Oct 24, 2016

Eurex

Eurex Exchange's Fixed Income Derivatives - Facts & Stats of Q3/2016

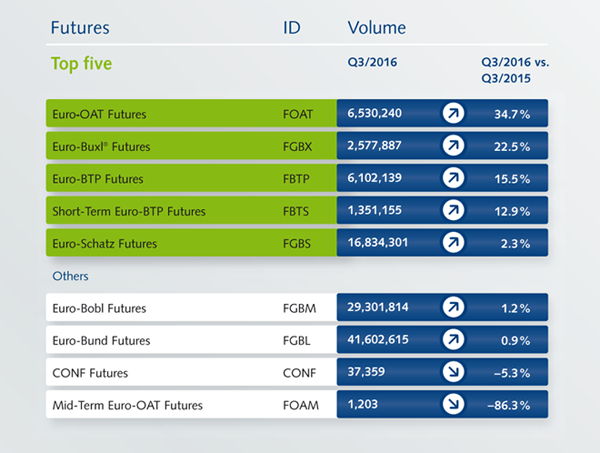

104 million Fixed Income Futures were traded in Q3/2016, which translates into a 4% YTY increase.

Euro-OAT and BTP-Futures continued their strong growth - both trading more than 6 million contracts each.

Euro-Buxl®-Futures surpassed 2.5 million traded contracts in the third quarter.

Fixed Income Options traded 11 million contracts, a decrease of 32% over Q3/2015.

New record quarter for Euro-OAT Futures: +34,7%

- Long-Term Euro-OAT Futures (FOAT) have rebounded on a quarter to quarter comparison with an increase of 34.7% compared to third quarter in 2015.

- Over 6.5 million contracts were traded during the quarter, with September volumes surging to a new record high of 3.2 million.

- The positive liquidity development is further highlighted by the average daily volume (ADV) exceeding 103,000 contracts. Open interest peaked at 336,900 contracts during the quarter.

Euro-Buxl® Futures: +22,5 %

- Volume in Euro-Buxl® Futures (FGBX) continued to grow with a promising quarterly increase of 22.5% compared to the same period in 2015.

- ADV for 2016 is at 39,059 contracts, open interest peaked at 174,642 during the quarter.

Euro-BTP Futures: +15.5%

- Long-Term Euro-BTP Futures (FBTP) continues to be a fast growing fixed income instrument. Over 6.1 million contracts were traded in Q3/2016, a 15.5% increase over Q3/2015.

- The positive liquidity development is highlighted by its 2016 ADV which exceeds 106,300 contracts. Open interest reached a high of 358,158 contracts in Q3/2016.

- The Short-Term Euro-BTP Futures (FBTS) continued to grow strongly with nearly 1.4 million traded contracts in Q3/2016, which is an increase of 12.9% over the same period last year. Open interest reached an all time high of 114,287 contracts during Q3/2016.