Select Finance - Secured Funding and Financing for Buy-side Clients

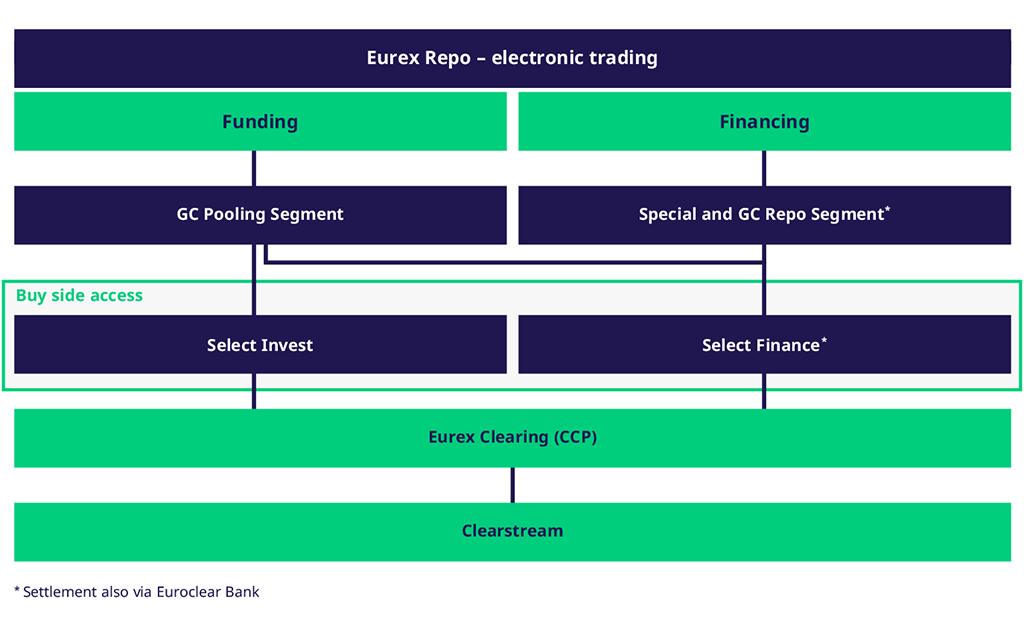

Eurex Repo and Eurex Clearing have expanded the existing, successful interbank markets to address buy-side clients. In contrast to the anonymous interbank segments, the customized buy-side trading permissions offer bilateral trading. This allows banks and their buy-side clients to continue their existing business relationships. The Select Finance trading permission provides buy-side clients such as regulated financial service companies, insurance and reinsurance undertakings, pension funds or investment funds access to the GC Pooling, Special and GC Repo segments.

Select Finance is designed to accommodate buy-side needs, specifically those of pension funds and asset managers, for variation margin funding. By leveraging proven GC Pooling infrastructure clients are enabled to perform collateral transformation for cash margin coverage.

Key characteristics

- Electronic and bilateral cash funding in EUR, USD, CHF and GBP collateralized with fixed income and equity baskets (four GC Pooling baskets)

- Electronic, bilateral and tailor-made financing with 41 standardized General Collateral (GC) baskets of fixed income securities against EUR or GBP

- Single securities financing

- Requests-for-Quotes (RFQ) can be sent to preferred banks or automatically to all admitted participants of the GC Pooling, Special and GC Repo segments

- Multiple standard terms from overnight until two years

- Manual allocation of GC basket collateral enables selective collateralization

- Automatic allocation of collateral and real-time substitution of collateral within GC Pooling baskets

- With the conclusion of the repo trade, Eurex Clearing becomes immediately the legal counterparty to both trading entities (open offer)

Trading hours

07:30 - 18:00 Frankfurt am Main time, Overnight (ON) deadlines depending on segments and products

Contract size

Minimum trade size of one million EUR, USD, CHF or GBP in all baskets

Minimum trade size of 500,000 EUR for single bonds

Minimum trades size of one share respectively 1,000 nominal for bonds

Participation

Buy-side clients that are domiciled in the European Union or Switzerland can participate. The following steps need to be taken:

- Apply to participate in Select Finance

- Set up web based access to the Eurex Repo trading system

- Set up web based access to the Eurex Clearing systems

- Apply for a ISA Direct Clearing Member license

- Sign a trilateral clearing agreement with a Clearing Agent and Eurex Clearing

- Sign Clearstream agreements to open an account for cash and securities settlement and collateral management. Alternatively securities financing transactions can be settled via Euroclear.

Clearing Agent

A Clearing Agent must be an existing General Repo Clearing Member of Eurex Clearing. The Clearing Agent is required to provide at least the clearing fund contribution and default management bidding obligations on behalf of the Select Finance participant. In addition further cash, transaction and collateral management services may be provided.