Sep 19, 2023

Eurex

Fixed Income Futures – September roll analysis

Stable activity with the minimum exchange day rule in place

The roll into the December expiry was smooth, without any hiccups. The minimum exchange day rule ensured that no front month CTD switches occurred, supporting an orderly roll with ATM Bund implied volatility remaining range-bound between the 8% and 9% mark.

Open interest dropped significantly after the roll period to slightly below 5 million contracts, possibly due to less speculative trading at the back of the minimum exchange day rule and lower hedging requirements as new CTD bonds for Bobl and Schatz have higher duration and coupon levels.

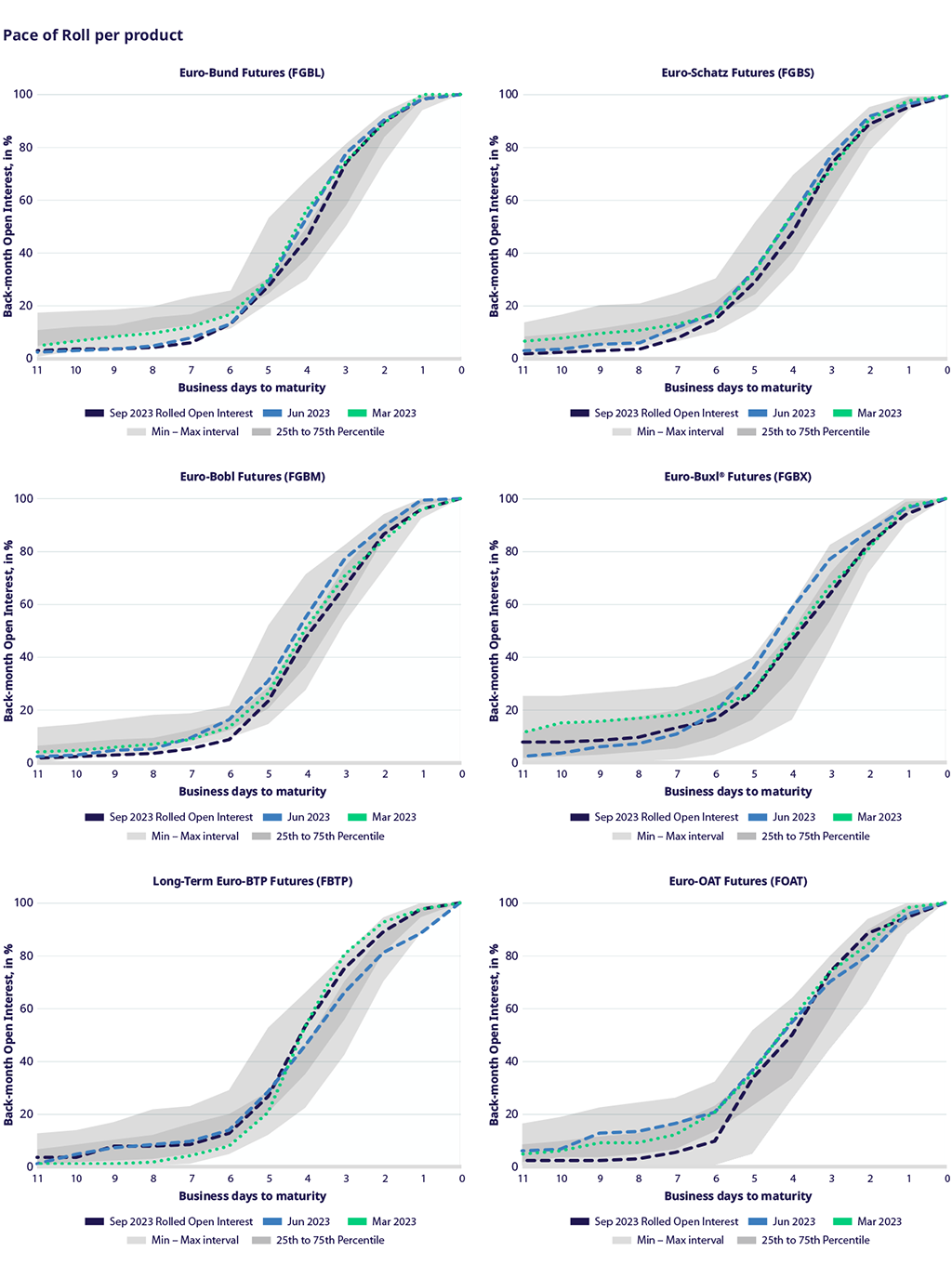

The September 2023 roll to December expiry saw similar activity compared to the June 2023 roll, with most products seeing an acceleration six days before expiry. In the German segment, Bund (FGBL), Bobl (FGBM), Schatz (FGBS) and Buxl (FGBX) roll activity was slightly lower compared to the June 2023 roll. This was more prominent in Bobl and Buxl, where activity rose a day later compared to the last roll. For BTP futures (FBTP), the increase in rolled open interest was steeper in the last four days before expiry compared to June 2023. OAT futures (FOAT) roll activity accelerated six days prior to expiry compared to the June 2023 expiry, where roll activity began as early as ten days before the last trading day.

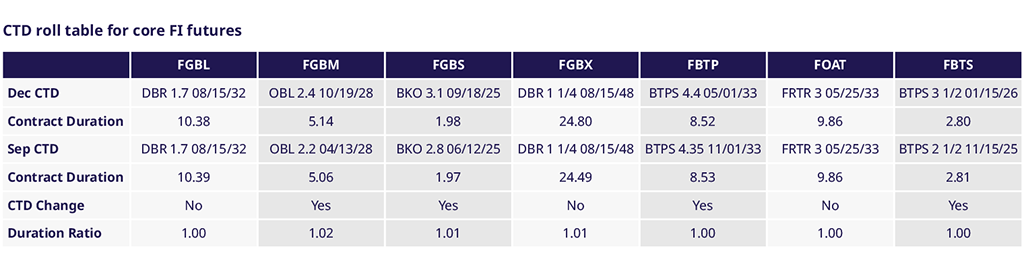

For December 2023 expiries, within the core German segment, the CTD bond changed in Bobl and Schatz futures, while in the European segment, a CTD switch occurred in all except for OAT futures. Contract duration decreased across all CTDs except for Bobl and Schatz.

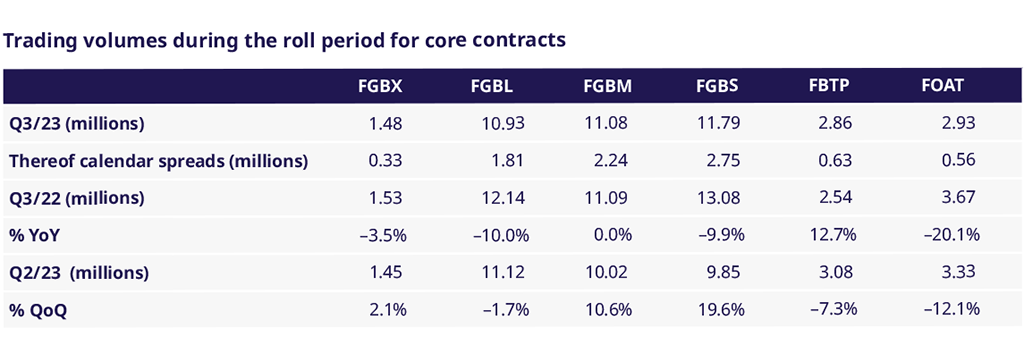

Trading volumes during the roll period (last ten days before expiry)

Calendar Spreads narrowed throughout the roll period