Apr 15, 2020

Eurex | Eurex Clearing | Eurex Group

Eurex Exchange's Quarterly Equity Derivatives Highlights - Q1/2020

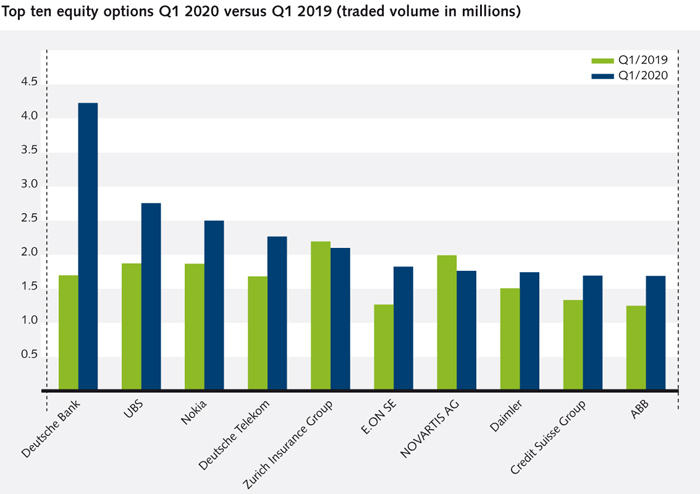

Equity options

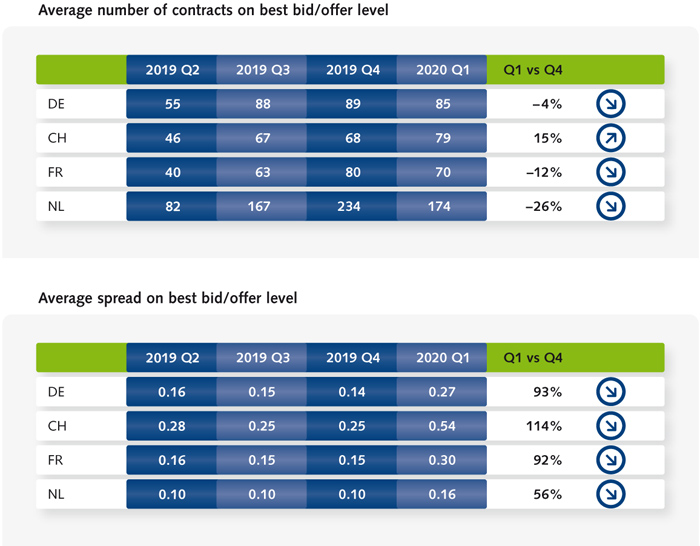

The first quarter of 2020 was undoubtedly a unique market environment. We didn’t just have to deal with the particularly high volatility but also the other fall-out caused by the COVID-19 pandemic. The index and single stock derivatives markets experienced a situation of uncertainty based on postponed AGM’s, the respective dividend payments, and also potential reductions of announced dividends. These challenging market conditions created some additional difficulties for all market participants, especially liquidity providers. We’d like to express our gratitude to our on-screen and off-book liquidity providers and highlight their exceptional performance. Thanks to them, we saw orderly and functioning markets, able to absorb extraordinarily high volumes, despite difficult operational circumstances such as the splitting of teams and work-from-home solutions.

New options market making program for European style exercise options

As of 1 April, Eurex offers a market-making rebate program for European style exercise options. Eurex expects further growth and interest in this segment as it is an excellent alternative to the OTC market for hedging structured products. With committed market makers, we expect to improve the on-screen liquidity picture in this segment. Two packages are available for CHF and EUR names.