Oct 31, 2024

Eurex Clearing

Risk management: Update of concentration and wrong-way risk limits for additionally monitored risks

1. Introduction

Eurex Clearing herewith informs about an update to the related Eurex Clearing Circulars 121/13, 131/13 and 043/23.

- Update of concentration and “same country” wrong-way risk limits for margin collateral, default fund collateral and repo and cash market activities.

Effective date: 31 October 2024

2. Required action

We kindly ask you to forward this circular to all involved departments within your company.

3. Details of the update

In this circular, Eurex Clearing informs Clearing Members about updated concentration and “same country” wrong-way risk limits. All thresholds are set per Clearing Member entity.

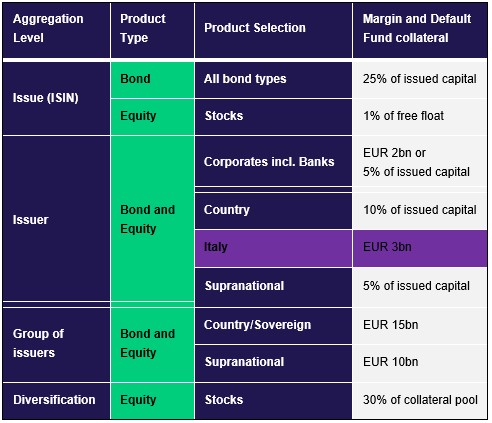

Concentration risk limits for margin and Default Fund collateral are shown in the table. The updated concentration risk limits are highlighted in purple.

The complete set of concentration and wrong-way risk limits are available in the Member Section of Deutsche Börse Group under the following path:

Resources > Eurex Clearing > Documentation & Files > Risk Parameters

Table: Concentration risk limits for green classified and specific countries (changes highlighted in purple)

For further information on additionally monitored risks, please refer to the following link on the Eurex Clearing website: www.eurex.com/ec-en/ under the following link:

Services > Risk management > Credit, concentration & wrong way risk

Unless the context requires otherwise, terms used and not otherwise defined in this circular shall have the meaning ascribed to them in the Clearing Conditions or FCM Clearing Conditions of Eurex Clearing AG, as applicable.

Further information

Recipients: | All Clearing Members, ISA Direct Clearing Members, Disclosed Direct Clients and FCM Clearing Members of Eurex Clearing AG and vendors | |

Target groups: | Front Office/Trading, Middle + Back Office, IT/System Administration, Auditing/Security Coordination | |

Related circulars: | Eurex Clearing Circulars 121/13, 131/13, 043/23 | |

Contact: | Risk Analytics, tel. +49-69-211-1 24 52, risk@eurex.com | |

Web: | ||

Authorized by: | Dmitrij Senko |