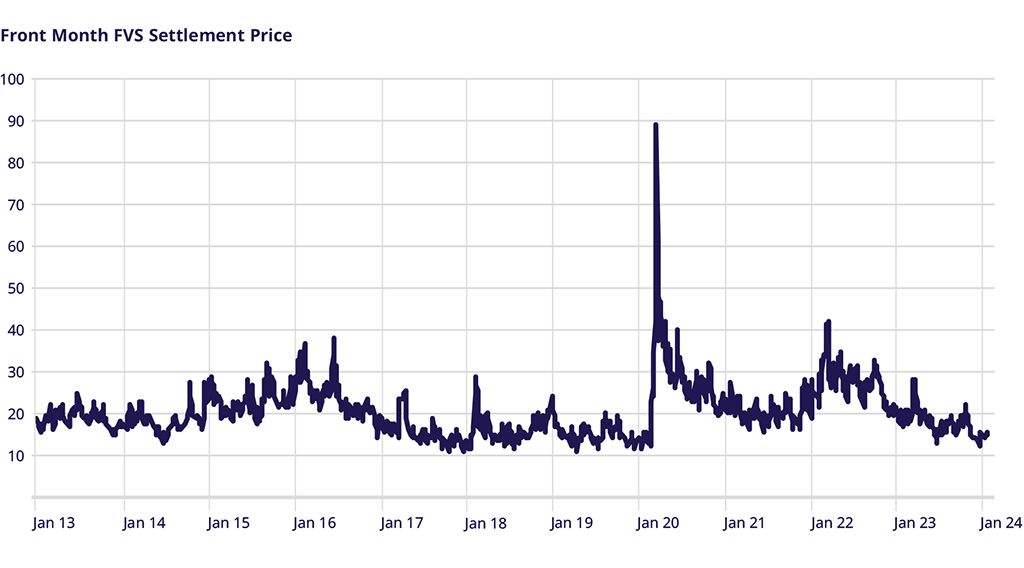

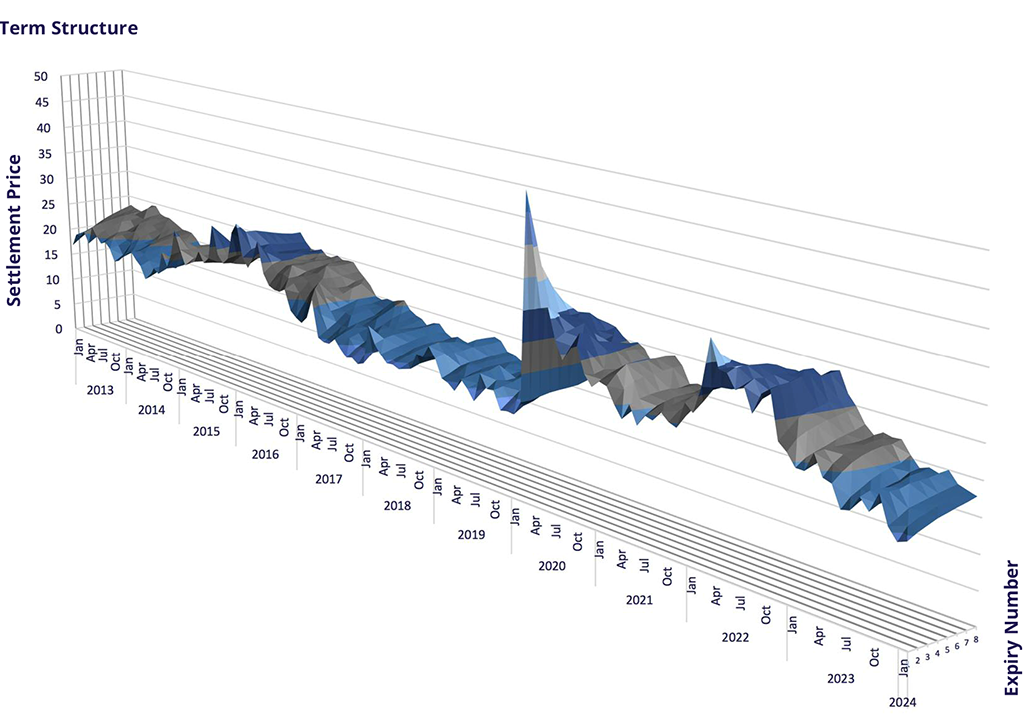

V2X itself was choppier than in December, hitting a high of 15.93 on 17 January (JAN expiry). Term structure continued to collapse, with the spread between the FEB and SEP contract narrowing to just 2.3 points by month end.

VSTOXX Futures (FVS)

Options on VSTOXX Futures (OVS2)

Contacts