Aug 22, 2014

Eurex Clearing

Benefiting from our Exchange for Swaps Service

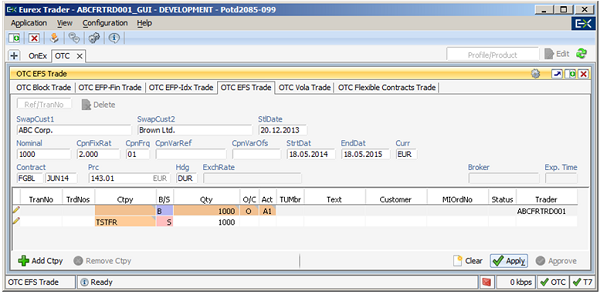

The Eurex Trade Entry Services enable our Trading Participants to enter off-book trades to the Eurex system, allowing them to benefit from the flexibility of customized trading and the advantages of standardized clearing and settlement through Eurex Clearing. Our Exchange for Swaps (EFS) Service is available for variety of combinations of Eurex fixed income futures and interest rate swaps.

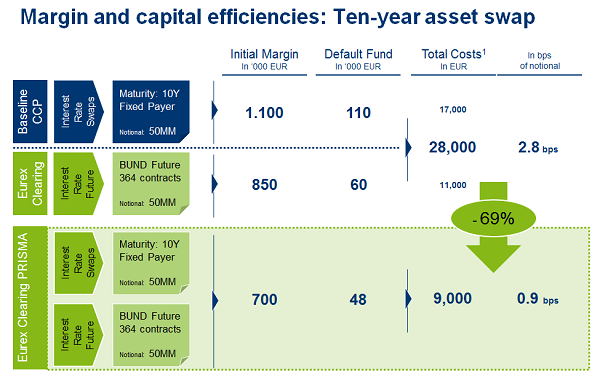

Sell side and buy side trading Euro-Bund, Euro-Bobl or Euro-Schatz Futures versus OTC interest rate swaps can benefit greatly if both the futures and the swap legs are booked through the Eurex system and Eurex Clearing. As you can see in the example below, clearing both with Eurex Clearing can result in up to 70 percent lower inital margin and corresponding default fund contribution.

We would be happy to discuss our EFS Service as well as the benefits of Eurex Clearing with you – so, please don’t hesitate to contact us.

Eurex Clearing AG

Clearing Business Relations