Reflecting on the businesses' third quarter performance, there is much to be positive about. The team continued to work hard to keep key initiatives on track, with several launches planned for October. Despite the holiday period, we were able to increase the dialogue with our members, liquidity providers and clients. The focus of these interactions was to discuss upcoming product initiatives and outline our roadmap for 2023. It was also a time to exchange and share perspectives, insights and updates on the challenges and opportunities that lie ahead in 2023 and beyond. More on this later.

Volatility continued throughout Q3, and we saw raised volumes across the portfolio. I expect these to continue into year-end and 2023. Futures and Options volumes were 30.0% and 29.7% higher, respectively. Listed FX volumes enjoyed a strong quarter, increasing 120.5% versus Q3 2021. In this challenging environment, these numbers would not be possible without the support of our liquidity providers, members, clients, and colleagues. Yes, liquidity has been challenging, but we have seen shifts in how end clients execute risk, which we see continuing in the years ahead. Technology will play a key role and our market structure will adapt to ensure that access to the level of liquidity expected by end clients remains. We will continue to move forward.

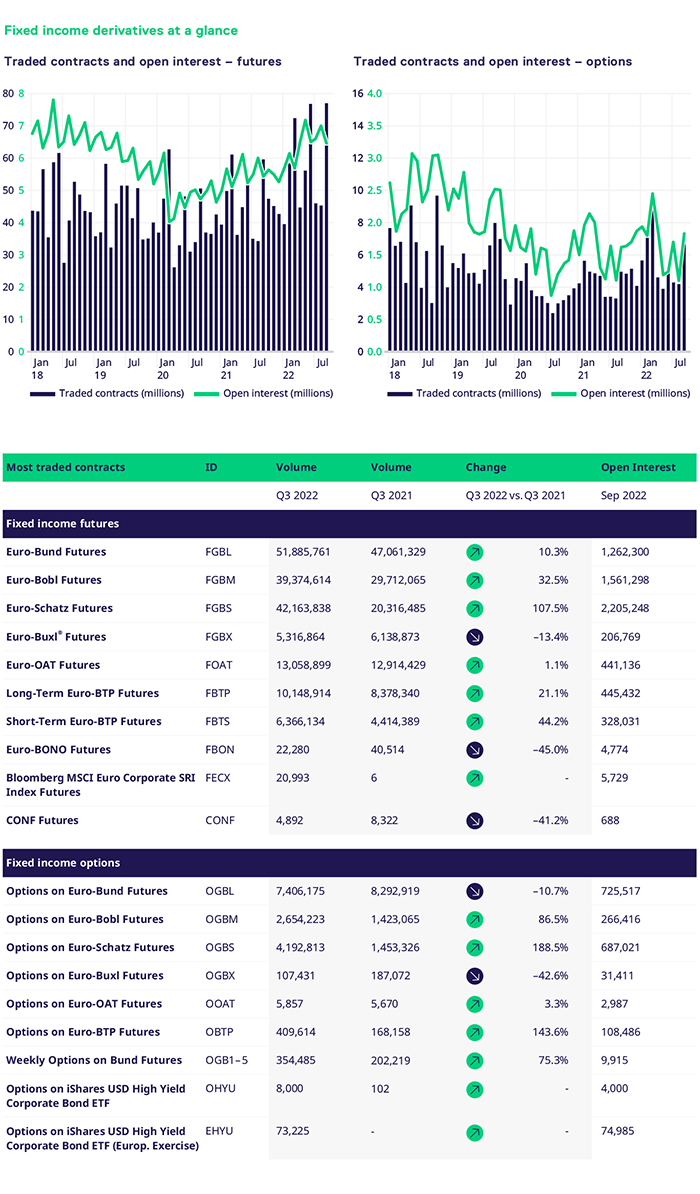

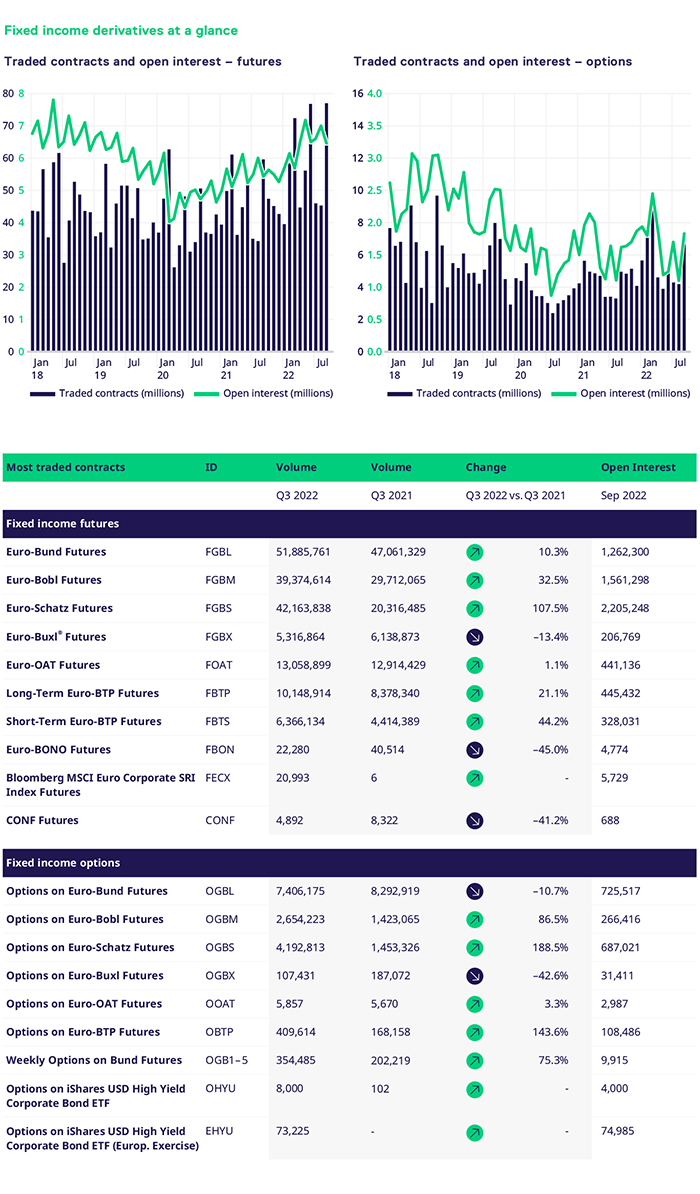

Q3 proved a very challenging quarter from a volatility perspective, as the Bund continued to exhibit large intraday moves. The front end consistently drew large increases in volumes in the futures space. The core German segment performed strongly across the board, underpinned by the macroeconomic backdrop. Bund, Bobl and Schatz saw double-digit volumes increase, 10.3%, 32.5% and 107.5%, respectively. The long end of the curve was 13.4% lower versus the same period last year with c.5.3m contracts trading. The Italian and French segments continue their positive momentum with 21.1%, 44.2% and 1.1% higher volumes. The front end of the Italian curve continues to be a strong outperformer throughout 2022.

As we move into the final quarter, the macroeconomic backdrop still supports our portfolio. Central banks across the globe are grappling with increasingly elevated levels of inflation, supply constraints and increased geopolitical risks. Considering the increased rhetoric around the factors mentioned, options volumes were well supported across the portfolio in Q3. The German segment outperformed except for the 10y, where Bund options saw a decline versus Q3'21, with c.7.4m contracts trading versus c.8.29m in Q3 last year. On the other hand, weekly options on Bunds saw a significant increase in volumes by 76%, with ADV above 10k some days. The belly of the curve and the front end saw a significant percentage increase, with Bobl volumes 86.5% and Schatz 188.5% higher versus 2021. Bobl and Schatz segments traded 2.65m and 4.19m contracts, respectively. The long end of the curve underperformed relative to the rest, seeing a 42.6% reduction in volumes.

