Nov 07, 2022

Eurex

Equity Index market briefing November 2022

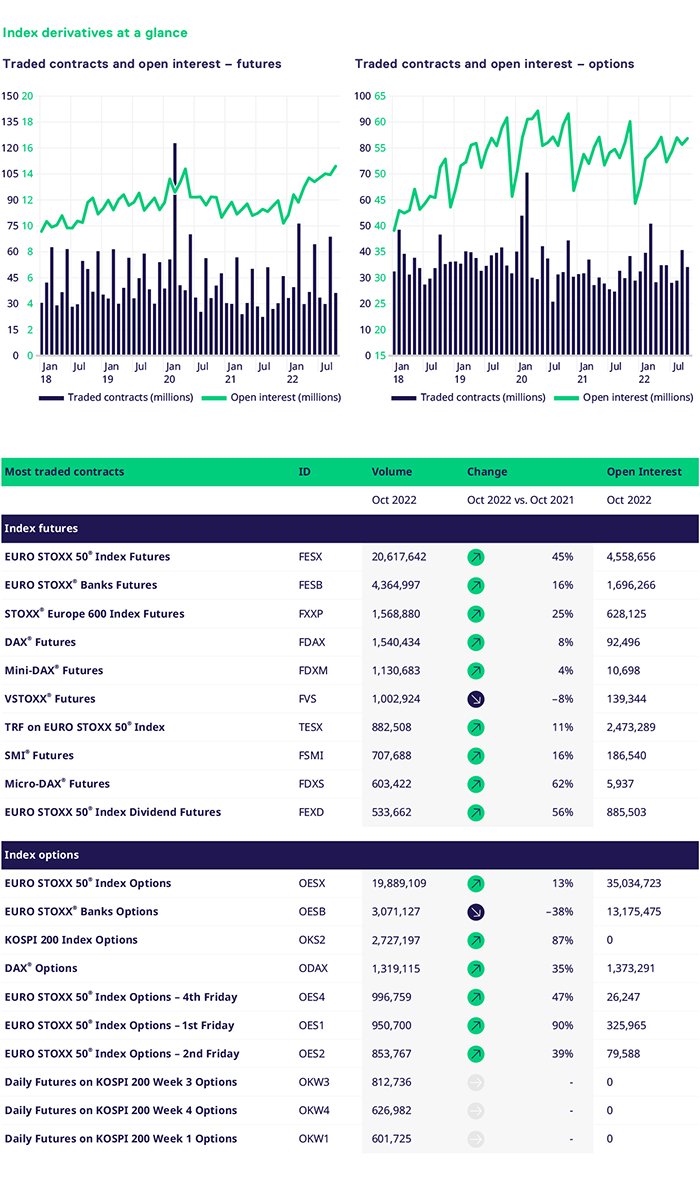

Benchmark STOXX and DAX index derivatives with a strong volume uplift

Global equity markets staged a relief rally in October, but for some technical analysts, the bearish trend still seems intact. The key word is “pivot”; the market is looking for any sign, such as weaker employment or consumer spending data, to predict when the Fed and other central banks may ease back on their QT and pause interest rate rises. It has become almost a preoccupation to attempt to decipher every word and hint taken from the speeches of key central bank heads and their committee members.

Volumes at Eurex continued to be robustly supported by this volatile macroeconomic backdrop. Understandably, single-name derivatives take a back seat despite the recent earnings season as traders focus on interest rate changes. The benchmark STOXX®, DAX® and MSCI index derivatives all saw a strong volume uplift versus the same month last year in a similar pattern carried over from Q3.

The last quarter of the year is typically busy as we review liquidity provider schemes for next year while also completing our remaining product launch ambitions for 2022 in the coming weeks.

We anticipate that the strong end-client demand for derivative hedging will continue into the rest of Q4 due to the high open interest levels across Eurex futures and options. Inflation statistics remain stubbornly high despite record interest rate increases. This has created fear that central banks may tip the global economy into a recession. In early November, we have the U.S. mid-term elections. This will provide a forward-looking perspective on the U.S. political landscape. Given this environment, we closely monitor the liquidity of our key derivative segments to ensure markets function well for the needs of our members and clients.