Dec 04, 2023

Eurex Clearing

Equity Index Futures and Options, Total Return Equity Index Futures: Changes to transaction fees, post-trade fees and volume rebates, amendments to the Price List of Eurex Clearing AG

1. Introduction

This circular contains information with respect to the transaction and post-trade fees in selected Equity Index Futures & Options as well as Total Return Equity Index Futures. Furthermore, changes to volume rebate thresholds and rebate levels in Equity Index Options are contained therein, and the corresponding amendments to the Price List of Eurex Clearing AG (Price List).

The amendments will come into effect as of 1 January 2024.

2. Required action

Market participants should ensure that their internal processes and technical interfaces are updated in order to process the amended fees properly.

3. Details

Important note: The following list of changes is not exhaustive. This information reflects the most relevant changes to the Price List. For a complete list of all changes, please refer to the Attachment.

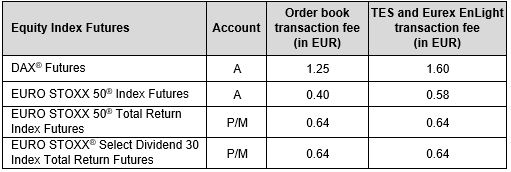

Equity Index Derivatives

Effective 1 January 2024, the transaction and post-trade fees in the A-account for DAX® Futures (FDAX), EURO STOXX 50® Index Futures (FESX) and P/M-account fees in EURO STOXX 50® Total Return Index Futures (TESX)/EURO STOXX® Select Dividend 30 Index Total Return Futures (TEDV) will be adjusted and are outlined in the table below:

Additionally, the daily accrued maintenance Fee per contract in the M account for EURO STOXX 50® Total Return Index Futures and EURO STOXX® Select Dividend 30 Index Total Return Futures will be adjusted to EUR 0.0015.

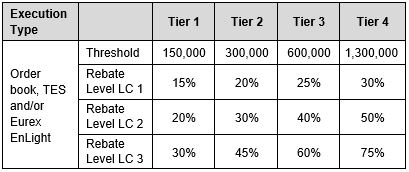

Effective 1 January 2024, volume rebate thresholds and rebate levels in Equity Index Options, as defined in Number 3.2.2.3 of the Price List will be adjusted. These changes are outlined in the table below:

To reflect the amendments, the following provisions of the Price List will be amended as outlined in the Attachment:

- Numbers 3.1, 3.2, 3.3, 3.4 and 3.14 of the Price List

As of the effective date, the full version of the amended Price List will be available for download on the Eurex Clearing website www.eurex.com/ec-en/ under the following link:

Rules and Regs > Rules and Regulations > 3. Price List

The amendments to the legal framework of Eurex Clearing AG published by this circular are deemed accepted by each affected contractual party of Eurex Clearing AG, unless the respective contractual party objects by written notice to Eurex Clearing AG prior to the relevant effective date(s) as stipulated in this circular. In case of an objection by the respective contractual party pursuant the preceding sentence, Eurex Clearing AG is entitled to terminate the respective contract (including a Clearing Agreement, if applicable). Instead of submitting an objection, the respective contractual party may submit in writing to Eurex Clearing AG comments to any amendments of the legal framework of Eurex Clearing AG within the first 10 Business Days after the publication of the amendments. Eurex Clearing AG shall assess whether these comments prevent the published amendments from becoming effective taking into account the interests of Eurex Clearing AG and all contractual parties.

Unless the context requires otherwise, terms used and not otherwise defined in this circular shall have the meaning ascribed to them in the Clearing Conditions or FCM Clearing Conditions, as applicable.

Attachment:

- Amended sections of the Price List of Eurex Clearing AG, as of 1 January 2024

Further information

Recipients: | All Clearing Members, ISA Direct Clearing Members, Disclosed Direct Clients of Eurex Clearing AG, vendors, all FCM Clearing Members and other affected contractual parties | |

Target groups: | Front Office/Trading, Middle + Backoffice, IT/System Administration, Auditing/Security Coordination | |

Related circular: | Eurex Circular 101/23 | |

Contact: | Eurex Pricing, eurex.pricing@eurex.com | |

Web: | ||

Authorized by: | Matthias Graulich |