Jun 13, 2016

Eurex

Colin Bennett on volatility trading. Part 3: Focus on Options on Volatility Futures

In our final part of our 3 part series on volatility, we focus on options on Volatility Futures and the trading of volatility of volatility. The key differences between options on equity and options on volatility are established. How traders arbitrage the imbalances between options on volatility, Variance Swaps and Volatility Futures is revealed.

About Colin Bennett

Colin Bennett is the author of 'Trading Volatility', the top ranked book on Amazon for volatility. Previously he was a Managing Director and Head of Quantitative and Derivative Strategy at Banco Santander, Head of Delta 1 Research at Barclays Capital, and Head of Convertible and Derivative Research at Dresdner Kleinwort.

Underlying of options is not spot, but the forward

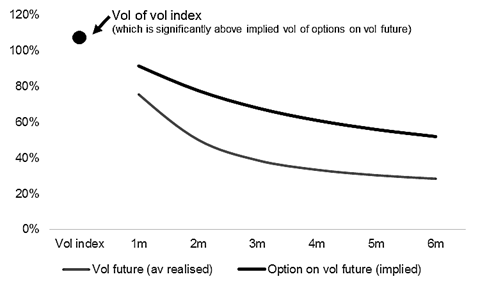

In order to value options, it is standard practice to look at the implied volatility and compare to realised volatility. One of the most common mistakes people make when attempting to value options on Volatility Futures is to assume that the underlying is spot (i.e. the Volatility Index) rather than the Volatility Future. In fact, the underlying for all options is the forward but for equity underlyings (or any other underlying that follows a random walk) the volatility of the forward and the volatility of spot are virtually identical. For an underlying such as Volatility Futures which mean reverts, the volatility of spot is far greater than the volatility of the volatility forward. If the implied volatility of an option (on volatility forward) is compared to the volatility of the Volatility Index, the option appears very cheap indeed. In order to accurately value options on volatility forwards, we first need to examine how volatility mean reverts.

Volatility jumps only last c10 months

It can be shown (see Appendix) that volatility jumps mean reverts in a period of time 10 months or less (the higher the volatility jump, the quicker the mean reversion). This means that even if there has been a significant volatility jump, a Volatility Index should have returned to previous lower levels in less than a year. Far dated options (year or more) on a Volatility Index should therefore trade with an implied volatility that is relatively stable. As an option on a Volatility Index approaches expiry, its sensitivity to current levels of volatility increases and the implied volatility should converge with the volatility of the underlying index (see chart below).

Options on VSTOXX® Futures term structure (is negative)

Mean reversion of volatility causes negative term structure

As volatility should be modelled as a process with high volatility of volatility and high mean reversion, there is a significant difference between the volatility of spot and the forward (as can be seen in the chart above). Having a high volatility of volatility means near dated options on a Volatility Index have a high implied volatility. Similarly having a high mean reversion depresses the implied volatility of far dated options on volatility, causing a negative term structure (the opposite to the average term structure of equities).

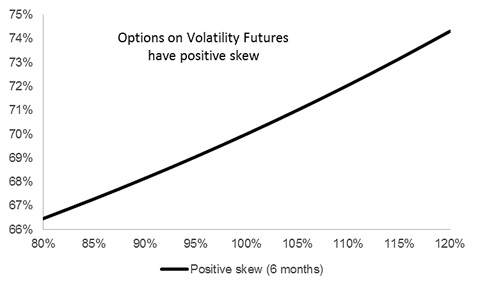

Volatility is stable at low levels, and volatile at high levels

It can be shown (see Appendix) that volatility is relatively stable when it is low (as markets can be calm for several years). Conversely as volatility spikes last only a few weeks or months, volatility cannot be stable at high levels. This feature causes options on volatility indices to have positive upward sloping skew, the opposite direction to options on equity.

Options on VSTOXX® Futures skew (is positive)

Far dated Volatility Futures are normally higher than near dated

The term structure of Volatility Futures is normally upward sloping due to the demand for long dated hedges. As far dated implied is, on average, higher than near dated implied this means the value of a Volatility Future should (on average) decline as expiry approaches. This means buying puts on Volatility Futures is on average a profitable strategy, while buying calls is an unprofitable strategy. An investor could therefore benefit from selling calls or buying puts.

It is easier to determine the risks and rewards for puts on Volatility Futures than calls

As volatility jumps are rare, but a gradual softening of implied volatility is common, there is far more reliable data about the profitability of puts on Volatility Futures than calls on Volatility Futures. This is because the payout of an ATM put is indifferent to volatility remaining constant or spiking, while the payout of an ATM call is very sensitive to the degree of a volatility spike (and as significant volatility spikes are rare it is difficult to model them).

