OTC Clear Procedures Support

Overview of content

- Trade Transfer

- Account Transfer

- Portfolio Transfer

- Netting

- Package Clearing

- MtM Adjustment

Account Transfer

As derivable from its name one or more trades can be transferred. This transfer is always a transfer to a different account under the same Clearing Member ID. An account transfer always terminates the existing trade and re-opens a new trade with the same attributes and a new trade id.

An account transfer can be performed via the Eurex OTC Clear GUI (Production/Simulation). It is the same process for both environments.

FAQ

- A Clearing Member or Disclosed Client with access to the EurexOTC Clear GUI.

- For each transfer, a member needs two users with the respective access rights to initiate and confirm the action.

- Clearing Member or Disclosed Clients with system access can trigger the transfer. In the Cleared Trade tab, trades that should be transferred can be selected by ticking the box next to the CCPTradeID. After selecting the trades, the button “Account Transfer” needs to be pressed.

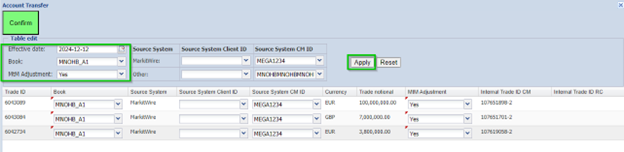

- In the Account Transfer window which opens automatically, the Effective date, target book as well as MtM Adjustment option (yes or no) can be selected. By clicking on Confirm, the transfer process will start

- Who needs to approve it?

- In any case the Clearing Member needs to accept the transfer.

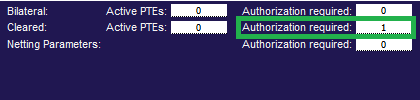

- By 4EP there is always a 2nd approval necessary.

- The second approver can find the trade(s) to be approved for transfer under the authorization required window (click on the number):

- The second approver cannot make any changes, just accept or reject.

- If there is enough collateral to fulfill the margin requirements for both parties, then the trade in transferor account will be in TERMINATED status and trade in transferee's account will be in VERIFIED status!

At any time during the business hours:

- Production: 8am – 10pm CET

- Please note, in Simulation, there will be no trade novation after 6 pm CET. This means, after 6pm CET account transfer can be initiated but will be queued until the system opens on the next business day at 8am CET

- From one account of a Clearing Member to another one within the same Clearing Member ID.

- This also includes client trades moved from one account of a Clearing Member ID to another one.

- Yes, if a Disclosed Client initiates the account transfer then the corresponding Clearing Member has to approve it until end of day.

- Until the approval is given, the trade(s) will be in status “WAIT_TAKEUP” for the Clearing Member.

- If the Clearing Member does not grant approval until 10pm CET, the account transfer request will be rejected afterwards.

Configurable box allows to select up to 100 trades at once when initiating a transfer in the GUI. If you wish to upload more than 100 trades, the procedure must be performed several times.

There is also an option to trigger transfer with no limitation on the number of trades in the respective portfolio.

Portfolio Transfer can also be done via EUREX OTC Clear GUI and more information on this can be found here (Please click here for the chapter Portfolio Transfer).

Yes, it is possible to transfer part of the original notional to a different notional.

It is also possible to allocate all of the original notional to several different accounts during the transfer.

To be considered in case of a partial transfer: It needs to be specified what happens to the remaining notional!

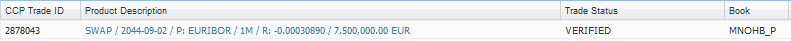

Example: We have the following trade with a notional of 7.5 mio. EUR.

