Reverse stress testing

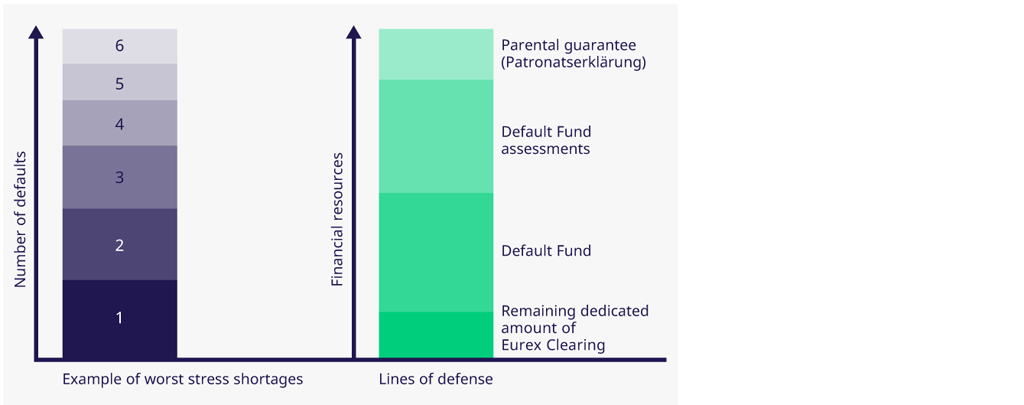

Reverse stress testing challenges the resilience of the CCP under different stress scenarios. In particular, it is analyzed how many Clearing Members can default in a very short timeframe in order to exhaust all financial resources. This analysis is done incrementally along the lines of defense, starting with pre-funded financial resources over additional assessments from all members and ending at the parental guarantee as well as the remaining equity capital of Eurex Clearing.

For each historical and hypothetical stress scenario as well as more severe market crash analysis scenarios, the number of possible defaults is estimated by aggregating the credit exposures and comparing the accumulated exposure with the available financial resources at each line of defense. The number of Clearing Members, whose corresponding credit exposure exhaust the different layers of available financial resources, is an indicator of how many defaults can occur under any given scenario until the CCP is not viable anymore as the respective layer of financial resources is exhausted.