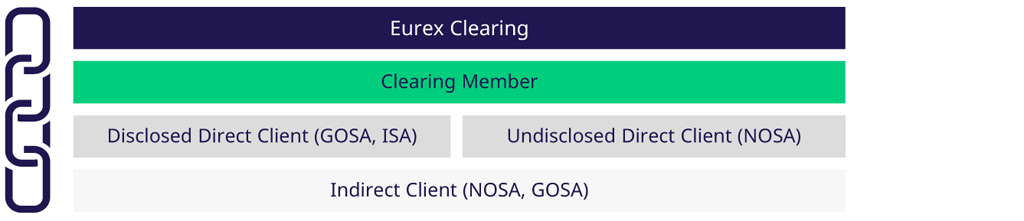

Client types

Eurex Clearing differentiates between clients of the Clearing Members ("Direct Clients") and clients of such Direct Clients ("Indirect Clients"). Direct Clients are further divided into clients that are accepted by Eurex Clearing on the basis of its compliance check and know-your-customer checks ("Disclosed Direct Clients") and Direct Clients which are not know to Eurex Clearing ("Undisclosed Direct Clients").

Disclosed Direct Clients are subject to a simplified on-boarding process. A more detailed compliance check during on-boarding is only required for Disclosed Direct Clients requesting post-trade management activities with respect to transactions relating to them.

Eurex Clearing requires contact information for each Disclosed Direct Client. Contact Information for Disclosed Direct Clients are

- Name of the company

- Legal form

- Address

- Email address (for default management processes)

- Telephone number (for default management processes)

- Legal Entity Identifier (LEI)

- Back-up CM & contact email (optional)

Disclosed Direct Client

- A Disclosed Direct Client is known to the Clearing Member (CM) and disclosed to Eurex Clearing

- Eligible for the Clearing of Eurex Transactions, OTC Interest Rate Derivative Transactions and OTC NDF Transactions

- No contractual relationship with Eurex Clearing

- No requirement to conduct post-trade trade management directly at the CCP with respect to transactions relating to them

- From a functional point of view, Basic DCs can be set-up in the systems of Eurex Clearing, on request of the Clearing Member either with a Member ID or in an A-account of the Clearing Member

- Optional access to Eurex Clearing Reports (in the event that the Clearing Member grants access). For a Basic DC is set up in an A-account, only a subset of reports will be available

- Eligible for the Clearing of Eurex Transactions, OTC Interest Rate Derivative Transactions, OTC NDF Transactions

- A Connection Agreement is required to access to the systems of Eurex Clearing

- System access will facilitate the requirement to conduct post-trade trade management with respect to transactions relating to them

- From a functional point of view, they are set-up in the systems of Eurex Clearing with a Member ID

- Optional access to Eurex Clearing Reports (in the event that the Clearing Member grants access). The full range of Direct Client reports are available

- A trading participant in one or more markets for which Eurex Clearing offers its clearing service

- A Connection Agreement is required to access to the systems of Eurex Clearing

- System access will facilitate the requirement to conduct post-trade trade management with respect to transactions relating to them

- Post-trade management can be transferred to the Clearing Member or the post-trade management can be outsourced to a third party

Undisclosed Direct Clients (UDC)

- An Undisclosed Direct Client is known to the Clearing Member (CM), but not disclosed to Eurex Clearing.

- Clients can use one or multiple executing brokers (EB) and one or multiple CMs. Trades of an UDC are posted into the agent account(s) of their CM.

- As a result of this, positions will be comingled with other direct clients of the Clearing Member in an NOSA account.

Indirect Clients

- An Indirect Client is known to the direct client only

- Clearing Members providing indirect clearing services are required to offer OSA and GOSA as segregation options to the direct client for its clients. Based on the offering of the Clearing Member OSAs can be provided on a per indirect client level (GOSA) or across all indirect clients (NOSA).

- Indirect GOSA clients are eligible for the clearing of Eurex Transactions, OTC Interest Rate Derivative Transactions, OTC NDF Transactions.

- Depending on the option chosen, it is possible that their collateral and positions will be comingled with other indirect clients. Indirect clients are not eligible for individual segregation.

- Depending on the bilateral clearing arrangement, a DC Market Participant can be classified by the Clearing Member as Indirect Client Market Participant. The Indirect Client Market Participants can conduct post-trade management although they are indirect clients.