C7 SCS Release 1.0

The new C7 Securities Clearing Service (C7 SCS) was introduced in September 2021, for all transactions involving CCP-eligible instruments concluded at the Frankfurt Stock Exchange (MICs: XETR and XFRA) and for all transactions concluded at Eurex Deutschland (MIC: XEUR) that result in securities transactions.

Eurex Clearing applied Trade Date Netting (TDN) as the main supported netting model in C7 SCS. The netting model Actual Settlement Day Netting (ASDN) for cleared transactions is not be available in C7 SCS.

New features, changes and improvements:

- Trade day Netting

- State of art reporting format

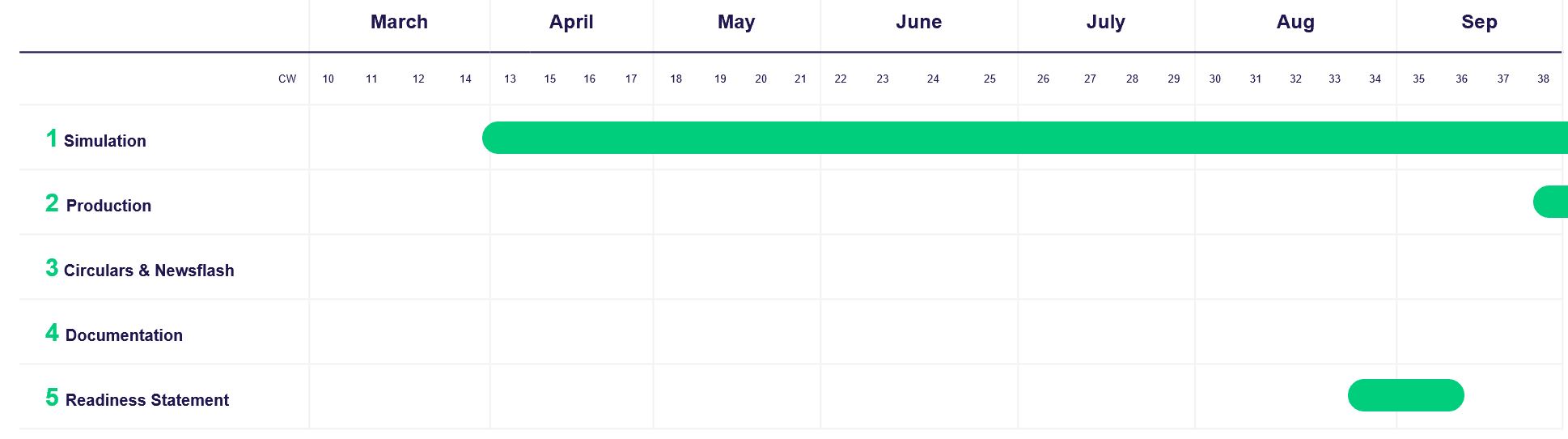

Simulation start: 29 March 2021

Production start: 27 September 2021

System Documentation

- Simulation Calendar C7 SCS Release 1.0 (effective from 20 Dec 2021)

Publication date: 01 Dec 2021

Simulation calendar for C7 SCS release simulation - 20 December 2021 - 03 April 2022. - C7 SCS – 1.0 Release Notes (final version)

Publication date: 25 Aug 2021

This document provides an overview of the functionality covered and available with the new C7 Securities Clearing Service (C7 SCS). - General Information on Tax certification transfer by Clearstream

Publication Date 20 May 2021 - Indicative Pricing - updated version

Publication date: 22 Mar 2021

This document provides an indication on the planned price structure for CCP services after migration of Equity and Bonds Clearing to the new securities clearing system, C7 Securities Clearing Service (C7 SCS), including indications on planned mark-ups on optional services

- Eurex Clearing – C7 SCS XML Reports – XML Schema Files

Publication date: 19 Aug 2021

Production/Simulation Version (valid from July, 2021).

This package contains the reports xsd files for Eurex Clearing's C7 SCS. - Eurex Clearing – C7 SCS XML Reports – Modification Notes

Publication date: 19 Aug 2021

Production/Simulation Version (valid from July, 2021).

