Aug 20, 2019

Eurex | Eurex Clearing | Eurex Group

Insight: ECB recommendations for the €STR transition

In a nutshell

The ECB established the working group on euro risk-free rates to identify and recommend risk-free rates. These should serve as a basis for an alternative to current benchmarks used in a variety of financial instruments and contracts in the euro area, such as EONIA and EURIBOR.

In September 2018, the working group recommended that the euro short-term rate (€STR) replace the euro overnight index average (EONIA) as the new euro risk-free rate.

It also recommended that €STR provide the basis for developing term fallbacks for contracts referencing Euribor.

Market participants need careful transition planning to minimize disruption to markets and consumers and to safeguard the continuity of contracts to the greatest extent possible, including contracts that currently reference a term rate rather than an overnight rate.

Can you first explain what the task of this working group is and what role Deutsche Börse plays in this?

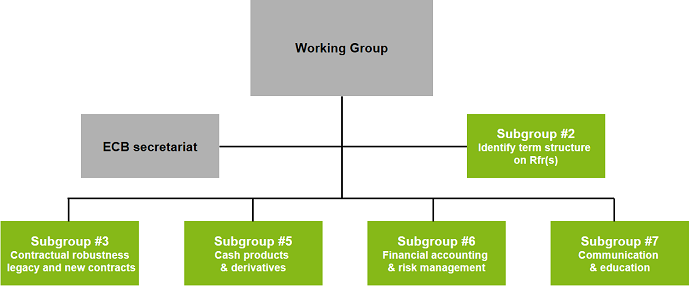

The main working group at the ECB is split into a number of sub-working groups (SGs), for various topics. We are involved in a number of these sub-working groups in our role as an important market infrastructure provider with our derivatives exchange Eurex and our clearing house Eurex Clearing. From a content perspective at this stage of the transition, the main sub-working groups are the completed SG4 on transition paths and SG3 on the legal action plan, as well as the ongoing SG5 on derivatives and cash products and SG6 on risk management and accounting. The ECB website gives a good overview of their constituents and their terms of references, should you want more detail.

Organization chart working group euro risk-free rates, phase 2

Can you give us a brief overview of the tasks assigned to the individual subgroups?

From a chronological perspective (and focusing on the Risk-Free Rate transition), SG4 was first asked to recommend a general path to move from EONIA as the primary risk-free rate to the new rate €STR. In parallel, SG3 was tasked with creating recommendations on how to execute this move from a legal perspective. SG5 is now developing concrete measures to adopt the recommendations from SG4 for cash and derivatives products and bring them to life ideally by the end-2021 deadline. SG6, in parallel, is looking at the same topic from an accounting and risk management perspective.

In a nutshell, the main outcome of the process so far is that:

- €STR has been chosen as the new EUR risk-free rate and as a replacement for Eonia (the current risk-free rate proxy);

- €STR shall replace EONIA by means of re-establishing EONIA as a rate that tracks €STR with a fixed, constant spread of 8.5 basis points;

- As of 1 October 2019, EONIA in its current form will be transitioned to this €STR tracker rate.

The transition from EONIA to €STR seems to be a Herculean task, considering the widespread direct or indirect use of EONIA in the EUR market. What steps have the subgroups now recommended to make this transition as smooth as possible?

Yes, it is, and not just here in the Eurozone. The EUR transition overlaps with many other global market reforms, like the reform of risk-free rates in other jurisdictions and the general transition and reform of LIBOR rates. Not to mention the fact that many other regulatory-driven changes will be happening over the next few years as well. Therefore, the work done by the working groups (not only in Europe, but across the globe) is of utmost importance; it would not be possible to perform the transition to risk-free rates without public and private sector alignment, communication and coordination for the relevant rates.

The main recommendation which forms the basis is the transition path proposed by SG4 to make EONIA a fixed dependent of €STR and encourages a so-called clean discounting approach per counterparty (or Central Counterparty [CCP] in our case). These two points really are the foundation of the work to come.

