How does Eurex’s Partnership Program work?

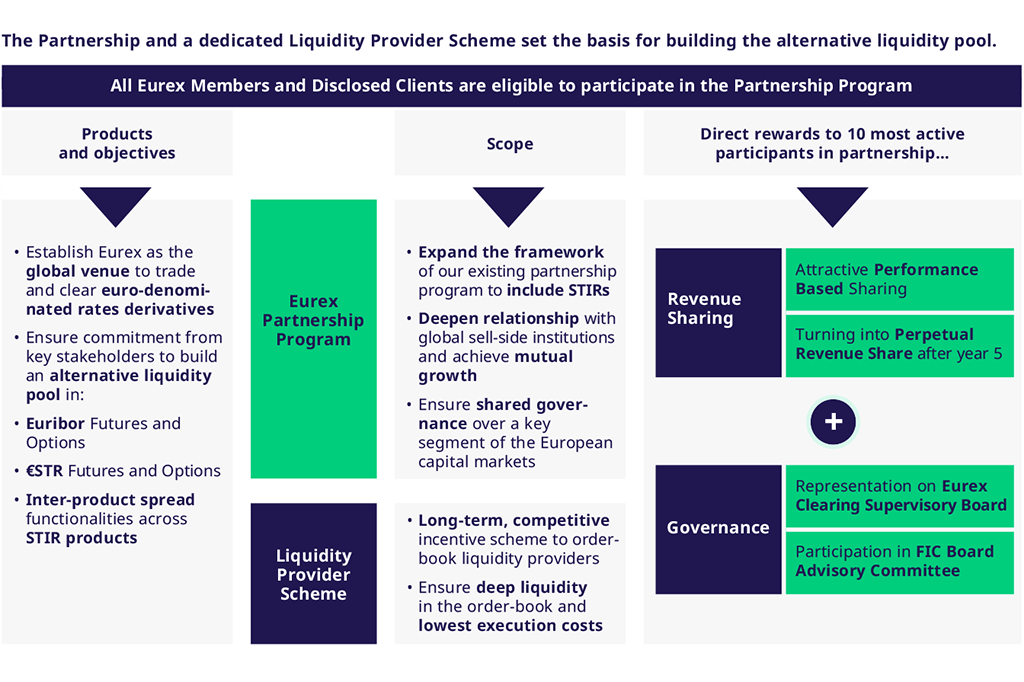

The ten most active program participants are eligible for a significant share in the economics of the STIR offering of Eurex Clearing on a permanent basis. In addition, these clients are included in the governance and committee structure of Eurex Clearing. Participation is open to all Clearing Members and Registered Clients of Eurex Clearing.

Expanding the partnership program to STIR derivatives

Market-led solution to create an alternative liquidity pool for € short-term interest rate derivatives

"The extension of the Partnership Program is the latest step in Eurex's efforts to provide the market with greater choice and bring more systematically relevant business into the EU."

Matthias Graulich, Member of the Executive Board at Eurex Clearing

The program’s key elements