This document provides an overview of the enhancements and changes to the Eurex Clearing - C7 SCS XML Reports – Reference Manual – updated as compared to the previous version. - Eurex Clearing - C7 SCS XML Reports – Reference Manual

Publication date: 19 Aug 2021

Production/Simulation Version (valid from July, 2021).

This manual provides the XML report descriptions for the Eurex Clearing's C7 SCS.

- Member SWIFT Interface with C7 SCS

Publication date: 12 Apr 2021

The purpose of this document is to describe the layout and format of the SWIFT interface of Eurex Clearing’s C7 SCS platform towards members. This interface allows participants to utilize Linking before Aggregation service and Routing service offered by ECAG via SWIFT Network.

Circulars

Circulars

- Eurex Clearing Circular 087/21 C7 Securities Clearing Service: Introduction of Pair-Off Request Form and Pair-Off Processing Manual

- Eurex Clearing Circular 085/21 C7 Securities Clearing Service (C7 SCS) Release 1.0: Production launch announcement

- Eurex Clearing Circular 084/21 Eurex Clearing’s Securities CCP: Changes to the Securities CCP system due to the introduction of C7 SCS 1.0

- Eurex Clearing Circular 079/21 C7 Securities Clearing Service (C7 SCS): Introduction of a Pair-Off-Service; Amendments to the legal framework of Eurex Clearing AG

- Eurex Clearing Circular 072/21 Amendments to the Price List of Eurex Clearing AG

- Eurex Clearing Circular 040/21 C7 SCS Release 1.0: Change of settlement location for deliveries of French, Italian and Spanish government bonds

- Eurex Clearing Circular 037/2021: C7 Securities Clearing Service Release 1.0: Production launch and amendments to the Clearing Conditions of Eurex Clearing AG

- Eurex Clearing Circular 084/2020: Eurex Clearing’s C7 SCS: New introduction date to offer sufficient testing lead time for participants

- Eurex Clearing Circular 034/2020: Securities clearing: Introduction of C7 Securities Clearing Service, Release 1.0

Newsflashes

- Eurex Clearing Readiness Newsflash | C7 SCS Release 1.0: Authorization Concept for Linking Service

- Eurex Clearing Readiness Newsflash | C7 SCS Release 1.0: Impact of Trading Hours Extension at Börse Frankfurt as part of T7 Release 10.0 on C7 SCS report delivery

- Eurex Clearing Readiness Newsflash | C7 SCS Release 1.0: December 2021 futures expiration - required action for Italian bonds settlement

- Eurex Clearing Readiness Newsflash | C7 SCS Release 1.0: Reminder to release payments from income events

- Eurex Clearing Readiness Newsflash | C7 SCS Release 1.0: Post-Migration Reports for production available

- Eurex Clearing Readiness Newsflash | C7 SCS Release 1.0: Early deployment of functionalities required for T7 Release 10.0

- Eurex Clearing Readiness Newsflash | C7 SCS Release 1.0: Reporting: Minor adjustments to XML header structure and treatment of optional fields; availability of billing reports in C7 SCS production

- Eurex Clearing Readiness Newsflash | C7 SCS Release 1.0: Tax certification of new CBF accounts; 2. Availability of Daily Eurex Fines Report (CB225) in Simulation

- Eurex Clearing Readiness Newsflash | C7 SCS Release 1.0: Eurex contracts and deliverable bonds ISINs availability for testing

- Eurex Clearing Readiness Newsflash | C7 SCS Release 1.0: Readiness Statement available

- Eurex Clearing Readiness Newsflash | C7 SCS Release 1.0: Member Reference Data Frozen Zone

- Eurex Clearing Readiness Newsflash | C7 SCS Release 1.0: 1. Revised Focus Days planning – Unavailability of certain Focus Days, 2. Simulation Activity, 3. Required action for Italian Bonds Settlement – Reminder

- Eurex Clearing Readiness Newsflash | C7 SCS Release 1.0: 1. Settlement Account Setup sheet – Setup available for Production, 2. Delayed billing reports, 3. ISIN list – Update

- Eurex Clearing Readiness Newsflash | C7 SCS Release 1.0: Reporting of Clearing Member and Trading Member in Party Level information

