EurexOTC Clear Releases

Overview of content

EurexOTC Clear Release 21.0

With the EurexOTC Clear Release 21.0, Eurex Clearing will introduce the following enhancements:

- Report, API, GUI and MC GUI changes

- Split Trade Functionality/ Partial Portfolio Transfer

- Enhancement of Netting process

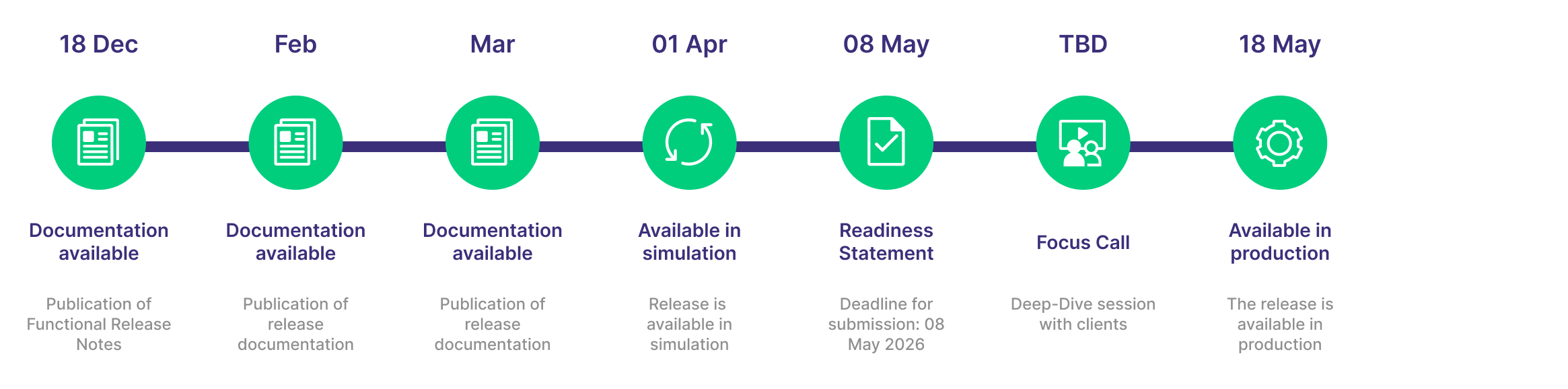

Simulation start: 01 April 2026

Production start: 18 May 2026

Supporting Documents

The OTC system documentation are stored in the Member Section under the following path: Resources > Eurex Clearing > Documentation & Files > EurexOTC Clear > System documentation.

Circulars

Release Items/Participants Requirements

Feature/Enhancement | Details | Action Item |

Report Changes | There are a few key updates to our reporting suite with the upcoming release. These changes are designed to provide greater flexibility and more detailed data:

For technical specifications, please see the Report Manual for Release 21.0. We are confident these enhancements will improve your reporting experience. | We kindly ask all Clearing Members to ensure that the relevant report changes are reflected in their internal processes. |

API Changes | The release will include enhancements to our API modules to improve data integrity. The following validation logic will be implemented:

These checks help ensure trades are processed correctly from the start. Any trade submission that fails these validations will be rejected, preventing potential data conflicts. Please ensure your systems are aligned with these new rules to avoid interruption. | We kindly ask all Clearing Members to ensure that relevant API changes are reflected in their internal processes. |

GUI Changes | To complement the new partial transfer capability, we have enhanced the OTC GUI. You can now easily initiate and monitor partial transfers using the “Portfolio Upload” feature. To enable this, we have introduced a new column called “Partial Transfer Amount”. Here is where you will see it and how to use it:

Important Note: This feature applies to all eligible trades. Partial transfers for VIRS and SCIS trades with varying notionals are not supported. | There is no action required. |

MC GUI Changes | We are improving the MC GUI to give you more control when checking trade eligibility. With our next release, you will find an enhancement to the Clearing Eligibility Checker for IRS and OIS products. On the "Holidays" tab, we've added two new fields. This update gives you the flexibility to enter separate Payment Lags and Holiday Centers for each leg of your trade, allowing for more precise and granular eligibility checks. | There is no action required. |

Split Trade Functionality/ Partial Portfolio Transfer | With EurexOTC Clear Release 21.0, Clearing Members can transfer partial notional amounts of an IRD transaction within a portfolio transfer, allowing greater flexibility in managing positions:

| There is no action required. |

Enhancement of Netting process | We have enhanced our netting process for trades with multiple "Upfront Fees" to improve data accuracy and prevent synchronization errors with MarkitWire:

This automated adjustment ensures your netted trades are processed smoothly and are always in sync with MarkitWire. | There is no action required. |

Eurex Initiatives Lifecycle

From the announcement till the rollout, all phases of the Eurex initiatives outlined on one page! Get an overview here and find other useful resources.

Are you looking for information on a previous initiative? We have stored information about our previous initiatives in our Archive for you!

Contacts

Eurex Frankfurt AG

Customer Technical Support / Technical Helpdesk

Service times from Monday 01:00 – Friday 23:00 CET

(no service on Saturday and Sunday)

T +49-69-211-VIP / +49-69-211-1 08 88 (all)

Eurex Frankfurt AG

Key Account Management

Service times from 09:00 - 18:00 CET