The French OAT segment bounced back in Q3, which saw volumes 3.3% higher than last year's volume. The Italian BTP segment saw a material increase of 143.6%, trading c.409k contracts. The Italian segment has performed strongly throughout 2022, with ADVs significantly above 2021 levels.

Moving away from core rates, the credit portfolio continues to build on the strong momentum of 2022. The Euro Corporate SRI Bond Index futures traded over c.21k contracts and continue to see more active clients participate in the product. This is a huge achievement for our team and our members. New clients continue to be activated, which should help the team accelerate growth in Q4 2022. ETF options continued to see pockets of liquidity, with volumes of c.80k across high-yield and corporate bond segments. As spreads continue to be volatile, we are confident that the ETF segment should see this momentum maintained into year's end.

In FX, we had another very solid quarter. The team had several significant clients become active and a recent trip to APAC and U.S. showed strong interest in the segment. The portfolio saw volumes 120.5% higher versus the same period last year. Just before the roll, we saw one of the largest EFP trades on Eurex with c. 60,000 contracts in EUR/USD. During the trade, our open interest rose to c. 140,000 contracts and remained at a high level of c. 80,000 contracts since expiration, an increase of c. 120% compared to the previous year. The key trends remain in place, e.g., long dollar vs. short AUD, NZD, EUR, GBP and JPY. Trends that, given the divergence in monetary policy, are likely to persist for the foreseeable future. Having worked closely with the team and clients, I am confident that this segment will continue to gain momentum in the remaining months of 2022.

As we move into the final quarter of 2022, we expect to see continued significant intraday volatility underpinning our portfolio. The team will come to market with several new initiatives, including FX emerging market currencies and high-yield credit futures. We feel both segments will evolve and see them as complementary to OTC markets. We are working closely with end clients, liquidity providers and members to create a product portfolio that is complementary and additive to their existing toolkits. The team continuously works to help clients build solutions that meet their current and future needs.

I had the pleasure of speaking on the Macro Panel at FILS Europe, where the panelists shared their insights, views, and perspectives on the current market and its outlooks for 2023. Credit is a market that is yet to exhibit the volatility which we have seen in rates. Perhaps this is an area to watch out for as central banks tighten further from current levels. This could be the catalyst for further and deeper intraday volatility into 2023.