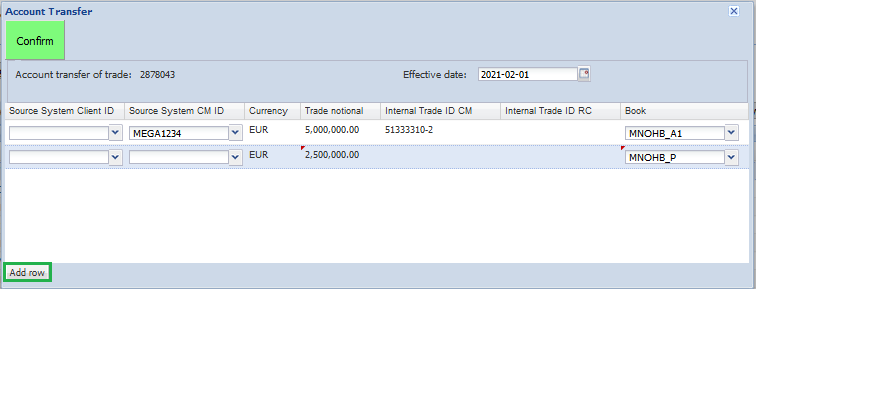

from this a trade with a notional of 5 mio. EUR should be transferred to another account (from MNOHB_P to MNOHB_A1).

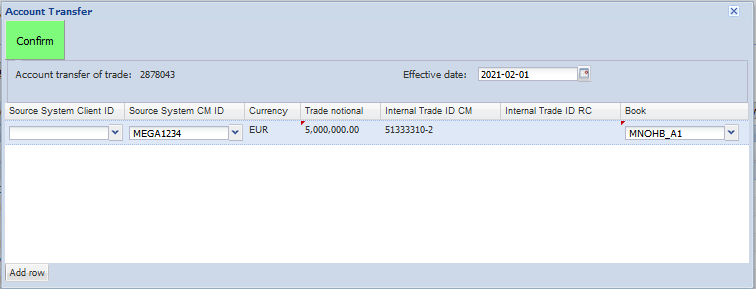

If the notional is just changed to 5mio. EUR when specifying the target account as below.

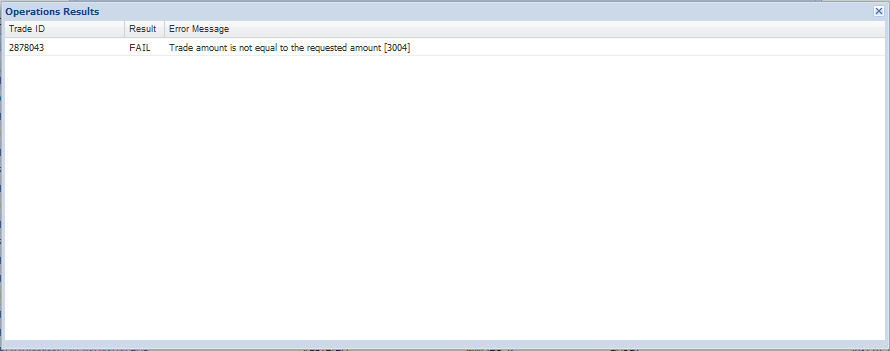

- Then we will get the following error message:

To avoid this message, it needs to be specified what happens to the remaining 2.5 Mio. EUR trade (use the Add row functionality!).

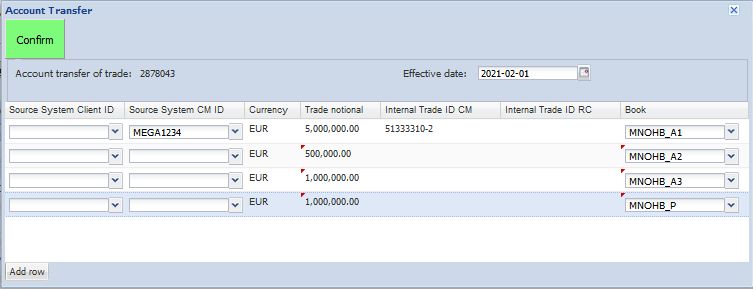

The remaining notional can be left at the original account, also a different account or split into smaller notional portions of your choice! Some examples below:

No, fees cannot be added in this case.

- The new trade id will be displayed when the transfer needs to be accepted by the second user (as in the screenshots under 7. visible as “Account transfer of trade: ..”).

- An internal trade ID CM (and/or internal trade ID RC in case of a client trade) can be used as a tracking code because it will be displayed for the original as well as the new trade.

