With the summer in full swing, and scorching temperatures persistent across Europe, markets have had plenty of event risk to digest. Volatility continued throughout July, and we saw raised volumes across the portfolio, which we expect to continue in August. Futures and options volumes were 31.5% and 23% higher, respectively. Listed FX volumes continued to be well supported, increasing 630% compared to last year. Throughout the increased volatility, we continue to engage regularly with our members to ensure that key initiatives remain on track and to exchange perspectives, insights, and updates for the remainder of the year.

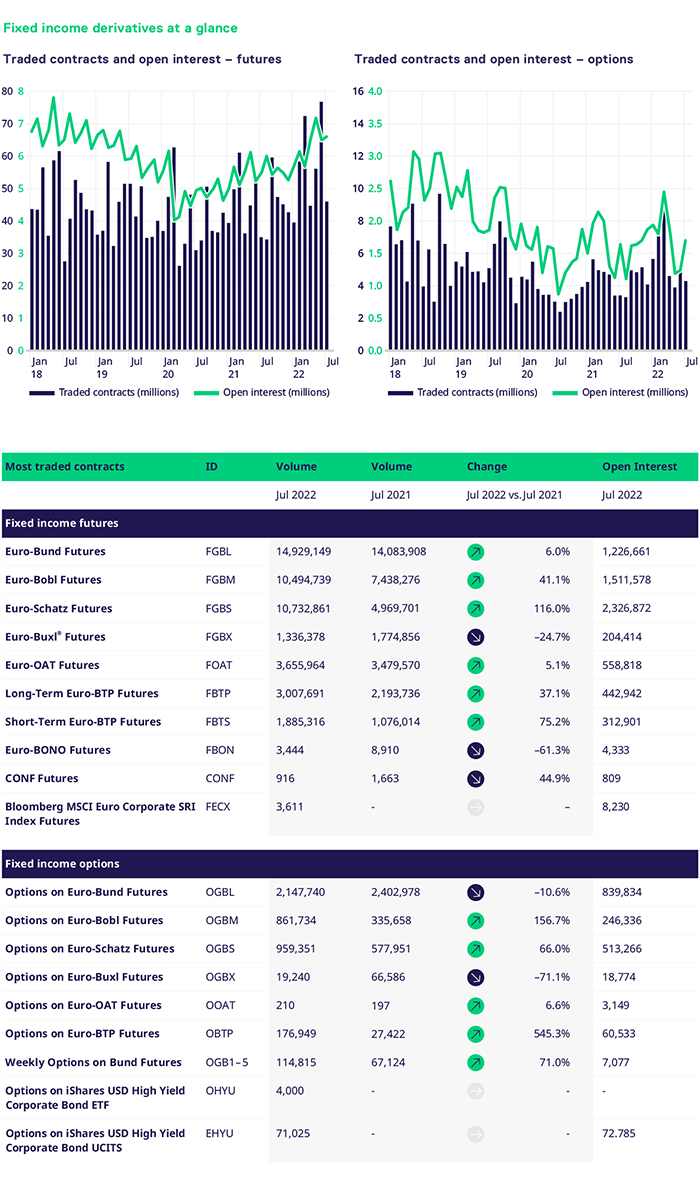

July was another strong period for the FIC portfolio. The core German segment performed strongly across the board, underpinned by the macroeconomic backdrop. Bund, Bobl, and Schatz saw single and double-digit increases in volumes, 6%, 41%, and 116%, respectively. The long end of the curve was 24.6% lower versus the same period last year with c.1.336m contracts trading. The Italian and French segments continue their positive momentum with volumes 75%, 37.4%, and 5.1% higher. The front end of the Italian curve continues to be a strong outperformer benefiting from increased event risk.

As we moved into July, the macroeconomic backdrop was still supportive of our options portfolio. Economies across the globe continue to grapple with increasingly elevated levels of inflation which has prompted all the major Central Banks to raise rates. The German segment outperformed except for the 10y, where Bund options saw a decline with c.2.1m contracts trading versus c.2.4m in July last year. In contrast, weekly options on Bunds continue to see a significant increase in volumes of 71%, with ADV above 10k regularly. The belly of the curve and the front end saw a significant percentage increase, with Bobl volumes 156.7% and Schatz 66% higher versus 2021. Bobl and Schatz segments traded c.862k and 959k contracts, respectively. Given the significant volatility in the long end of the curve, volumes were significantly lower, trading c. 19.2k contracts.

The Italian BTP segment continued to see solid volume development. Volumes were 545% higher compared to the same period last year, trading c.176.9k contracts daily. The performance of the BTP segment is a testament to the liquidity providers, sell side, and end clients supporting the product.

Moving away from core rates, the credit portfolio continues to build on the strong momentum of Q1 2022. The corporate bond SRI futures traded over 3.6k contracts and remains the second largest ESG contract measured by OI across all asset classes. New clients continue to be activated throughout July, which should help the team accelerate the growth for the remainder of 2022. ETF options continue to see pockets of liquidity, with volumes in USD High Yield trading c.4k contracts. As spreads and credit saw bigger moves in the underlying markets, a significant trade of c.71k lots went through.

In FX, we had a very solid July, driven mainly by movements in the EUR/USD, which traded below parity for the first time in almost 20 years. In the Japanese yen, which in late July was able to rapidly reduce its losses from the previous weeks, we saw increased volume coupled with an increase in open interest of our EUR/JPY contract by about 46% to 5,500 contracts. Meanwhile, the team had several significant clients become active, which helped increase our numbers. Overall, the portfolio saw volumes 630% higher versus the same period last year. Having worked closely with the team and clients, we are confident that this segment will accelerate in the second half of 2022.

As we move into August, the team will work tirelessly with our members to ensure our markets' smooth and continuous operation. But for now, the sea and surf are calling and I will resume my vacation with my family. After which, I will return refreshed and ready to help the team execute the initiatives it has in the pipeline for September. In closing, I wish you a relaxing and rejuvenating vacation with your families this summer.