May 08, 2023

Eurex

Fixed Income market briefing May 2023

Italian segment develops well in April | Euro High Yield Index futures Open Interest surpassed 10,000 contracts

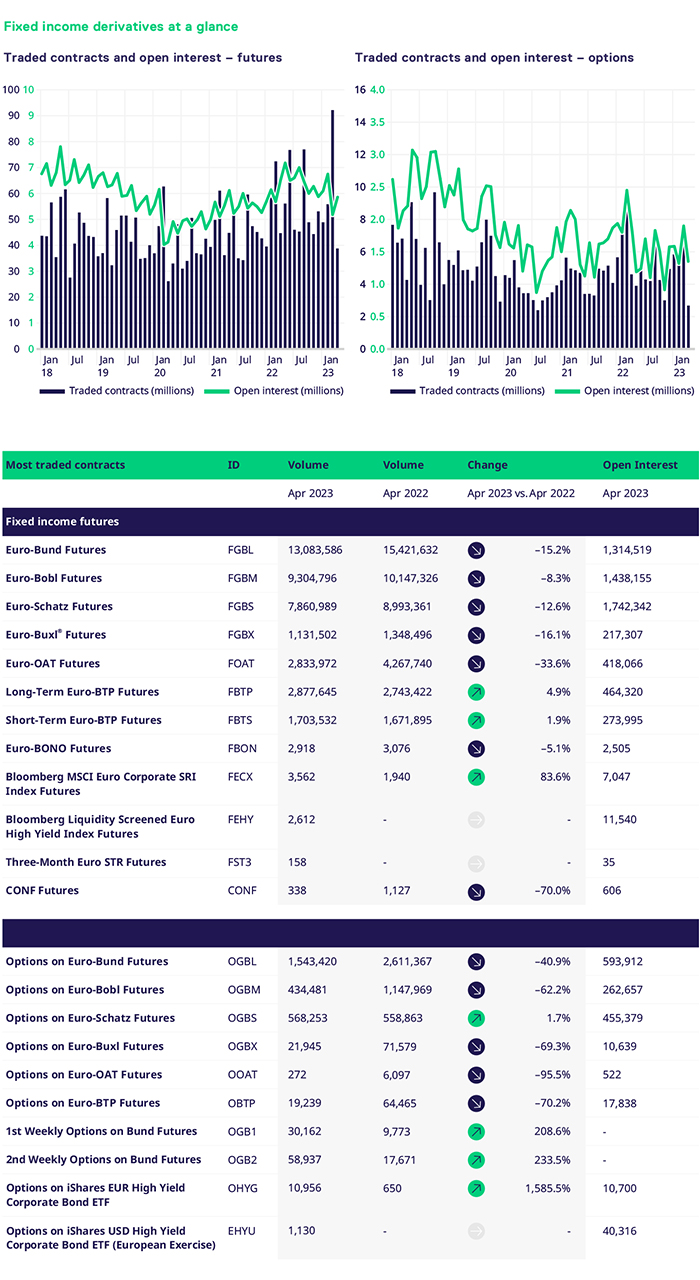

April’s performance could be best described as the ‘hangover’ effect. If March was the unexpected outperformance, April saw a reduction of volumes across the portfolio. People who know me best, know that I am someone who looks for positives even in the face of challenging circumstances, April is no exception. Let me put some of this into context, April 2022 was a strong month for Fixed Income, hence the bar was set high. The businesses and team’s focus were on executing the small details which will enable success in Q2. What was that? We continued to focus our attention on client readiness across the key initiatives, ESTR futures, Credit futures and FX. Across all three we made solid progress with new clients onboarded and began trading. The key is to build on this momentum, and we are confident that this will feed into the trading numbers as we progress in Q2.

Beginning with some positive news, our Credit contracts continue to go from strength to strength. Volumes in the Euro High Yield Index futures traded c6k, and open interest surpassed 10,000 contracts. This is particularly encouraging given the underlying driver of the volatility: credit. New clients continue to engage with the team on a weekly basis and the pipeline is strong. The team has one eye on volume development and liquidity, the other on new initiatives within this space. We are confident of creating an ecosystem where clients can trade listed products alongside their OTC instruments, thus enhancing their overall toolkit. ETF options saw new clients activated and execute new risk. Options on the HY corporate bond ETF traded c.10.9k contracts.

In core rates, the performance was below that of April 2022, except for the Italian segment. The BTP and BTS contracts traded c2.8m and c.1.7m contracts respectively, 4.9% and 1.9% above April 2022 levels. The German and French segments saw a reduction in volumes across the aboard. Performance across the options segment reflected the volume development in futures, lower across the board. The exception to this being Schatz options which were 1.7% higher compared to April 2022. All in all, a quiet month for the business. Overall, the business continues to perform strongly, and the team is committed to executing the initiatives on our roadmap.

There are several exciting initiatives in the pipeline which we feel will help to drive the business forward. The focus for the remainder of Q2 is on the execution of our strategy. That is to create critical mass within our STIR, FX and credit segments. In addition to those three key pillars, we will continue to assess the best time to bring new rates products to market.

Much like the rest of the segment, April was a benign month for FX. We have made good progress with client testing, readiness for the segment which will help the team develop the liquidity over the course of the year. To this end, thank you to the team for maintaining your focus and working with our partners to bring products to life.