Jul 19, 2022

Eurex Clearing

Eurex Clearing Readiness Newsflash | C7 SCS Release 2.0: 1. Introduction of new intra-day settlement report "Repo Intraday Settled Trades Report"; 2. Additional Corporate Action event in C7 SCS Simulation with processing at CSD

Dear Clearing Member,

With this Newsflash, Eurex Clearing wants to draw your attention to the introduction of new intra-day settlement confirmation report, Repo Settled Trade Report (CI870/1/2) and to additional Corporate Action event in C7 SCS simulation with processing at CSD. For that reason, Clearing Members participating in the Corporate Action event can expect their individual corporate action reporting from CBF.

1. Repo Intraday Settled Trades Report (CI870/1/2)

The new report contains partial or full settlement of Repo Trades (Special Repo and GC Pooling) with actual settlement date. The partial settlements are shown individually and not as one aggregated entry. This report is created multiple times from 07:00 until 19:00 CE(S)T every 1 hour during the day as a delta report which contains the settlement (partial or full) of Repo Trades that are received since the last run. As this report is generated multiple times per day, the report name contains a run number to uniquely distinguish the various intraday reports. This report is offered only in XML format and no print format is offered.

The settlement confirmations data is still available in CE870/1/2 Settled Delivery Report created in C7 SCS end-of-day processing.

The CI870/1/2 report description and xsd files are available under C7 SCS Release 2.0 > System Documentation > Reports > C7 SCS XML Report “RPTCI870 - Repo Intraday Settled Trades Report“ - Report description and XML Schema Files

- Eurex Clearing – CI870/1/2 Repo Settled Trade Report – XML Schema Files

- Eurex Clearing - CI870/1/2 Repo Settled Trade Report – Report description

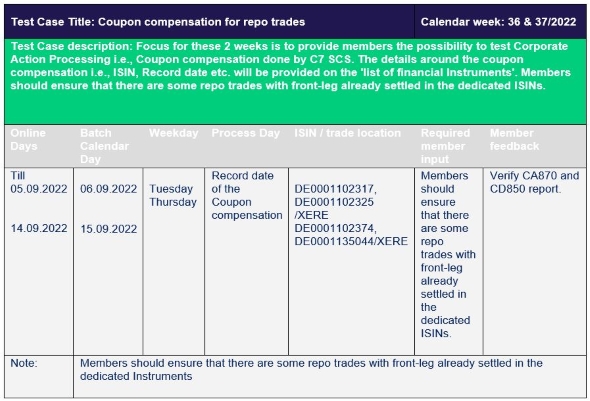

2. Corporate Action event in C7 SCS Simulation with processing at CSD

C7 SCS 2.0 simulation will offer additional corporate action event, which foresees processing for repo trades and the business directly at CBF.

End to End testing with CmaX and use of Basket ISINs

For End to End testing of GC pooling business with CmaX, please consider following timeline and the GC Pooling baskets that will be offered:

- In preparation to the E2E test, all trades entered in INT MXQ Basket (DE000A1PHUP5) before or on 29 July 2022 and active after this date will be considered as settled by C7 SCS.

- In time between 28 August 2022 and 5 September 2022 C7 SCS will connect to CmaX in the pilot phase for INT MXQ Basket (DE000A1PHUP5). In this time, Members who applied for CmaX setup with Clearstream will receive the CmaX reporting in addition to C7 SCS reporting. The settlement feedback for all the other baskets will continue to be simulated with the C7 SCS simulator.

- In preparation for the E2E simulation in ECB Basket (DE000A0AE077), all trades entered in this basket before or on 5 September 2022 and active after this date will be considered as settled by C7 SCS.

- After the pilot phase from 1 September 2022 onwards, C7 SCS will connect to CmaX for INT MXQ Basket (DE000A1PHUP5) and ECB Basket (DE000A0AE077). The settlement feedback simulator will be switched off for the trades in the respective baskets and only feedback from CmaX will be processed.

The settlement feedback for all the other baskets will continue to be simulated with the simulator.

Please note that Members who have not submitted the required member documentation at Clearstream prior to 1 July 2022, will not be set up in CmaX test environment and hence are advised to enter trades only in the baskets with simulated settlement feedback at the desired time of test and therefore not to use INT MXQ Basket (DE000A1PHUP5) after 29 July 2022 and ECB Basket (DE000A0AE077) after 1 September 2022.

The updated "ISIN - List of financial instruments for C7 SCS 2.0" is now available under the following link: Support > Initiatives & Releases > C7 SCS Release 2.0 > System Documentation > Overview and Functionality

Publication of C7 SCS 2.0 – Migration Strategy Paper

This document is already published and provides an overview of the migration strategy of repo business from the Securities CCP to C7 SCS Release 2.0 during the time from 20 October 2022 until its launch on 24 October 2022. Moreover, it provides updated information on the details and availability dates of migration reports and other important aspects that participants need to consider.

The Migration Strategy Paper and the updated List of known limitations can be found under the following link: Support > Initiatives & Releases > C7 SCS Release 2.0 > System Documentation > Overview and Functionality

Learn now more about C7 SCS Release 2.0 on our dedicated initiative page under the following link: Support > Initiatives & Releases > C7 SCS Releases > C7 SCS Release 2.0. System documentation, circulars, timeline and much more information is available there for you.

If you have questions or require further information, please contact us via e-mail: client.services@eurex.com.

Kind regards,

Your Client Services Team

Visit the Next Generation ETD Contracts webpage for all your Clearing and Trading content!

Recipients: | All Clearing Members, Basic Clearing Members, Disclosed Direct Clients of Eurex Clearing AG and vendors | |

Target groups: | Front Office/Trading, Middle + Back Office, IT/System Administration, Auditing/Security Coordination | |

Contact: | client.services@eurex.com | |

Web: | Support > Initiatives & Releases > C7 SCS Releases > C7 SCS Release 2.0 |