Put buying is most effective when volatility is high

While on average buying puts on Volatility Futures is a profitable strategy, the amount of profit earned is correlated to the initial level of volatility. If volatility is high, the average profit earned is also high. This makes sense as volatility for the SX5E is floored at c12 and there is therefore greater potential profit if volatility is 30 (maximum 18 points of profit) than if volatility is 15 (maximum 3 points of profit). When looking at the trendline for profit earned against initial level of the VSTOXX® (we note the data is very noisy) it can be shown that buying puts is on average profitable when the VSTOXX® is 19 or above, and unprofitable when the VSTOXX® is 16 or less. As a percentage of premium paid, the profits for OTM and ITM options are similar to that of an ATM option.

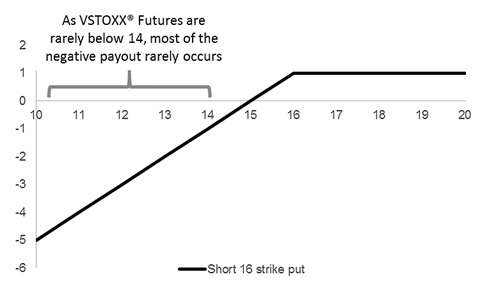

Selling puts on Volatility Futures makes sense when volatility is low

Implied volatility has a floor, which limits the downside to a short put strategy. If volatility is low, the maximum loss of a short put is similarly low. If volatility is very low, selling puts on Volatility Futures is therefore a viable strategy as this benefits from having a breakeven around the level of the historical floor of volatility.

Selling calls is a profitable carry strategy, but suffers from tail risk

A short call on volatility future strategy is on average profitable. However while a carry is earned most of the time, there are rare occasions when a volatility spike causes substantial losses. As implied volatility spikes are usually unforeseeable (if future realised volatility is expected foreseeable, implied volatility would have risen beforehand), the profits from call selling appear to have weak correlation to the initial level of volatility. We note however that the rarity of significant volatility spikes makes drawing a reliable conclusion about call selling difficult. As with all call overwriting strategies, the downside of spikes can be reduced by selling call spreads rather than calls (however this will reduce the average carry earned).

Volatility of volatility is often mispriced in different markets

In the option on volatility future market, volatility of volatility is usually expensive (as is the case for most options). However volatility of volatility is underpriced in the Volatility Futures market, as Volatility Futures are on average expensive (and Volatility Futures are short volatility of volatility). Trader can arbitrage this anomaly by shorting both Volatility Futures and (as strip of) options on Volatility Futures, both of which are on average expensive. The resulting (unwanted) short volatility position (from shorting Volatility Futures) can be hedged with a long forward variance. The final position is short Volatility Future, short (strip of) option on Volatility Future and long forward variance.

APPENDIX

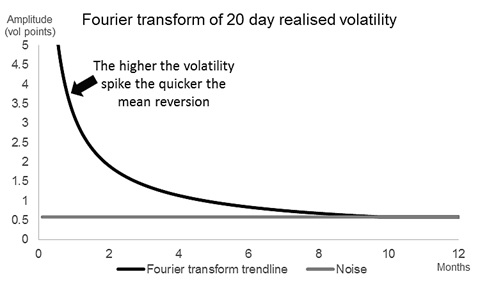

Fourier transform can show how long volatility can last

A Fourier transform can decompose any time series (e.g. 20 day realised volatility vs time) into a sum of sine waves of different amplitude and frequency (e.g. volatility amplitude vs frequency). If we use this analysis on 20 day realised volatility of a major index such as the S&P500, we can determine how long a volatility spike can last.

The higher the volatility spike, the shorter it lasts

The Fourier transform of 20 day realised volatility for the S&P500 shows that the higher a volatility spike, the quicker the mean reversion (see chart below). For example, if there is a 3 volatility point spike it tends to last c1 month. However a 2 volatility point spike lasts twice as long (c2 months). Conversely when volatility is low, it can remain low for several years (as it did in 1994-6, 2004-6 and 2012-14). This feature is what gives options on a Volatility Index a positive upward sloping skew, as a Volatility Index is more volatile the higher volatility is.

Spikes in volatility last a maximum of 10 months

The transform also shows that for frequencies over 10 months the amplitude of volatility is simply background noise. Hence volatility should mean revert in a period of time not greater than 10 months. This figure is in line with the fact that it takes approximately 8 months for EuroSTOXX50® 3 month volatility to return to levels seen before a spike in volatility.