To appreciate the symbiotic nature of these two aspects, one needs to be reminded that as a tracker of €STR, EONIA is essentially just a different label for €STR from an exposure point of view. In this regard one might be tempted to say that the transition is already in effect just by the EMMI (European Money Markets Institute) announcing that EONIA will be this tracker. If you think about your EONIA-labelled exposure going forward and beyond October, you really ought to be thinking €STR, even though the label says EONIA. This means that you do not need to start a whole new market on a rate like €STR; essentially it is already there as we speak. Now the task is to follow through on this from a legal, operational, and technical perspective, and to transition the label EONIA to €STR to get rid of the fixed spread. Again, this is a tremendous effort and should not be underestimated in any way, but the task to get the market on the new rate seems now more a matter of "how fast?" than "will it happen at all?".

The second recommendation that serves as a basis is clean discounting. This is particularly important for us (and our members) as a CCP. It gives clarity on the way settlement prices are to be calculated and recommends a single setup in which you either base everything on EONIA or €STR, but not both at the same time.

This is much less complex from a practical perspective when you remind yourself that all EUR derivatives in the cleared OTC space involve some way of equating current values of future payments. This is for the most part done on an EONIA basis, meaning Euribor swaps depend on EONIA indirectly. What this means is that your current values will change when you base them on €STR instead of EONIA, and if you are driven by fair values or net present values of your books, then this matters to you a lot.

This is where SG5 picks up the thread to outline which options you have to mitigate and deal with this effect. Clearly SG5 has done much more, also for other markets, and provides a holistic impact outline for areas which are important for a wide user base, but it is fair to say that the change of the basis to compute prices (PAI and discounting) is one of the pivot points in the process.

Moreover, the recommendations also provide guidance on how to build an €STR curve from day one and discuss what could be done for remaining EONIA swaps once the rate vanishes at the end of 2021.

To sum up, the main recommendations for cleared markets are:

- Preferably compensate for the value transfer by simple cash payments, sometime in (mid-)2020,

- CCPs should align their timelines for the change of discounting and PAI as much as possible (ideally on the same date),

- build your €STR curve in a first instance from your existing EONIA curve by a simple -8.5 basis point shift, and

- avoid an EONIA fallback scenario post 2021 for certain derivatives should be preferred over letting contracts fall back to €STR+8.5bp.

These recommendations should aid a smooth(er) transition and demonstrate that the fixed link between EONIA and €STR was a good choice.

Where do you personally see the biggest challenges in this transition process?

We think it helps tremendously that a simple cash compensation has been deemed preferable to other options. We see this cash-only scheme as simple enough to facilitate a switch of the discounting sooner rather than later as fewer processing changes are required. Mid-2020 seems in reach, although it should also not be rushed; in our opinion, even if this needs more time, the process should not extend past the end of 2020. We are already in active discussion with our members regarding this factor of the transition process. The next step and challenge will then be to achieve agreement across the CCPs and to ideally find a single discounting switch date.

Soon after this is done (ideally in parallel), the discussion about EONIA fallbacks and cleared, legacy EONIA swaps needs to take place. We firmly believe that an active management of exposures to achieve a controlled and future-proof transition from EONIA swaps to €STR swaps should be the aim for the next two and a half years until EONIA vanishes. Again, the fixed spread opens the door to achieve this in a rather smooth manner.

Finally, in its role as a clearing house and exchange operator, what is Deutsche Börse and its clearing house Eurex Clearing doing to facilitate this transition process and support its clients?

In short, a lot.

- Offer €STR swaps for clearing quickly yet still along our robust delivery chain after €STRs first publication;

- Talk, talk, talk to members, clients and working groups to create trust and shape the process together;

- Provide clarity as soon as possible via official publications once agreement has been reached;

- Listen to the market and gather requirements for additional services needed, not only for €STR but also in the greater scheme of things for IBOR transition topics.