Jun 30, 2023

Eurex

Fixed income futures – June roll analysis

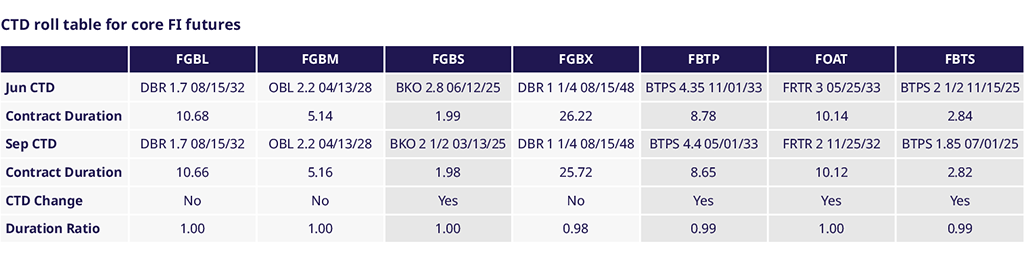

Stable activity as minimum exchange day rule comes into effect with the June expiry

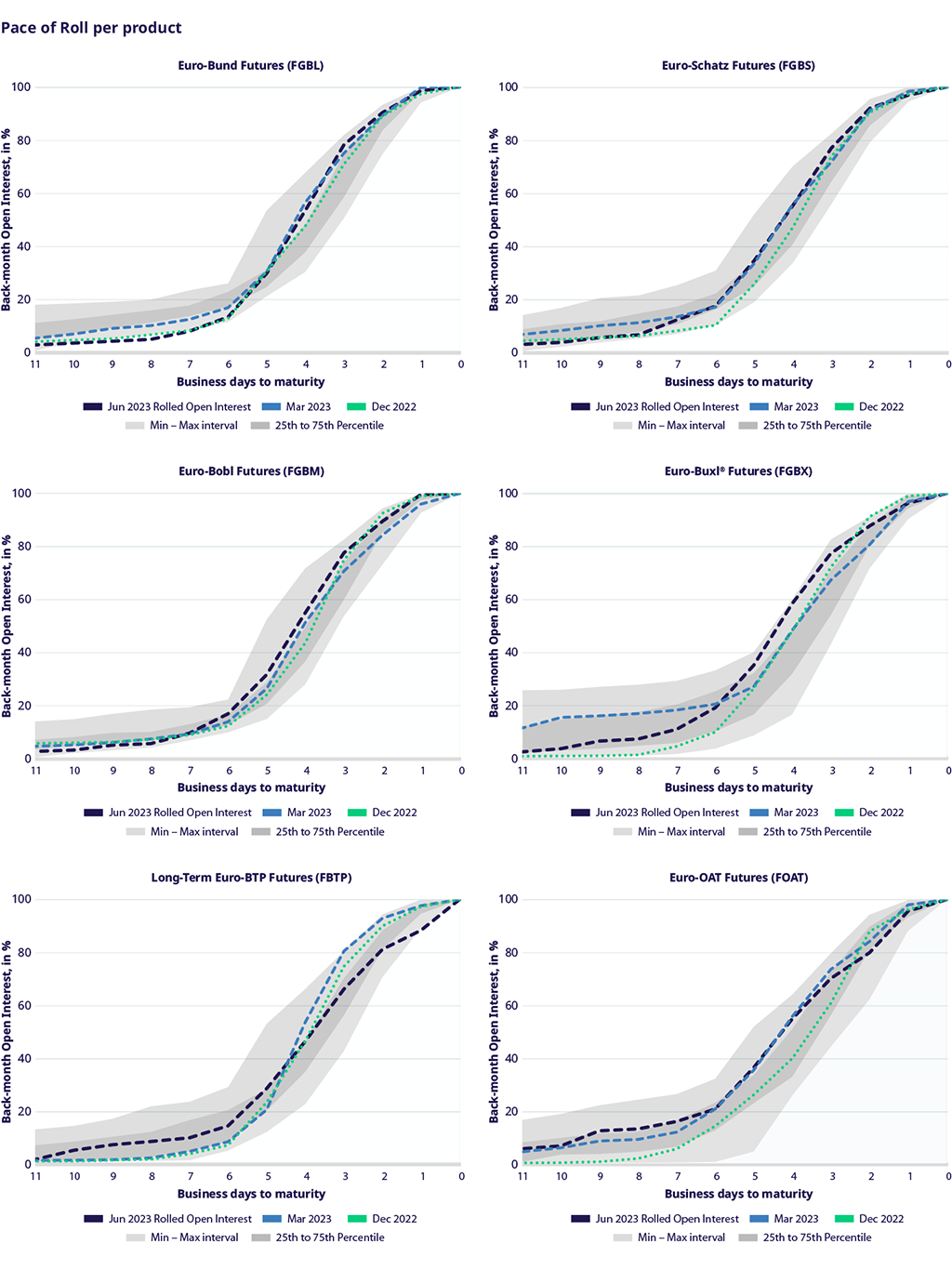

The roll into the September expiry saw similar volumes to previous rolls and was higher in comparison to June 2022. The introduction of the minimum exchange day rule ensured that there were no front month CTD switches, which, in turn, supported an orderly roll with Bund implied volatility remaining range bound around the 9% mark.

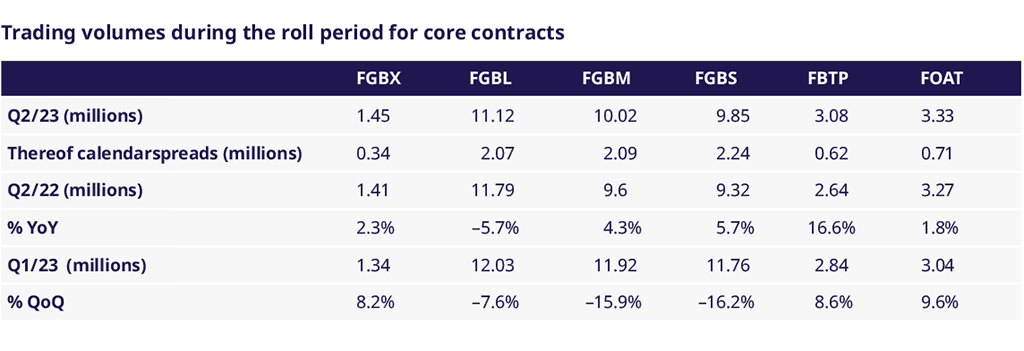

Trading volumes during the roll period (last nine days before expiry)

Calendar Spreads narrowed throughout the roll period