C7 Releases

Overview of content

C7 Release 12.1

With the introduction of C7 Release 12.1, Eurex Clearing will implement several key enhancements, including changes in Fee Identification Code with a new value for BLOCK_QTPIP transactions, restrictions for FX option processing on expiration day, extended trading unit limits for corporate actions, enhanced Advanced Risk Protection (ARP) email notifications for Level 1 and Level 2 limit breaches, and comprehensive updates to C7 reports to support these changes. For further information on Optional Scalability for FIXML, please refer to the relevant documentation Optional Scalability Enhancements for FIXML Processing or contact your Technical Key Account Manager (TKAM).

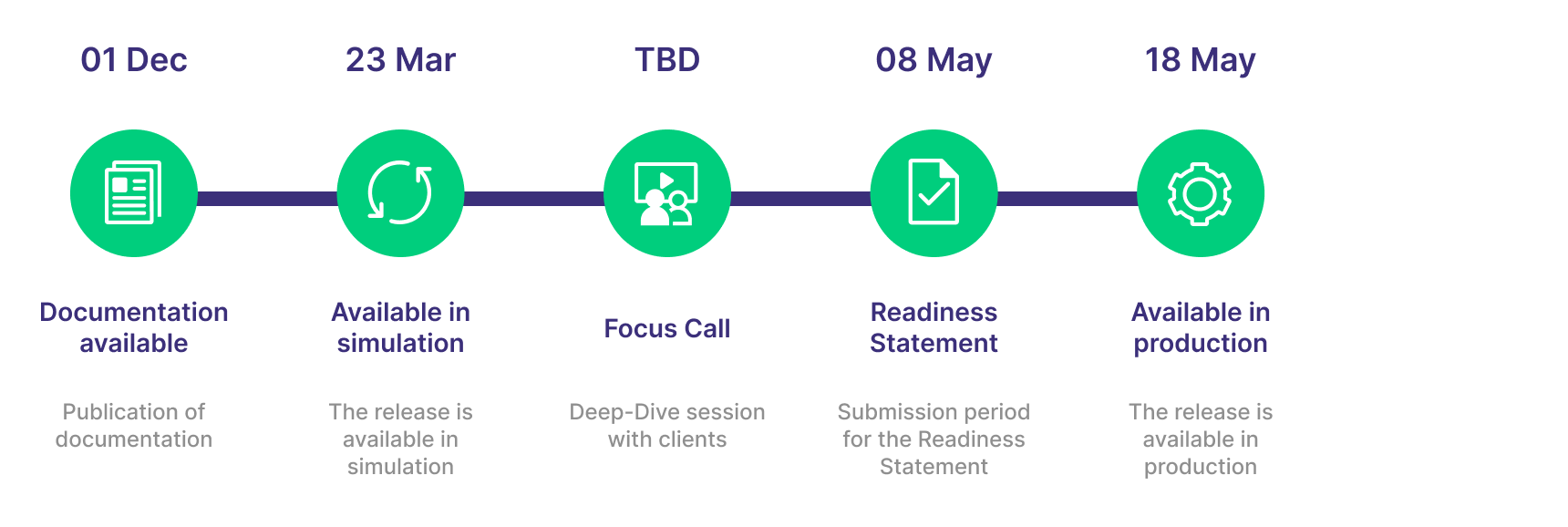

Simulation start: 23 March 2026

Production start: 18 May 2026

System Documentation

-

C7 Release Notes

Publication date: 16 Feb 2026

This document gives you an overview of functional and technical enhancements and changes to be introduced. -

C7 Fee Identification Code - User Guide

Publication date: 01 Dec 2025

This document provides an overview of the different values a Fee Identification Code can take and outlines examples on how to use this information -

C7 Collateral Management Functional Reference Guide

Publication date: 01 Dec 2025

This document provides detailed information about the collateral management functions of C7. - C7 Advanced Risk Protection Functional Reference Guide

Publication date: 01 Dec 2025

This document provides detailed information about the advanced risk protection functionality of C7. - C7 Member Communication Calendar

Publication date: 01 Dec 2025

This document provides the publication schedule for C7 member documentation planned in 2025. - C7 Derivatives Clearing Functional Reference Guide

Publication date: 01 Dec 2025

This document provides detailed information about the transaction and position maintenance functionality of C7. - C7 User Entitlement Guide

Publication date: 01 Dec 2025

This document describes the major components of the user entitlement model with the description of each privilege available for entitlement user. - C7 Reference Data Functional Guide

Publication date: 01 Dec 2025

This document provides an overview of the reference data and related functionalities maintained in C7.

- Eurex Clearing CSV Reports - Header Field Name

Publication date: 01 Dec 2025

This package contains the headers of the CSV files for C7. - Eurex Clearing XML Reports – XML Schema Files

Publication date: 01 Dec 2025

This package contains the reports xsd files for C7. - Eurex Clearing XML Reports – Modification Notes

Publication date: 01 Dec 2025

This document provides an overview of the enhancements and changes to the C7 XML Reports as compared to the previous version. - Eurex Clearing XML Reports – Reference Manual

Publication date: 01 Dec 2025

This manual provides the XML report descriptions for the Eurex Clearing's C7.

