Early November, Eurex hosted a webcast highlighting the relatively new Daily EURO STOXX 50® index options and a discussion around VSTOXX®. The first half of the program was dedicated to EURO STOXX 50® options. Participants included Dorte Carlsen, VP Equity & Index Sales EMEA from Eurex, Lotte de Vos, CFA, Head of European Market Structure at Optiver and Carl-Johan Munch-Jensen, Head of Trading, Swissquote Bank. For an hour, they discussed why Eurex introduced Daily EURO STOXX 50® Options, how the market has quickly embraced these new expirations, and any potential ancillary impact on the EURO STOXX 50® ecosystem.

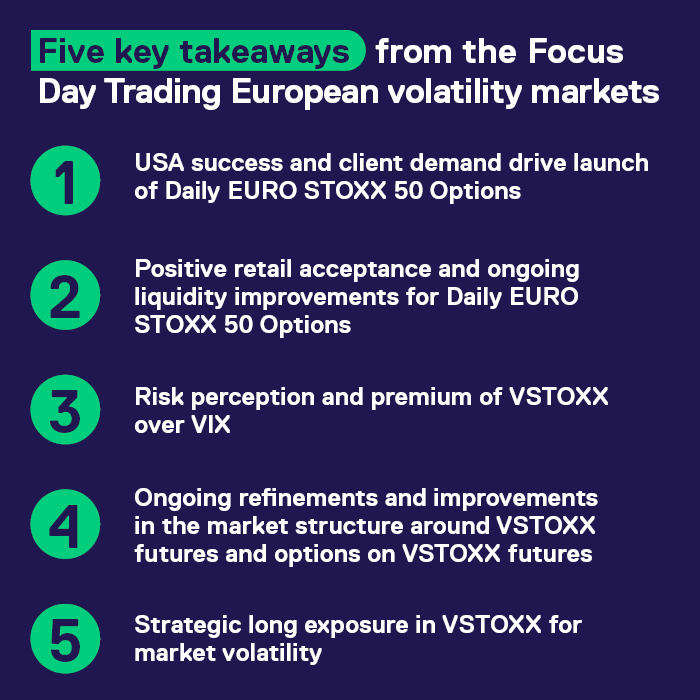

1. USA success and client demand drive launch of Daily EURO STOXX 50 Options

During a discussion regarding the motivation behind the launch of Daily EURO STOXX 50® Options, Dorte Carlsen acknowledged that the success of similar products in the US was a factor behind introducing Daily Options. She also stated that several market participants asked for daily expirations. The final motivation came from market makers, who broadly supported launching the Daily EURO STOXX 50® Options.

Optiver's Lotte De Vos echoed Dorte's comments regarding market makers' support of the new short-dated expirations. Optiver is a market maker in the new options and she noted they were involved in several block trades. Lotte also noted that the PM settlement feature is attractive to both retail and institutional traders.

2. Positive retail acceptance and ongoing liquidity improvements for Daily EURO STOXX 50 Options

Carl-Johan Munch-Jensen offered insights into retail acceptance of daily expirations. He also mentioned that the PM settlement feature is a positive, especially for retail clients. He discussed liquidity, which is already impressive for a new product but also improving. A final thought related to any impact on other methods of gaining exposure to the EURO STOXX 50® was that the new trading is organic and additive to the overall EURO STOXX 50® ecosystem liquidity.

3. Risk perception and premium of VSTOXX over VIX

After a short break, the discussion turned to European market volatility and VSTOXX® with two participants from J.P. Morgan: Yangyang Hou, Senior Equity Derivatives Strategist and Equity Index Derivatives Trader Federico Borghese. The final participant in the second half of the focus day was Eugen Mohr from Eurex.

Yangyang Hou started the VSTOXX® discussion by comparing the behavior of VSTOXX® versus VIX. There is some divergence in behavior that is a function of differences in the composition of the EURO STOXX 50® and S&P 500. Hou also noted that VSTOXX® has been at a premium to VIX based on higher risk perceptions in Europe versus the US and a breakdown in correlation within the EURO STOXX 50®.

She also discussed the benefit of having long exposure to VSTOXX® in cases of an equity market crash, as VSTOXX® has rallied more in the past than VIX during periods of excessive market volatility.

4. Ongoing refinements and improvements in the market structure around VSTOXX futures and options on VSTOXX futures

Eugen Mohr from Eurex followed Yangyang, discussing the market structure around VSTOXX® futures and options trading. Eugen noted that Eurex is working toward some tweaks to the VSTOXX® markets based on conversations the exchange has had with various traders.

5. Strategic long exposure in VSTOXX for market volatility

The VSTOXX® portion of the program closed with Federico Borghese joining Eugen for a panel discussion around specific aspects of the VSTOXX® market. Federico shared his view of VSTOXX® trading, commenting on methods that managers use to get both short and long exposure to VSTOXX®. He also noted that VSTOXX offers equity managers the ability to get long VSTOXX® exposure for European-specific events. One of the trades that managers favor would be to sell an out-of-the-money put and buy a call spread, a trade that would benefit from a quick move up in volatility in response to lower equity prices.