Eurex Daily USD/KRW Futures on US Dollar Futures of KRX

In addition to the existing KOSPI products a new product “Eurex Daily USD/KRW Futures on US Dollar Futures of KRX (FCUW)” has been introduced to the Eurex/KRX Link.

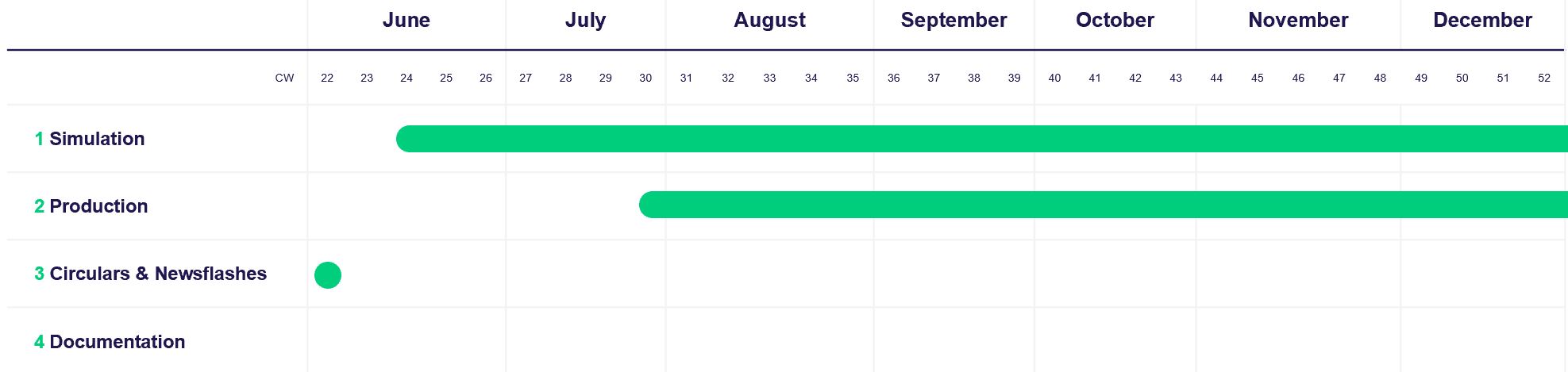

Simulation start: 18 June 2021

Production start: 26 July 2021

Supporting Documents

Circulars

Participants Requirements

Features | Details | Action Item |

Daily USD/KRW Futures on US Dollar Futures of KRX | The Daily USD/KRW Futures on US Dollar Futures of KRX (FCUW) will be under the C7 Capacity Group - CASH KRW – CFTC. Trading Participants can assign product and set up transaction size limits for traders using the User maintenance functions of the Eurex Admin GUI. This product extension will follow the same trading and clearing protocols as for all other KRX Link products. The products will sit in their own liquidation group. | Trading Members are requested to align with their respective Clearer for any risk limit setup, if necessary. The technical requirements are the same as for the existing Eurex KOSPI Products. |

Further information are available on our dedicated websites in various languages:

Member Section

The Member Section is our group-wide portal solution which is used by customers of almost all business segments. Get here an overview of the services offered within the Member Section.

For technical support, please contact your Technical Key Account Manager or CTS@deutsche-boerse.com. In case of any questions or you require further information please contact client.services@eurex.com.

Are you looking for information on previous projects? We have stored information about our previous projects in our Archive for you!