Sep 08, 2022

Eurex

Fixed Income market briefing September 2022

As the peak of summer draws to a close, it is always a good time to take stock of key initiatives. Several segments have continued to evolve over the busy summer, with progress set to accelerate into the year's final months. Additionally, we have new initiatives that will be launched in September, giving me confidence that we will deliver on our objective to build a diversified yet complimentary product portfolio that supports key trends, namely, FX, ETFs, ESG and credit.

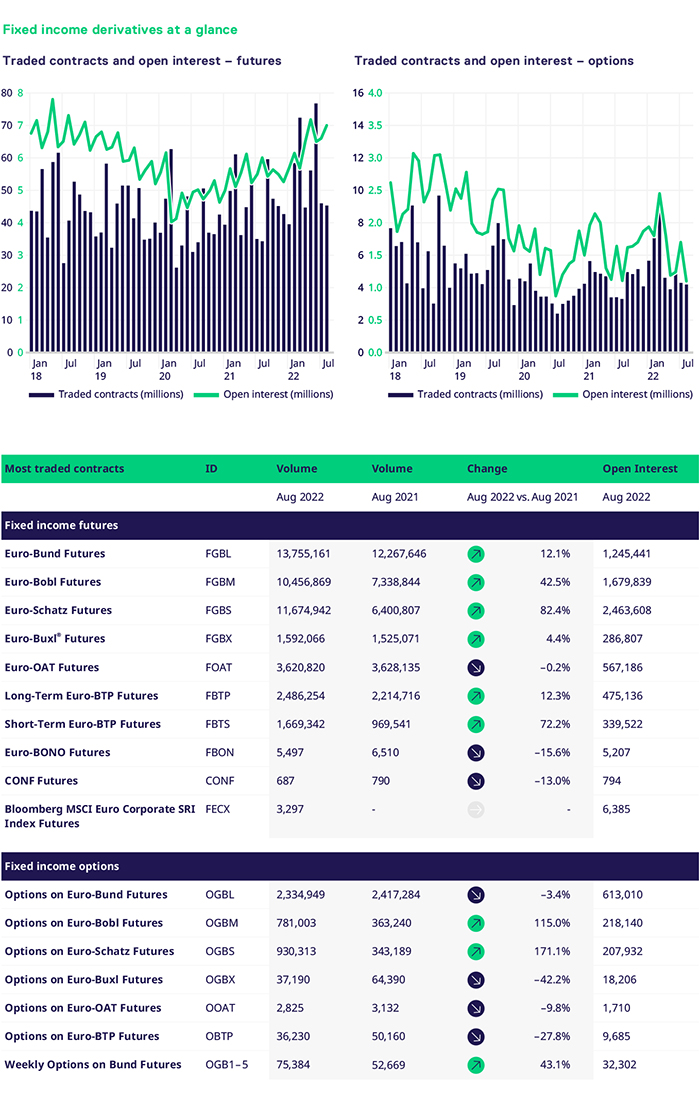

August was yet another strong period for the FIC portfolio. The core German segment performed strongly across the board, underpinned by the macroeconomic backdrop. Bund, Bobl and Schatz saw double-digit volumes increase, 12.1%, 42.5% and 82.4%, respectively. The long end of the curve was 4.4% higher versus the same period last year with c.1.592m contracts trading. The Italian segment continued its positive momentum with 12.3% and 72.2% higher volumes. The French segment was flat versus the same period last year.

Themes from July continued into August. The German segment outperformed except for the 10y and 30y, where Bund and Buxl options saw a decline versus August last year with c.2.3m and c.37k contracts trading versus c.2.41m and 64k. Weekly options on Bunds continue to see a significant increase in volumes of 43.1%, with ADV above 10k regularly. The belly of the curve and the front end saw a significant percentage increase, with Bobl volumes 115% and Schatz 171% higher versus 2021. Bobl and Schatz segments traded c.781k and 930k contracts, respectively.

The Italian BTP segment saw a particularly quiet month, with volumes 27.8% lower than last year. The French OAT segment underperformed relative to August 2021, with volumes 9.8% lower versus the same period.

Moving away from core rates and the credit portfolio continues to build on the strong momentum of Q1 2022. The corporate bond SRI futures traded over 3.2k contracts in August and, last week, saw over 9k contracts trading in the roll as most of the open interest moved over to the December 2022 expiry. New clients continue to be activated throughout August, which should help the team accelerate the growth for the remainder of 2022. ETF options continue to see pockets of liquidity and the team is confident that this segment will continue to evolve.

In FX, we continue to see a pickup in volumes. The team had several significant clients become active, which helped increase our overall numbers. The general trend of a stronger U.S. dollar remains in place in August. In particular, GBP (c. -5.2%) and JPY (c. -6.5%) depreciated significantly against the U.S. dollar, while the EUR (c. -2.9%), after initial gains at the beginning of the month, traded consistently slightly around the parity level with lower volatility at the end of the month. Therefore, the portfolio saw a more modest uptick in volumes, 89.6% higher than last year's period, with a very stable OI of c. 79.000 contracts. With the team working more closely with the clients, we are focused on further building the segment. We will accelerate volumes in the second half of 2022 with the launch on 10th October of cash-settled futures on Emerging Market currency pairs.

As we move into the final month of Q3, the team will continue to work with our members to ensure that key initiatives are launched. The team is focused on executing the initiatives in our roadmap and outlining key projects for delivery in 2023. We are committed to building a portfolio that best serves our members, clients, and liquidity providers. It is important to us that we work together to make each initiative a success. Navigating the rest of 2022 will surely be a challenge and one we will discuss with our clients in the coming months. I will share some of these insights in September's review.