- C7 Clearing GUI - User Manual

Publication date: 01 Dec 2025

This user manual for the Eurex Clearing's C7 Clearing GUI provides final descriptions of all windows and related functions. - C7 Advanced Risk Protection GUI - User Manual

Publication date: 01 Decay 2025

This user manual for the Eurex Clearing's C7 ARP Clearing GUI provides final descriptions of all windows and related functions. - Clearing GUIs - Access Guide V3.11

Publication date: 01 Dec 2025

This document describes the technical requirements to access the Eurex Clearing GUIs: C7 Clearing GUI, EurexOTC Clear GUI and EurexOTC Clear Margin Calculator GUI.

- C7 - Eurex Clearing FIXML Interface - Schema Files

Publication date: 01 Dec 2025

This package contains the schema files for the Eurex Clearing FIXML Interface. The schema describes message structures and fields applicable to position and transaction management on C7, and for public broadcasts. - C7 - File Interface Layouts Manual

Publication date: 01 Dec 2025

This manual contains the file descriptions for the Currency haircut parameters/adjusted exchange rates and admissible securities. - C7 - Eurex Clearing FIXML Interface Specification - Volume 1: Overview

Publication date: 01 Dec 2025

Volume 1 contains an overview of the functionality supported by the Eurex Clearing FIXML Interface. - C7 - Eurex Clearing FIXML Interface Specification - Volume 3: Transaction & Position Confirmation

Publication date: 01 Dec 2025

Volume 3 contains the message layouts for the transaction confirmation and position update confirmation broadcast streams. - C7 - Eurex Clearing FIXML Interface Specification - Volume 4: Transaction & Position Maintenance

Publication date: 01 Dec 2025

Volume 4 contains all message layouts and workflow descriptions for transaction and position management. - C7 - Eurex Clearing FIXML Interface Specification - Volume 5: Public Broadcasts

Publication date: 01 Dec 2025

Volume 5 contains public broadcast messages for settlement prices and corrections, end-of-assignment information, contract changes, and corporate action information. - C7 - Eurex Clearing FIXML Interface Specification - Volume 6: Message Samples

Publication date: 01 Dec 2025

Volume 6 contains sample messages for the Eurex Clearing FIXML interface.

Circulars

Release Items/Participants Requirements

Features | Details | Action Item |

Changes in Fee Identification Code – New Value in Fee Trade Type Qualifier | Introduction of new value “Q” for BLOCK_QTPIP transactions (previously “T”). | Clearing Member should update internal fee mapping tables and VBAP grouping logic. Valid values and examples for Clearing Members can be found in the document “C7 Fee Identification Code – User Guide”. |

FX Options Restrictions | At market request Eurex Clearing AG will change the following FX option exercise processing:

| Clearing Members should ensure systems and procedures comply with new restrictions. Further details about “Fee Identification Code” and all valid values can be found in the document “C7 - Derivatives Clearing Functional Reference Guide”. |

Corporate Action/Product Setup – Trading Unit > 9,999.9999 | In C7 Release 12.1, the Capital Adjustment process will support larger trading unit values. Previously, trading units were limited to a maximum of 9,999.9999. | Clearing Member should update data models and reporting tools to support the new format. Further details can be found in the document “Eurex Clearing XML Reports – Modification Notes”. |

Advanced Risk Protection (ARP) Email Service | Extension of Email notifications extended to Level 1 and Level 2 limit breaches (previously only Level 3). No notifications for manual slowdown events. | Clearing Members opting in for this service newly shall contact their Key Account Manager or send an email to client.services@deutsche-boerse.com and review entitlement privilege A017INQ for GUI inquiry of email addresses. |

General Report Changes | Harmonization of equalization payment reporting post corporate action processing harmonized (CA 752 - Capital Adjustment Position Overview). Numeric format changes (10,4) for trading unit fields across multiple reports. | Clearing Members should review updated XML and CSV specifications in “Eurex Clearing XML Reports – Reference Manual v.12.1.” and “Eurex Clearing XML Reports – Modification Notes v.12.1.” |

Eurex Initiatives Lifecycle

From the announcement till the rollout, all phases of the Eurex initiatives outlined on one page! Get an overview here and find other useful resources.

Are you looking for information on a previous initiative? We have stored information about our previous initiatives in our Archive for you!

Contacts

Eurex Frankfurt AG

Customer Technical Support / Technical Helpdesk

Service times from Monday 01:00 – Friday 23:00 CET

(no service on Saturday and Sunday)

T +49-69-211-VIP / +49-69-211-1 08 88 (all)

Eurex Frankfurt AG

Key Account Management

Service times from 09:00 - 18:00 CET