- Eurex Clearing Readiness Newsflash | C7 SCS Release 1.0: Settlement related cash instruction changes; 2. Introduction of billing reports in Simulation; 3. Change in Corporate Action (CA) Focus Days in Simulation

- Eurex Clearing Readiness Newsflash | C7 SCS Release 1.0: Reporting of Clearing Member and Trading Member in Party Level information

- Eurex Clearing Readiness Newsflash | C7 SCS Release 1.0: Settlement Account Setup Sheet: Update; Simulation news

- Eurex Clearing Readiness Newsflash | C7 SCS Release 1.0 Simulation: Additional relevant information

- Eurex Clearing Readiness Newsflash | C7 SCS Release 1.0 Simulation: 1. Eurex Contracts and Deliverable Bonds ISINs available for testing, 2. Publication of additional documents

- Eurex Clearing Readiness Newsflash | C7 SCS Release 1.0: Simulation with end-to-end (E2E) connection to CSD

- Eurex Clearing Readiness Newsflash | C7 SCS Release 1.0 Simulation: Additional information on simulation services, usage of CBF service upgrade on MT530 for C7 SC

- Eurex Clearing Readiness Newsflash | C7 SCS: Simulation start – further information

- Eurex Clearing Readiness Newsflash | C7 Securities Clearing Service: Update of publications

- Eurex Clearing Readiness Newsflash | C7 Securities Clearing Service: Update of publications

- Eurex Clearing Readiness Newsflash | C7 Securities Clearing Service (SCS): Simulation start and update of publications

- Eurex Clearing Readiness Newsflash | C7 Securities Clearing Service: Update of publications

- Eurex Clearing Readiness Newsflash | C7 Securities Clearing Service: Update of publications

Supportive Documents

Release Items/Participants Requirements

Feature/Enhancement | Details | Action Item |

Trade Date Netting | Trade Date Netting (TDN) is a new mechanism optimizing the delivery obligations resulting from trading offered within C7 SCS. | Familiarize the Back-office staff with the C7 SCS basic concepts. |

Processing Set-up | The selection of Processing Set-up must be performed per:

| Provide the processing set up for settlement accounts, which shall not be processed with default “net” parameter. |

Delivery instructions | Delivery instructions can be sent out as released (default) or on hold on the same level of netting parameters. | Provide the processing set up for settlement accounts, which shall not be processed with default “released” parameter. |

Net Position Trade | For every Net Position Trade, a delivery instruction is sent to the respective settlement location (CBF/T2S, CBL and SIX SIS) already on the trading day. | Please check the delivery instructions on (I) CSD (Central Securities Depository) side. |

Processing method | For the processing method Clearing Members have the following setting choice: Netting (default), Aggregation or Gross Processing. | Prepare and execute the test scenarios for processing methods. |

C7 SCS Processing results | At the end of the trading day, netting, aggregation or gross processing is performed combining single trades to Net Position Trades depending on the processing method. | Please check if the end of day netted positions corresponds to the trading activities of the day. |

Net Clearing Report | A Net Clearing Report is provided on the end of each trading day containing single trades, resulting Net Position Trades and delivery instructions. | Check the if report results reflects the chosen processing method. |

Changes to Gross Delivery Management Interface | Instead of today’s Gross Delivery Management on single trades, Members can modify the Hold/Release status on delivery instructions at the (I)CSD. T2S members can use partial release at CBF/T2S. | Check the possibilities to execute GDM actions on the (I)CSD site. |

CRE

Eurex Group’s central repot solution. It allows a greater flexibility and meets the needs of today’s high frequency and algorithmic trading.

What's next?

Have a look at the Cross-Project-Calendar and find out what’s coming next or is on the horizon and might have an impact you!

Eurex Initiatives Lifecycle

From the announcement till the rollout, all phases of the Eurex initiatives outlined on one page! Get an overview here and find other useful resources.

Are you looking for information on a previous initiative? We have stored information about our previous initiatives in our Archive for you!

Contacts

Eurex Frankfurt AG

Customer Technical Support / Technical Helpdesk

Service times from Monday 01:00 – Friday 23:00 CET

(no service on Saturday and Sunday)

T +49-69-211-VIP / +49-69-211-1 08 88 (all)

Eurex Frankfurt AG

Key Account Management

Service times from 09:00 - 18:00 CET