- Sometimes there is already an Internal Trade ID (has been entered sometime earlier by a user) – if not or if preferred to be changed a new internal trade ID can be entered in the triggering process of the transfer.

- If the transferor informed the transferee on bilateral basis about the CCP trade ID of a trade, the transferee can find a trade based on PrePTE ID equal to the CCP trade ID in the Advanced Search section of the cleared trade window.

- As stated under 7. the sum of the notionals entered in the account transfer window need to add up to the notional of the original trade.

- Further information and a step-by-step manual is available (EUREX OTCCLEAR User Guide).

It can appear when the Clearing Member tries to pick up the trade(s).

If an initiated PTE does not pass the incremental risk check successfully it can stay pending in status ‘WAIT_MARGIN’ until the end of the business day and will be rejected afterwards.

- The trade can then be in status WAIT_MARGIN if there is not enough collateral on one or both collateral pools.

- This can only happen in case the two accounts belong to different collateral pools.

- Via C7 Clearing GUI:

- More information on this can be found in the manual which can be downloaded from www.eurexclearing.com.

- Go to Support > Initiatives > C7 Releases and select the latest release:

- System Documentation > Eurex Clearing GUIs.

- In the CC760 Daily Margin Summary Report.

- In the CD298 Static Data Report.

- As stated under 14. this can only happen in case the two accounts belong to different collateral pools.

- Depending on portfolio/position changes additional collateral is necessary for the transfer to be able to be processed.

- These can affect the old account as well as the new account.

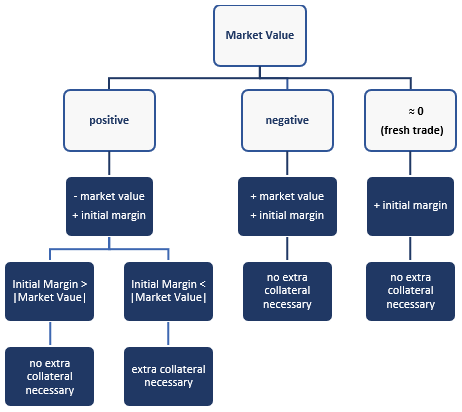

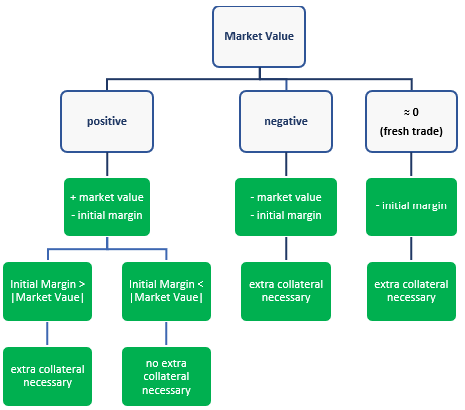

* Under the assumption that the transferred trade has a risk increasing effect on old and new portfolio, the Initial margin in below chart represents the Initial margin amount which will be released after the transfer for the transferor account and increase in initial margin amount for transferee account.

Possible effects for the old account:

Possible effects for the new account:

The trade daily summary report (CI201 / CB201) shows all terminations and novations due to post trade events like the trade transfer.

You can find it on the Member Section or via Help button in the OTC Clear GUI.

Member Section:

- Login to the Member Section of Eurex Clearing.

- Go to Resources > EurexOTC Clear > System Documentation > GUIs.

Help Functionality in the OTC Clear GUI:

- This will directly provide the manual to be opened or saved.

Contacts

EurexOTC Helpdesk

Eurex Clearing AG | worldwide

Helpdesk Clearing Data Control

Service times from 08:00 – 20:00 CET

(no service on Saturday and Sunday)

T +49-69-211-1 24 53

Eurex Clearing AG

Helpdesk Derivatives Clearing

Service times from 01:00 – 22:30 CET

(no service on Saturday and Sunday)

T +49-69-211-1 12 50

F +49-69-211-1 43 34

Eurex Frankfurt AG

Key Account Management

Service times from 09:00 - 18:00 CET