Oct 10, 2023

Eurex Clearing

A. Amendments to the benchmark for interest rate calculation on cash margin in EUR and CHF; B. Amendments to the Price List reg. securities collateral concentration add-on fee; C. Activation of securities collateral concentration add-on fee as of 2 January 2024

1. Introduction

This circular contains information with respect to the service offering of Eurex Clearing AG (Eurex Clearing) regarding the following topics:

- A. Amendments to the benchmark for interest rate calculation on cash margin in EUR and CHF

- B. Amendments to the Price List of Eurex Clearing AG (Price List) regarding the securities collateral concentration add-on fee

- C. Activation of the securities collateral concentration add-on fee as of 2 January 2024

The amendments for topic A. will come into effect as of 1 December 2023.

The amendments for topics B. and C. will come into effect as of 2 January 2024.

2. Required action

There is no required action.

3. Details of the initiative

A. Amendments to the benchmark for interest rate calculation on cash margin in EUR and CHF

Eurex Clearing will change the benchmark for

- cash margin in EUR from STOXX GC Pooling ON Index to ECB Deposit Rate minus an adjustment factor of 10 bps and

- for cash margin in CHF from SARON to SNB Policy Rate minus an adjustment factor of 50 bps

with effect as of 1 December 2023.

With the benchmark change, Eurex Clearing will provide more stable benchmark rates without high volatility effects, more transparency to its Clearing Members and allows a higher level of predictability for the interest on cash margin. Further, the move to deposit rate minus adjustment factor addresses year end effects as seen in the market rates in the past. The adjustment factor will mitigate additional costs resulting from changes in the overall market conditions and regulatory requirements such as the changed interest rate applied on minimum reserve by the European Central Bank.

Eurex Clearing is one of the very few global CCPs to also have guaranteed access to the central bank account in EUR and CHF which allows Eurex Clearing to offer such benchmark rates.

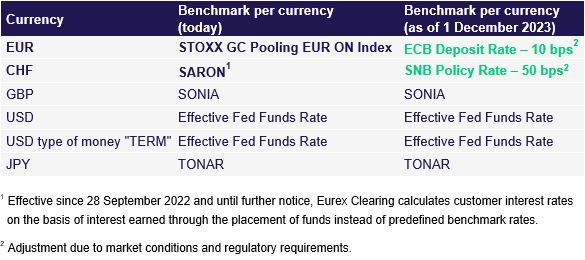

The applicable interest rates Eurex Clearing applies with respect to cash margin are, in principle, based on a predefined benchmark rate per currency as shown in the table below:

B. Amendments to the Price List regarding the securities collateral concentration add-on fee

Eurex Clearing will enhance the securities collateral concentration add-on fee (“Concentration Fee”) to further simplify the approach and to meet its client needs as outlined in detail below. The current scheme excludes all (i) client collateral pools only relating to OTC Interest Rate Derivatives Transactions and NDF Transactions, (ii) individual segregated client collateral pools that are actively using cross-margining and (iii) ISA Direct Clearing Members. Eurex Clearing will amend the Concentration Fee scheme to exclude all segregated client pools independent of their active market; meaning all pure GOSA Omnibus pools (includes only GOSA-segregated accounts) and all individual segregated client pools. Therefore, based on the new scheme, Eurex Clearing will exclude all

(i) Internal Omnibus Margin Accounts relating to Disclosed Direct Clients (GOSA-segregated accounts),

(ii) Internal ISA Margin Accounts (individual segregated accounts),

(iii) Internal ISA Direct Margin Accounts, and

(iv) FCM Client Margin Accounts

from the calculation of the required cash ratio for the Concentration Fee.

The Concentration Fee, which relates to the cash ratio, and which was introduced with Eurex Clearing Circular 062/21 and amended with Eurex Clearing Circular 023/23, shall be determined as follows:

The 40 percent cash threshold shall apply to all collateral pools (excluding the collateral pools enumerated above) on an aggregated level.

The cash ratio is calculated on Clearing Member level on a daily basis and is determined as the ratio of the actually delivered cash margin and the applicable margin requirements on all standard collateral pools, omnibus collateral pools (including at least one net omnibus segregated pool) and the Default Fund Contribution pools. Supplementary Margin is not considered in the calculation.

If the 40 percent threshold on an aggregate level is not fulfilled, the Concentration Fee of 10 basis points per annum will be charged on the security collateral that is needed to cover the margin requirement on that day. Additional securities collateral leading to an overcollateralization will not be affected and will not be considered in the calculation. Eurex Clearing provides a new daily client report with detailed information that allows monitoring the relevant cash ratios and Concentration Fees since the beginning of September 2023. The report will be also enhanced to reflect the scope modifications and is planned to be available as of 1 December 2023.

The amendments to the Price List will become effective as of 2 January 2024.

The following provision of the Price List will be amended as outlined in the Attachment:

- Number 9.2 (4)

C. Activation of the securities collateral concentration add-on fee as of 2 January 2024

Against the background of changing market conditions, Eurex Clearing observes that overall margin requirements are reducing and a further trend of Clearing Members posting more securities collateral and at the same time reducing the cash balances held. To ensure continued regulatory compliance and a balanced mix of cash and securities collateral, Eurex Clearing will activate the Concentration Fee and start charging the Concentration Fee with effect as of 2 January 2024.

As of the effective date, the full version of the amended Price List will be available for download on the Eurex Clearing website www.eurex.com/ec-en/ under the following link:

Rules & Regs > Eurex Clearing Rules & Regulations > 3. Price List

The amendments to the legal framework of Eurex Clearing published by this circular are deemed accepted by each affected contractual party of Eurex Clearing, unless the respective contractual party objects by written notice to Eurex Clearing prior to the relevant effective date(s) as stipulated in this circular. In case of an objection by the respective contractual party pursuant the preceding sentence, Eurex Clearing is entitled to terminate the respective contract (including a Clearing Agreement, if applicable). Instead of submitting an objection, the respective contractual party may submit in writing to Eurex Clearing comments to any amendments of the legal framework of Eurex Clearing within the first 10 Business Days after the publication of the amendments. Eurex Clearing shall assess whether these comments prevent the published amendments from becoming effective taking into account the interests of Eurex Clearing and all contractual parties.

Unless the context requires otherwise, terms used and not otherwise defined in this circular shall have the meaning ascribed to them in the Clearing Conditions or FCM Clearing Conditions of Eurex Clearing AG, as applicable.

Attachment:

- Amended sections of the Price List of Eurex Clearing AG

Further information

Recipients: | All Clearing Members, FCM Clearing Members, ISA Direct Clearing Members, Disclosed Direct Clients, FCM Clients of Eurex Clearing AG and vendors | |

Target groups: | Front Office/Trading, Middle + Backoffice, IT/System Administration, Auditing/Security Coordination | |

Related circulars: | ||

Contact: | FixedIncome.Sales@eurex.com | |

Web: | www.eurex.com/ec-en/ | |

Authorized by: | Matthias Graulich |